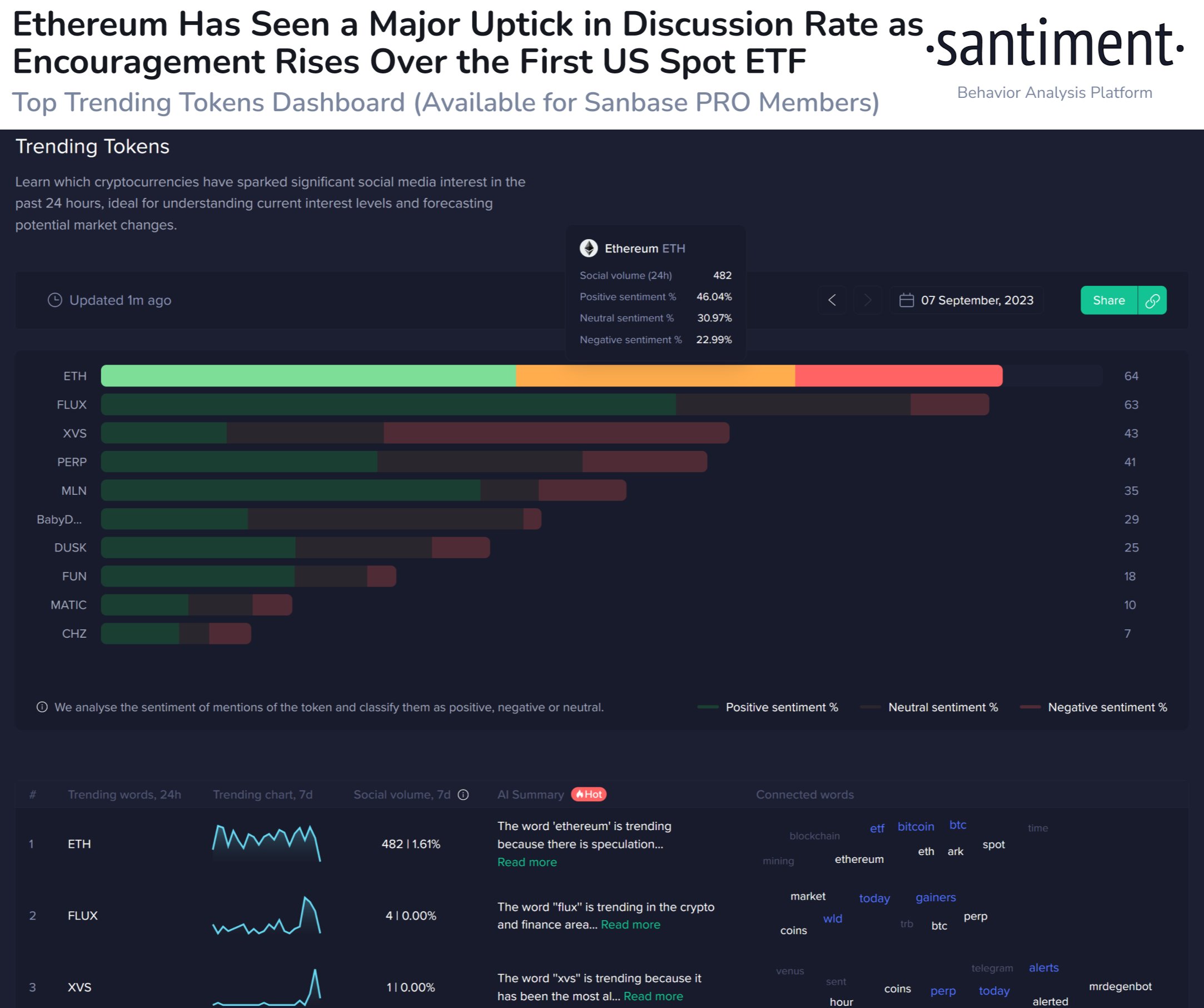

Ethereum (ETH) has started to make headlines in the world of cryptocurrency as a result of the sharp increase in discussions surrounding the crypto king. The high-level crypto analysis platform Santiment reported that the expectation of the approval of an Ethereum Exchange Traded Fund (ETF) by the U.S. Securities and Exchange Commission (SEC) has put the altcoin king on the agenda of the crypto world.

Ark Invest and 21 Shares Apply for a Spot Ethereum ETF

The findings of the crypto analysis platform Santiment show that speculation and hype have driven investors and traders to make Ethereum the most trending asset in the world of cryptocurrency. This indicates that for the first time since last year, the altcoin king has received so much attention and interest.

In particular, the applications made by the leading two companies, 21Shares and ARK Investment Management, to offer the first spot Ethereum ETF in the U.S. have made the altcoin king the focal point of the crypto world with the expectation of potential ETF approval. If the applications of these companies are approved, the first Ethereum-based ETF in the U.S. will be offered.

Following the announcement of the spot Ethereum ETF applications by 21Shares and ARK Investment Management, both ETH and BTC prices increased. Interestingly, this increase was short-lived and both cryptocurrencies returned to their price levels before the announcement.

Ethereum Shows Signs of Price Increase

In addition to the spot Ethereum ETF application, there are encouraging signs indicating a potential price increase for Ethereum. Analysts suggest that ETH/BTC may have bottomed out, which is a sign of a potential price increase. In addition, past price patterns indicate that Ethereum tends to gain momentum about 252 days before Bitcoin‘s block reward halving. When this is combined with the expectation that the U.S. SEC may give the green light to the first futures-based Ethereum ETF, it is considered as an important sign of a significant increase.

Furthermore, work on the development of the Ethereum network continues in full swing. The Ethereum client Nethermind recently released an update to prepare for the Holesky testnet launch on September 15th for validator clients and node operators. This milestone is considered an important step in Ethereum’s development and indicates strong progress in the network.

Santiment’s data also reveals a significant increase in Ethereum’s network activity with over 467,000 unique wallet address interactions recorded in a single day. Such increased adoption and activity often result in a price increase.

In addition to all of this, there is also a significant increase in the number of crypto whales showing interest in Ethereum. Experienced crypto analyst Ali Martinez notes that crypto whales have bought over 260,000 ETH worth approximately $425 million in the past 24 hours, indicating their belief in Ethereum’s future potential.

Türkçe

Türkçe Español

Español