Binance Coin (BNB) recently filed a legal objection to the Securities and Exchange Commission’s (SEC) lawsuit, claiming that the SEC does not have the authority to initiate legal action. The legal dispute between Binance and the SEC continues, and Binance has taken action to challenge the regulatory authority of the commission.

Disadvantages of the Binance Lawsuit for BNB!

On September 21, Binance, Binance.US, and Changpeng Zhao submitted a petition for the dismissal of the SEC’s lawsuit. They argued that the SEC failed to provide sufficient evidence to support its claims of various securities violations.

Additionally, they claimed that the SEC is attempting to establish authority over cryptocurrencies without clear legal support from Congress. The regulatory agency initially filed its lawsuit against Binance and its affiliates on June 5. The commission alleged that the exchange conducted illegal securities sales and engaged in unlawful activities.

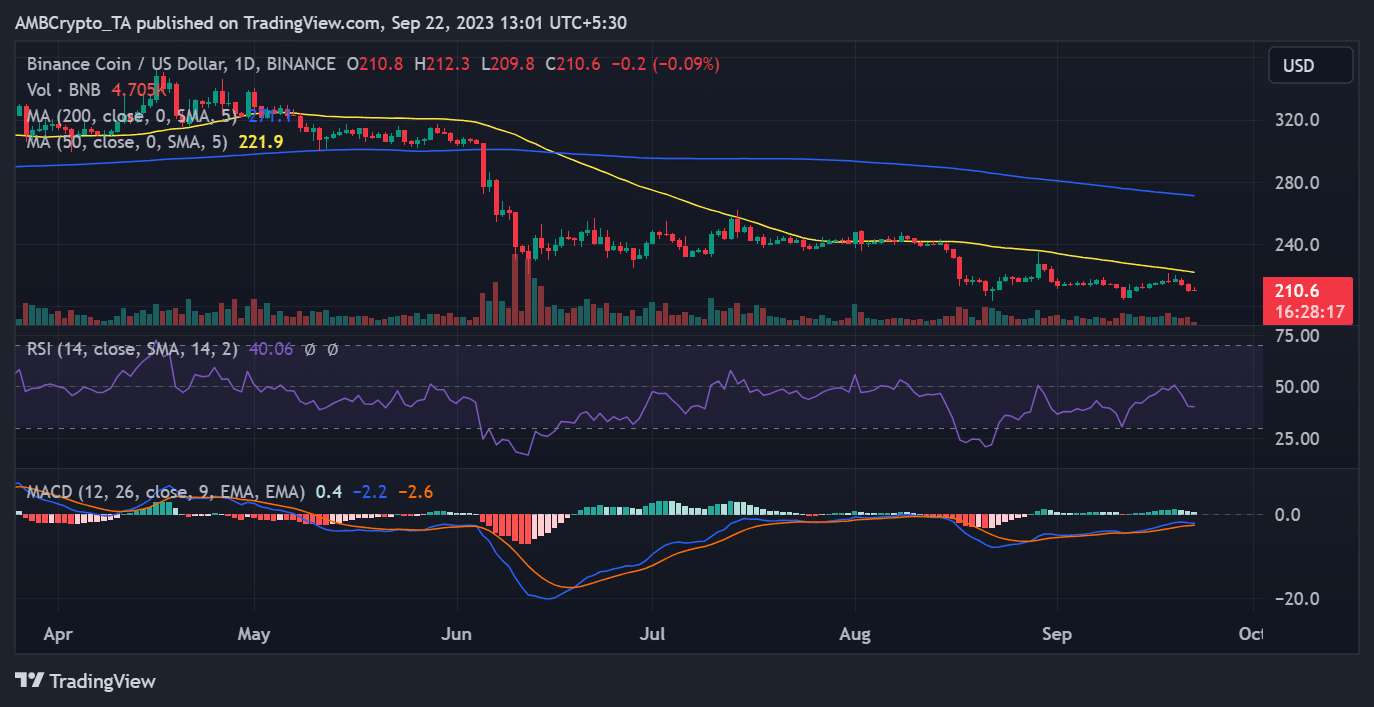

The daily chart of BNB showed that it did not respond positively to the recent developments in the exchange. The downward trend continued. On September 21, when Binance made its legal move, the value of BNB was trading at 210.8 dollars, experiencing a drop of more than 1.6%. As of writing, it was experiencing a loss of less than 1%, hovering around 210.7 dollars. The chart also revealed that since the decline in May, BNB had spent a significant amount of time below the neutral line on the Relative Strength Index (RSI).

On-Chain Metrics for BNB!

As of writing, the RSI remained below the neutral line, indicating the continuation of the downward trend. Additionally, its short-term moving average acted as immediate resistance at the 220-dollar price level.

Although not directly related to the recent legal developments, it is worth noting that the transaction volume on the Binance chain has experienced a decline in recent days. Looking at the volume chart on DefiLlama, the transaction volume dropped from approximately 300 million dollars to 180 million dollars. As of writing, the volume was around 182 million dollars.

Another measure that saw a slight decline was the total locked value (TVL). As of writing, TVL was at the level of 2.8 billion dollars. This could indicate a decrease of more than 2.8 billion dollars compared to the previous day.

Türkçe

Türkçe Español

Español