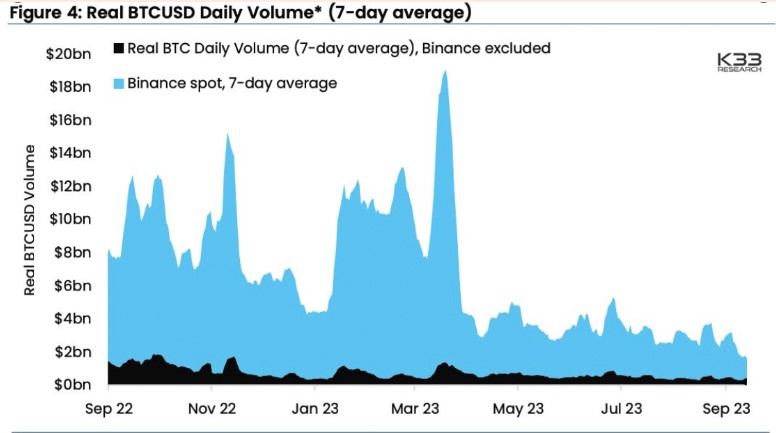

According to K33 Research, Bitcoin‘s (BTC) spot volume has dropped by 8% in the past seven days, reaching an incredibly low level in 35 months. When measuring spot volumes for any asset, the correct place to look is the exchanges, as they are the ones providing trading pairs in the spot market.

Binance Reflects Bitcoin’s Decline

One of the significant reasons for the decline in Bitcoin volume can be attributed to the seven-day spot volume on Binance, which has dropped by 57% since the beginning of September. This decline is mostly related to the regulatory battles that Binance seems to be struggling with. However, the situation may not be as it seems. The power behind the decline appeared to be a reflection of a specific decision.

On September 7th, Binance announced an unexpected decision to change the fees applied to the BTC/TUSD pair. According to the exchange, buyer fees on the pair were changed to a new rate depending on the VIP level of any user.

As a result of this decision, the BTC/TUSD volume, which had 380,000 Bitcoins between August 31st and September 6th, dropped to 90,000 Bitcoins between September 7th and 14th. This decline also revealed the unrest among investors regarding the decision to change the fee rate. Additionally, the decision may be linked to Binance’s desire to increase the use of First Digital USD (FDUSD).

It is worth mentioning the introduction of the stablecoin as a potential substitute for Binance USD (BUSD), which is gradually being phased out by Binance. Therefore, it was not surprising that the market value of FDUSD increased by 51% to $394 million on September 6th.

Bitcoin Comments

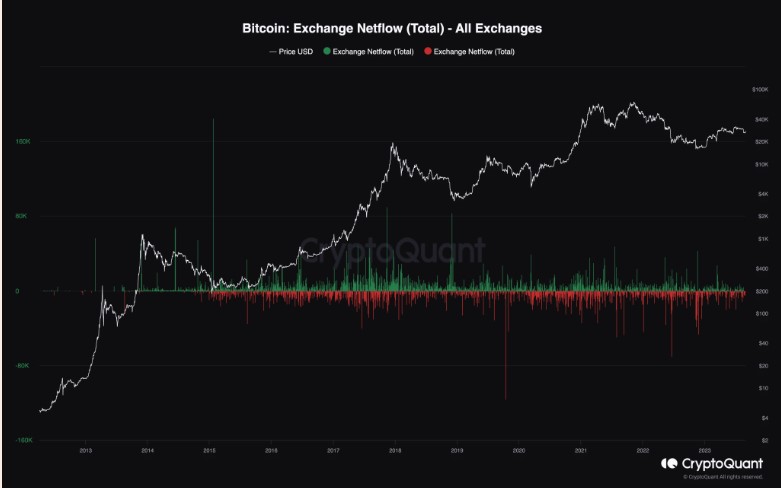

Looking at the net flow on exchanges, CryptoQuant demonstrated through charts that Bitcoin had a net flow of -4,191. This metric reflects the difference between Bitcoin flowing into exchanges and Bitcoin being withdrawn. Generally, high values for spot exchanges indicate selling pressure.

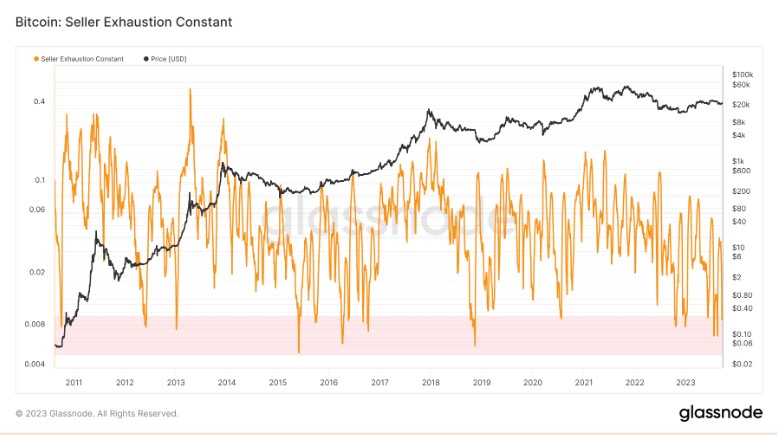

However, the mentioned value was in the negative zone, indicating that Bitcoin did not experience significant selling pressure until the time of writing. Regardless of the value obtained from this calculation, it may indicate low-risk bottoms or high-risk tops. At the time of writing, Bitcoin’s selling exhaustion constant was 0.023. This value indicated that the broader market did not want to sell BTC at the time of writing.

Furthermore, considering the current Bitcoin cycle, it also indicated the possibility of buying Bitcoin at a price very close to the bottom. Therefore, despite the decline in Binance volume, there may not be a sharp drop in Bitcoin price in the near future.

Türkçe

Türkçe Español

Español