The Federal Reserve (Fed) Federal Open Market Committee (FOMC) will announce its critical interest rate decision today. It is expected that FOMC will keep the target range for the federal funds rate at 5.25-5.5%, which is the highest level in the past 22 years. Bitcoin (BTC), which has been priced above $27,000 before the interest rate decision, is predicted to rise to $30,000 after the decision.

Markets Awaiting the Critical Interest Rate Decision

Fed Chairman Jerome Powell signaled that the committee would evaluate the impact of its recent interest rate hikes as the end of the rate hike period approaches. Inflation is still above the Fed’s 2% target, and FOMC is preparing to declare a second “pause” this year. Despite this pause, it is expected that the Fed will raise interest rates by 25 basis points by the end of the year if inflation continues to rise.

The annual PCE data, which is the inflation indicator used by the Fed to control inflation, increased from 3% in June to 3.3% in July, while the increase in the unemployment rate indicates a cooling job market in the US.

Leading giants of Wall Street predict a “pause” in September, but there are concerns that rising oil prices will drive inflation higher. While JPMorgan, Goldman Sachs, Morgan Stanley, Barclays, BNP, BMO, Bloomberg, Nomura, RBC, and Wells Fargo expect a pause from the Fed, Raymond James and Mizuho expect a 25 basis point interest rate hike. The common expectation of experts is that the Fed will keep interest rates unchanged and maintain its tightening bias at the FOMC meeting, but the median dot plot will continue to show another increase this year. The most negative expert opinion is the revision of the long-term median dot to be higher.

CME FedWatch Tool shows a 99% chance of a pause decision in today’s FOMC meeting, while the US dollar index (DXY) continues to trade above the 105 level, indicating the risk of BTC’s price remaining under pressure.

Possible Target: $30,000 for Bitcoin

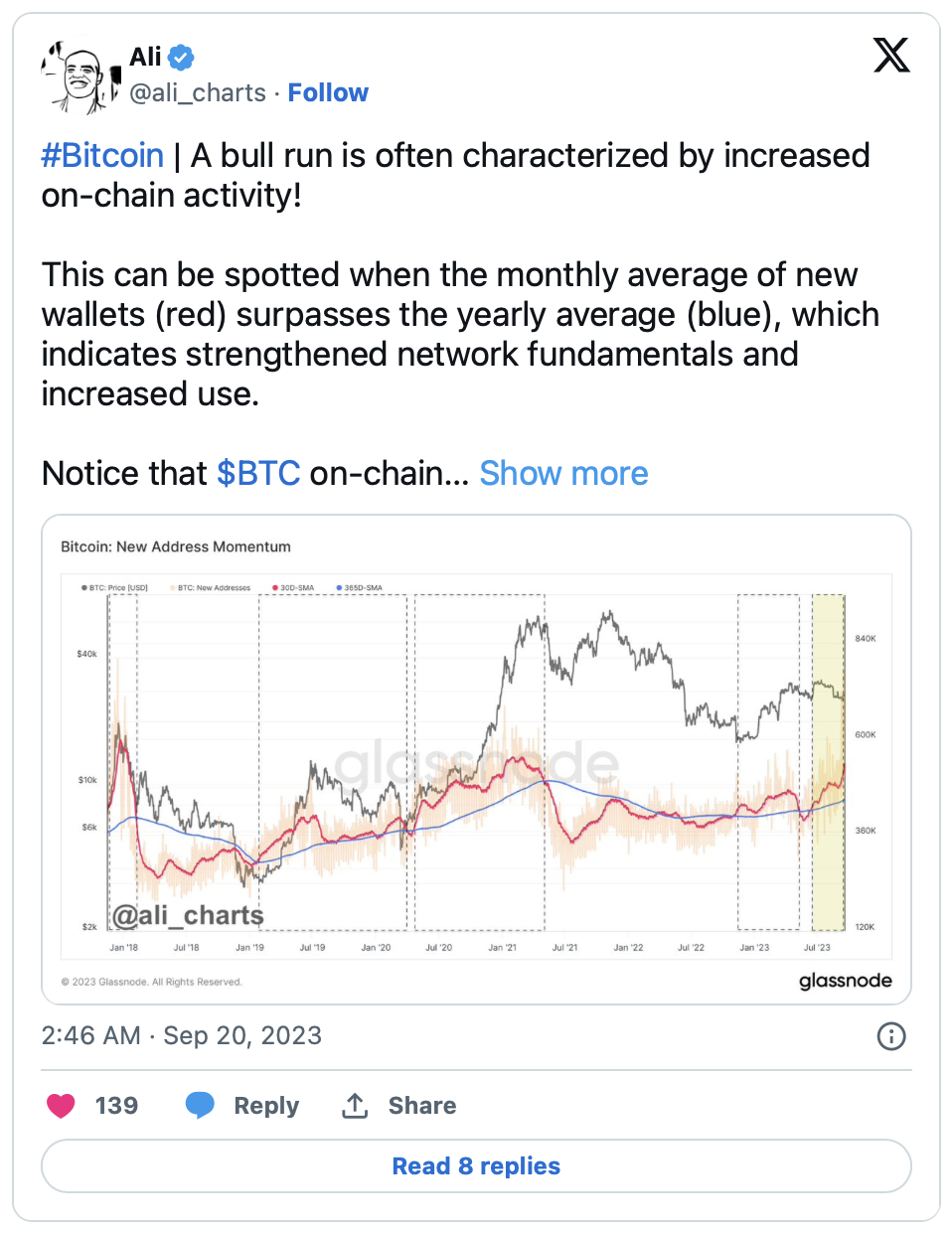

The price of the largest cryptocurrency, Bitcoin, has increased by 1% in the last 24 hours and is currently trading at $27,044. Despite the volatility in price, market experts predict that the upward trend may continue and Bitcoin may rise to $30,000.

Investors expect an upward momentum in the cryptocurrency market following the interest rate decision, which has caused a 5% increase in the price of Bitcoin since the beginning of the week. If the statements following the interest rate decision are positive, it can bring back the much-needed bullish sentiment to the markets.

Türkçe

Türkçe Español

Español