Experienced crypto analyst Michael van de Poppe stated that the long-standing downtrend of altcoins corresponds to the depression phase, and they are ready to rise sharply after leaving this phase. The analyst also commented on the crypto king Bitcoin (BTC).

Analyst Gives Good News for Altcoins

Crypto analyst Michael van de Poppe said that the numerous applications made for crypto-based exchange-traded funds (ETFs) on his personal X account are a significant sign of a rise in the crypto market. In his comment specifically on altcoins, Van de Poppe noted the following:

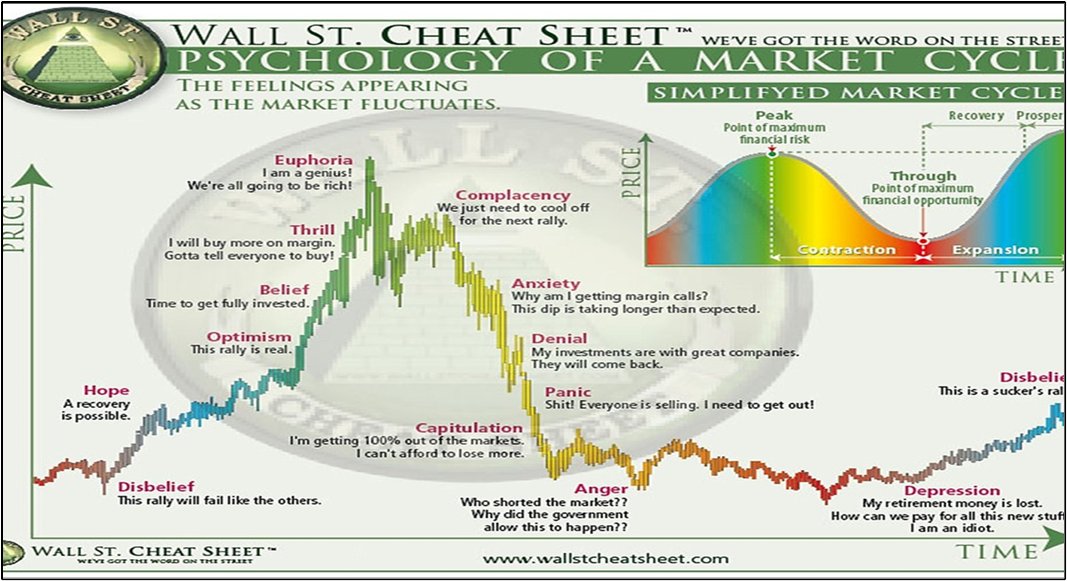

Altcoins are in a depression phase and getting ready to start an upward trend. It may sound repetitive, but most altcoins have either hit rock bottom or are close to their bottom levels. While the interest in the crypto market is at the same level as in 2020, altcoins are slowly rising in BTC pairs.

Meanwhile, it would be wrong to say that the interest in the markets will not return while we have some significant indicators. Spot Bitcoin ETF is waiting for approval just around the corner. There are applications for Spot Ethereum ETF, and the approval of futures-based Ethereum ETFs is now a matter of time. Institutions are stepping in.

It can be seen that the analyst refers to the classical graph that depicts the psychological periods that investors go through during volatile market cycles, called the Wall Street Cheat Sheet, while commenting on altcoins. For those who do not know, according to the theory put forward by the Wall Street Cheat Sheet, the end of the cycle corresponds to the depression phase where prices are extremely low. The depression phase is typically followed by the skepticism phase, where prices start to rise slightly but most market participants cannot make sense of it.

Analysis of Bitcoin

Van de Poppe, who also analyzed BTC, said that he expects the price to rise after breaking out of the range between $24,500 and $26,800. According to the analyst, a price movement towards the bottom of the range indicates a buying opportunity at discounted prices, while a movement towards the top of the range signifies a breakout:

Do not get stuck in this range of Bitcoin. The trend in this range can last for a few more weeks. Ultimately, it will result in a fake breakout followed by a real breakout. If we break above $26,800, I will consider buying without hesitation. If it falls back to the range between $24,500 and $25,000, I will buy again without hesitation.

Türkçe

Türkçe Español

Español