The cryptocurrency markets are experiencing a volatile trend after the Fed, and the initial reaction shook altcoins with the drop in BTC. AXS Coin, which is the most popular among P2E tokens, had shown some recovery in its price today. So, will this positive movement continue in the coming days?

AXS Coin Review

Axie Infinity (AXS) investors strongly defended the $4 region during the major pullback in early September. The price has increased by over 10% throughout last week. However, according to vital on-chain indicators, the price rise may not bring stability. This is due to the current trend of whales. While the AXS price experienced a 12% increase between September 11th and September 20th, whales saw this as a selling opportunity. This highlights the lack of belief in the continuation of the price increase.

According to the data compiled by Santiment, crypto whales holding 100,000 to 10 million AXS tokens sold 760,000 AXS tokens during the uptrend. This means that whales sold tokens worth $3.4 million within the past week.

AXS Coin Price Prediction

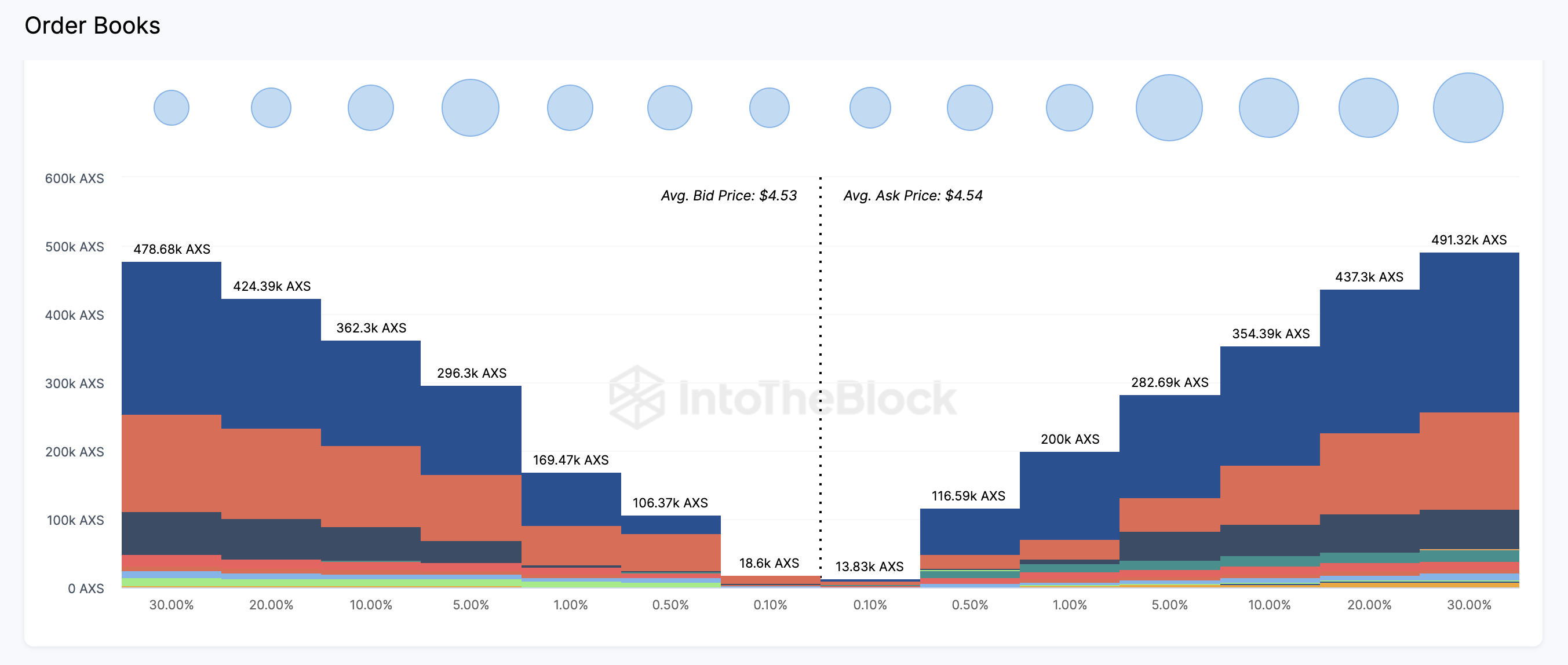

When we look at the order books on exchanges, a strong sell wall stands out. While the overall market sentiment is not perfect, this situation specific to AXS Coin leads to comments about an approaching downtrend. As seen below, traders have placed active orders to sell 1.9 million AXS tokens around the current prices, and buyers are less active.

On-chain indicators suggest that while bulls defend the $4 region, the price may return to the $3 range. The potential recovery scenario is undermined due to whale selling pressure and 1.16 million AXS at a cost of $4.7.

Bitcoin price was struggling to reclaim $27,000 at the time of writing. Amidst signals that the Fed may raise interest rates further, the atmosphere is tense for altcoins. The most noteworthy detail for the overall market is that despite the Fed meeting, the cumulative volume remained at $18 billion. This clearly shows how the lack of appetite and investor shortage prevent a major uptrend.

Türkçe

Türkçe Español

Español