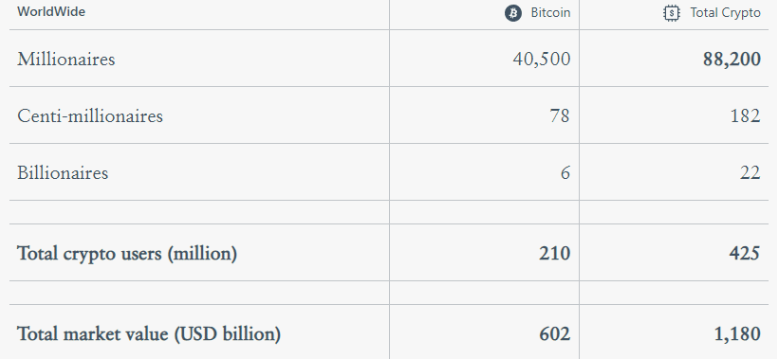

According to research conducted by London-based consultancy firm Henley & Partners, the results of which were published on September 5th as part of the Crypto Wealth Report, only six out of the 22 individuals with at least $1 billion worth of crypto investments hold their investments in Bitcoin (BTC).

The report reveals that there are 88,200 millionaires worldwide who own crypto assets, with 40,500 of them holding their investments in Bitcoin. The report also found that 182 individuals have more than $100 million in crypto assets, with 78% of these millionaires holding their investments in Bitcoin. Although the report does not name any crypto billionaires, we know the high-profile crypto assets of some individuals.

Among the richest crypto investors are Barry Silbert, the founder and CEO of Digital Currency Group, Cameron and Tyler Winklevoss, the co-founders of Gemini, Changpeng Zhao, the CEO of Binance (BNB), Brian Armstrong, the CEO of Coinbase (COIN), Chris Larsen, a co-founder of Ripple (XRP), and Michael Saylor, the chairman of MicroStrategy. Globally, a total of 425 million people own some form of crypto asset.

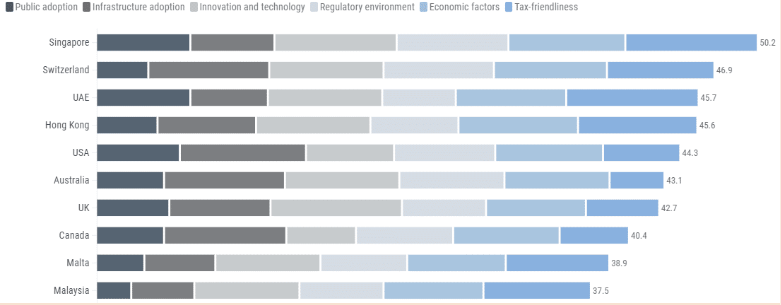

Singapore, Switzerland, and UAE: Crypto-Friendly Countries

The report also includes a Crypto Adoption Index, which takes into account various factors such as public adoption, infrastructure adoption, regulatory environment, tax regulations, and more to list the most crypto-friendly countries.

Singapore, Switzerland, and the United Arab Emirates (UAE) emerged as the top three countries leading the index. Hong Kong, Australia, the United Kingdom, Canada, Malta, and Malaysia also made it to the top 10 list of crypto-friendly places.

Singapore and the UAE rank at the top in terms of both tax ease and public adoption. However, when it comes to regulatory environment, Singapore and Switzerland lead the way, while the UAE lags behind. Juerg Steffen, the CEO of Henley & Partners, highlighted a significant increase in inquiries from crypto millionaires regarding crypto-friendly countries in recent months and stated:

In the last six months, we have seen a significant increase in requests from crypto millionaires who want to protect themselves against possible future bans on the trading or use of cryptocurrencies in their own countries and reduce the risks of aggressive tax policies that tax crypto assets at their source.

A range of crypto stakeholders, including entrepreneurs, traders, and miners, are interested in investment migration strategies to optimize their crypto assets. Stringent regulations and impending crypto bans are driving crypto enthusiasts to seek safer havens.

Türkçe

Türkçe Español

Español