Crypto markets were focused on the announcements coming from the US today. The regulatory agency made the announcement. The hot development we announced was about the rules that licensed crypto exchanges in the US will follow regarding listing. However, an important detail means bad news for XRP, DOGE, and LTC.

XRP, DOGE, and LTC Delisted

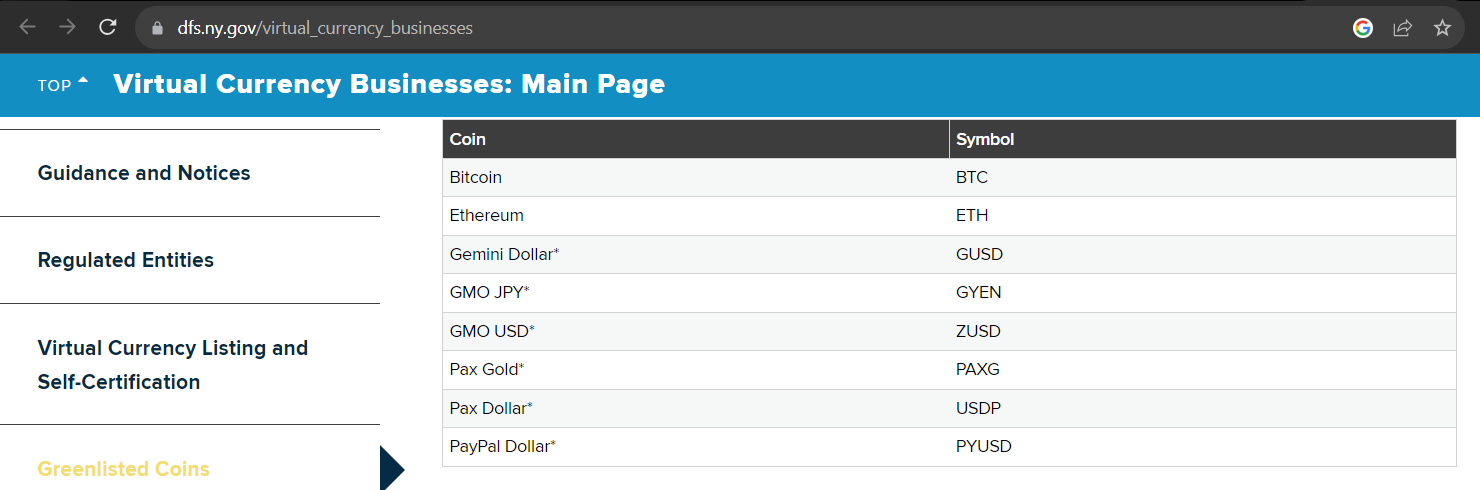

Today, the New York Department of Financial Services announced an update to the cryptocurrency surveillance rules, including new criteria for how agency-licensed digital firms can list different cryptocurrencies. As part of the update, DFS announced that Ripple, Dogecoin, and Litecoin have been delisted from the green list.

Currently, only the following cryptocurrencies are on the green list;

- BTC

- ETH

- GUSD

- GYEN

- ZUSD

- PAXG

- USDP

- PYUSD

Services related to the altcoins listed in this list will be able to list much more easily, while others will remain outside the safe list. Regarding the advantage of this list, the official website states;

“If a VC Organization decides to list a cryptocurrency on the Green List, it must inform DFS at least ten days before presenting the crypto in New York. DFS may, at any time and entirely at its discretion, prohibit or otherwise restrict the use of a cryptocurrency before or after a VC Organization begins using a cryptocurrency; it may require any VC Organization to remove, stop, or otherwise restrict or reduce the listing of any cryptocurrency.”

Crypto Rules

Inspector Harris represents the face of the institution focused on cryptocurrencies. Since taking office, decisions have been made against many crypto companies, including Coinbase, and these institutions have been fined $132 million. The official announcement regarding the published rules states the following;

“The guidance published today enhances risk assessment standards for crypto listing policies and protects the interests of individual investors. License holders must develop and submit to our approval a crypto listing policy that is consistent with this proposed guidance. Given the pace of change in the crypto industry, DFS is using all of its regulatory tools to keep pace with the sector, make data-driven policy decisions, and proactively respond to changes and risks in the crypto market. With today’s publication, the proposed guidance is open for public feedback until October 20, 2023.”

Türkçe

Türkçe Español

Español