Following the announcement of a significant milestone for the network, the Hedera community is in celebration mode. According to the latest data, the Blockchain has processed over 20 billion transactions. While reaching the 20 billion transaction mark is a significant achievement for Hedera, the timeline is also noteworthy.

Transaction Volume Rising on Hedera!

According to official reports, it took the network 1,738 days to reach the first 10 billion transactions, while reaching the second 10 billion transactions only took 100 days. This highlights the exponential growth rate of the network. Partnerships, developments, and rapid adoption have been key pillars supporting Hedera’s transactional growth. Investors typically notice such explosive growth, and in most cases, these milestones can trigger an upward trend.

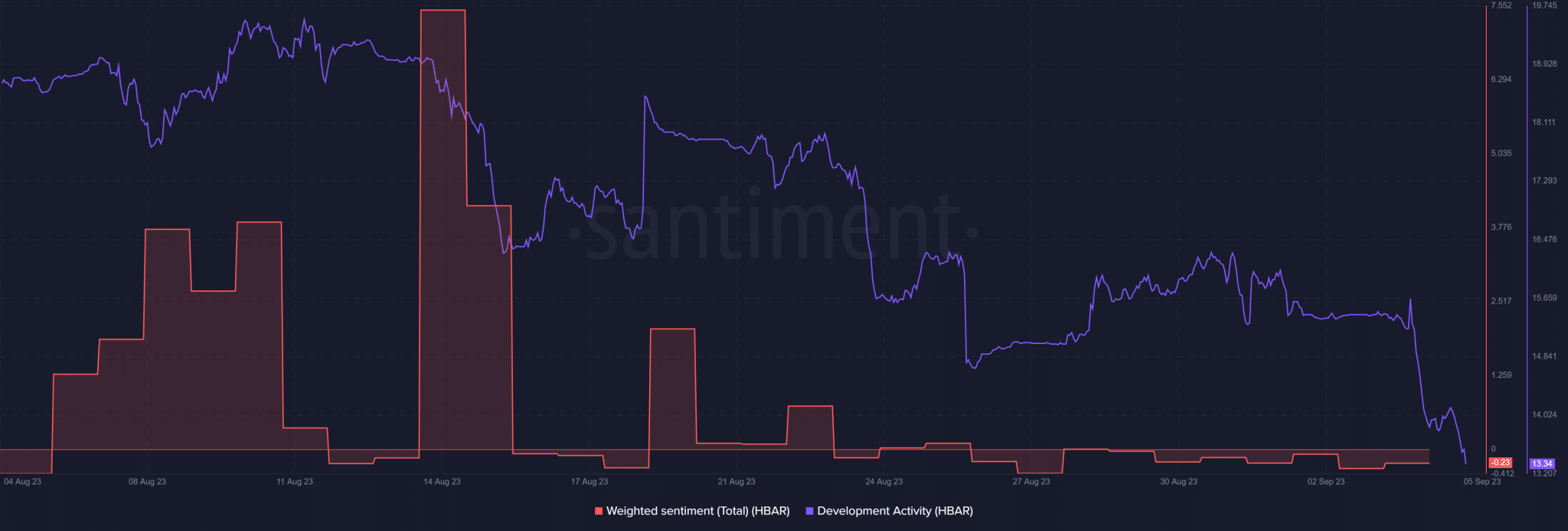

Recently, the situation has been different, considering that the network has remained relatively stagnant and near its monthly low. Despite the network’s growth in various aspects, development activities have witnessed a significant slowdown, especially in the last four weeks. At the time of writing, HBAR was trading near its monthly low. The lack of development activity can also contribute to a lack of confidence among investors.

Furthermore, the on-chain volume of HBAR has declined since August and was approaching its lowest level in the last four weeks. So why do these metrics not reflect Hedera’s growth? The low sensitivity and volume represent the current state of HBAR demand in the short term. The cryptocurrency moves in tandem with the rest of the crypto market, which explains why the bears have been dominant.

HBAR Price Movement!

Previously, it was noted that HBAR had retested a support line that was part of a short-term upward price channel. However, the downward market conditions in the last week of August resulted in the market’s weakness. At the time of writing, HBAR was trading at $0.049. Additionally, HBAR had declined by approximately 35% from its highest levels in August.

At the time of writing, the price is trading well below August levels. It had not yet become oversold at the time of writing, but if it approaches the $0.045 price level, it could potentially reach that condition. HBAR’s Money Flow Index (MFI) has become oversold for the first time since June. This indicates that it is closer to a psychological bottom and may trigger a downturn. However, HBAR had already shown signs of a slowdown in bearish momentum. Therefore, if market conditions allow, bears may regain dominance and have a chance to recover some of the recent losses.

Türkçe

Türkçe Español

Español