Stablecoins are seen as a haven of stability in the volatile world of cryptocurrencies. However, their benefits can continue as long as they maintain stability to the underlying asset, whether it is a currency like the US dollar (USD) or a crypto asset.

Aave’s $1 Battle!

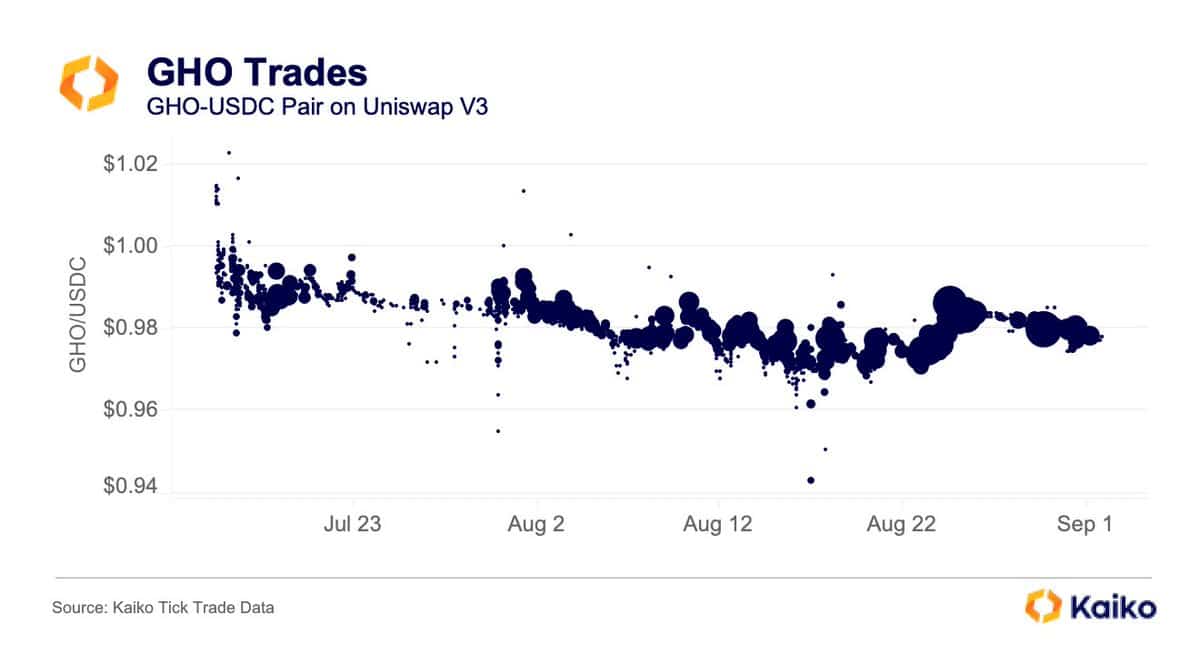

According to a recent post by crypto data provider Kaiko, Aave’s lending protocol stablecoin GHO has not been able to reach the ideal $1 stable level since its launch in mid-July. At the time of writing, the stablecoin was valued at $0.96. The algorithmic stablecoin was launched on the Ethereum (ETH) blockchain, and Aave users had the option to borrow it by depositing more valuable crypto collateral than the borrowed GHO.

According to DeFiLlama’s data, the initial response was promising, and the circulating supply increased to over 21 million within a month after the stablecoin was launched. The attractive lending rates of 1.5% played a significant role in increasing the market value of GHO. However, the lack of demand while the supply increased prevented GHO from reaching its stable point. Kaiko had previously stated in a report:

There is currently very little use case for GHO, meaning that most of the backers are selling it immediately for another stablecoin.

Identifying the root of the problem, Aave management proposed an increase in the borrowing rate from 1.5% to 2.5%. The logic behind the increase was for borrowers to buy back GHO and repay their loans. Although this would decrease the market supply of the token, it could eventually bring it closer to the dollar peg.

Aave’s Search for a Solution!

Aave DAO unanimously approved the proposal. With the circulating supply of GHO decreasing by more than 13% in the last two days, the efforts started to yield results. A significant part of the problem may also be attributed to the lack of a robust redemption mechanism and arbitrage opportunities. Unlike other stablecoins, arbitrageurs cannot profit from depegging events in GHO.

However, this situation can change with the upcoming release of the GHO Stability Module (GSM). The module will allow users to mint GHO by using other stablecoins as collateral. As a result, GHO issued through GSM can be redeemed at a 1:1 ratio for the underlying stablecoin collateral.

Türkçe

Türkçe Español

Español