FTX borrowers have revealed a series of financial statements that reveal transactions benefiting company executives shortly before the cryptocurrency exchange’s collapse in November 2022. However, the accuracy of the data is not guaranteed and no responsibility is accepted for any deficiencies. The disclosures only cover fiat currency and crypto transactions and do not include crypto assets.

Attention-Grabbing Payments

In a recent filing with the United States Bankruptcy Court for the District of Delaware, various payments directly benefiting senior executives at FTX and Alameda Research were disclosed, particularly payments or property transfers made in the year leading up to FTX’s collapse. However, FTX borrowers state that there is no guarantee of the absolute accuracy or completeness of the data and accept no responsibility for errors or omissions.

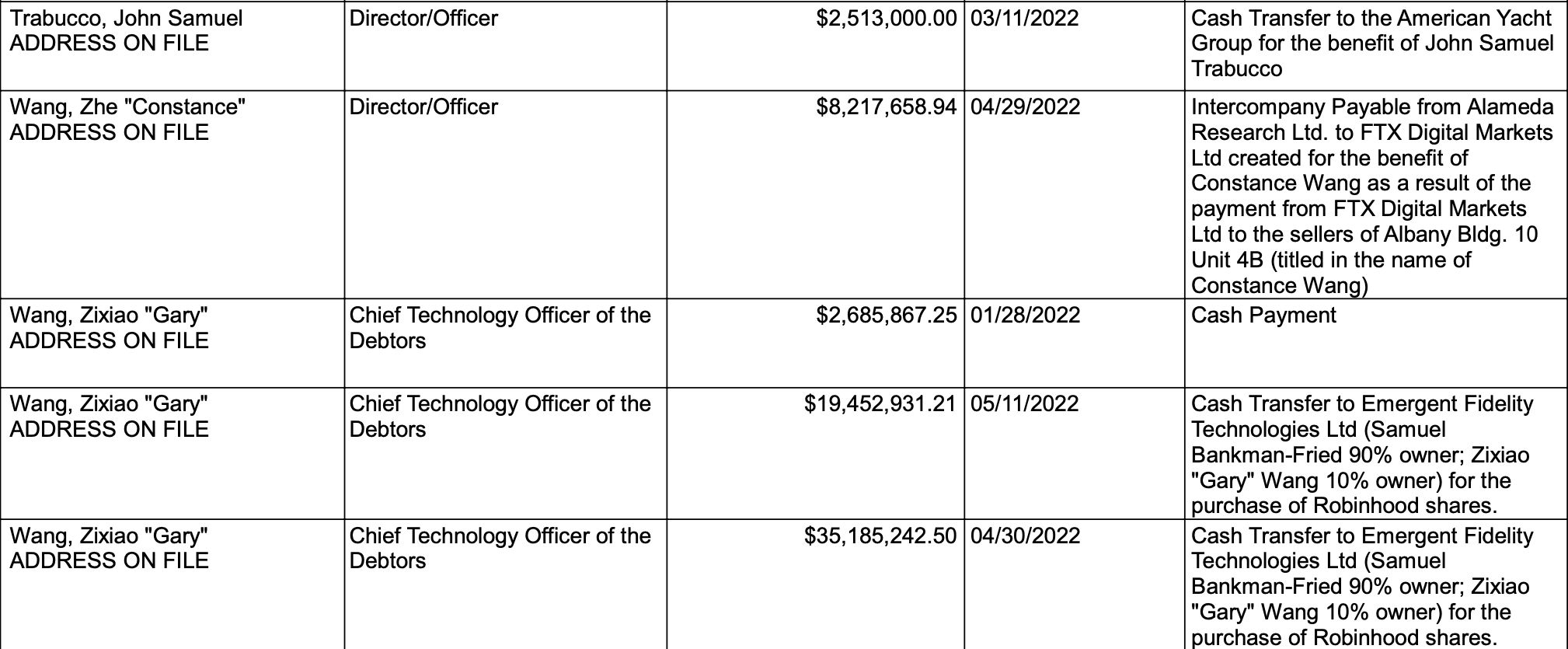

In March 2022, a transaction worth $2.51 million was directed from the company to American Yacht Group for the benefit of Sam Trabucco, former Co-CEO of Alameda Research. Just a few months after this transaction, Trabucco confirmed in a tweet in August 2022, when informing his followers about his resignation, that he owned a yacht. In response to Trabucco’s tweet, Caroline Ellison, former Co-CEO of Alameda along with Trabucco, extended her well wishes and expressed hope that he would spend more time on his boat.

Meanwhile, it was revealed that several cash payments were made to former FTX executives, including Sam Bankman-Fried and Gary Wang, as well as former FTX Engineering Director Nishad Singh, former FTX Marketing Director Darren Wong, and former FTX Operations Director Constance Wang, in the twelve months leading up to the collapse.

FTX’s Acquisition of Robinhood Shares

With this development, it is stated that the disclosures are only related to the extent to which fiat currency and crypto transactions can be traced. The following statements were included in the disclosure:

“The responses to this question currently do not include all cryptocurrency transfers, other digital assets, or other assets.”

The filing also emphasized that Bankman-Fried and FTX co-founder Gary Wang purchased a total of $35,185,242 worth of Robinhood shares in April 2022. They continued to purchase Robinhood shares in May 2022, spending an additional $19.45 million. It was disclosed that Bankman-Fried owned a 90% stake, while Wang held the remaining 10% stake through their company Emergent Fidelity Technologies. However, in January, the US Department of Justice seized the shares owned by Bankman-Fried and Wang.

On August 31st, Robinhood announced that it had repurchased all shares previously owned by FTX and Alameda Research. Robinhood stated that it completed the purchase of 55,273,469 shares for approximately $606 million. Following the announcement, Jason Warnick, Robinhood’s Chief Financial Officer, expressed his satisfaction with the result:

“We are pleased to have completed the purchase of these shares and look forward to implementing our growth plans on behalf of our customers and shareholders.”