The time has come for the Federal Reserve (Fed) to announce its interest rate decision on September 20, which was eagerly awaited by global markets. Crypto investors had a relatively good week as the expectation of interest rate hike being skipped strengthened, causing the price of Bitcoin to rise above $27,000. However, it could not surpass $27,500 until the decision was made.

September Fed Interest Rate Decision

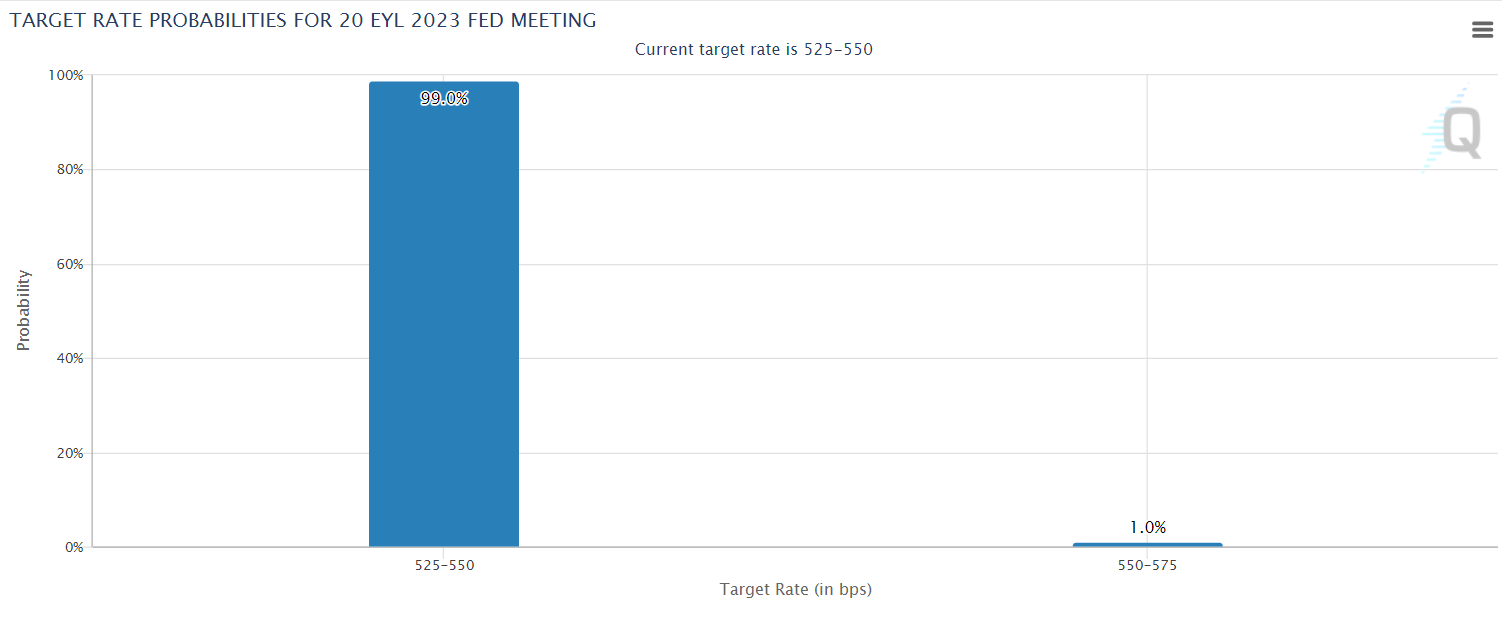

The decision was announced at 21:00 UTC, causing the markets to focus on the November 1 meeting decision of the Fed. The latest macro data indicated a sluggish rise in inflation. The problem is that fuel prices increased due to the extension of OPEC’s production cuts. This was evident in the August inflation data. However, the oil price exceeding $90 will inflate the September inflation. In this environment, the dot plot reflecting the Fed members’ 3-year interest rate expectations was of vital importance. The FedWatch expectation for this meeting was that the rates would remain unchanged with a 99% probability.

So, what are the key details of the Fed decision?

- The Fed kept the interest rates unchanged as expected in this meeting.

- Most officials expect another increase later this year.

- Officials expect to keep the rates higher for longer in 2024 and 2025 than in the June projections.

- Fed officials see inflation at 3.3% by the end of 2023, 2.5% by the end of 2024, and 2.2% by the end of 2025.

- Fed officials see core inflation at 3.7% by the end of 2023, 2.6% by the end of 2024, and 2.3% by the end of 2025.

- Inflation remains high, and we are extremely cautious against these risks.

Türkçe

Türkçe Español

Español