Bitcoin (BTC) price recently broke free from the $25,000 range, signaling a positive change in the cryptocurrency market. This price increase not only impacted analysts and investors but also had implications for the wider crypto ecosystem.

Bitcoin Hash Rate

The hash rate of Bitcoin, which represents the computational power securing the network, has experienced significant growth in recent times. This increase may be seen as a positive sign as it demonstrates miners’ confidence in the Bitcoin network and its long-term prospects. However, it is important to note that higher hash rate levels intensify competition among miners and potentially reduce individual rewards.

As we transition from the hot summer months to cooler ones, the load on electricity grids generally decreases. Factors such as increased energy consumption due to cooling in hot summer months tend to decrease as temperatures drop. This change can be significant in regions where Bitcoin mining operations consume a substantial amount of electricity. Changes in energy demand can affect the stability and overall efficiency of the energy grid.

Furthermore, daily miner revenue has increased from $19 million to $23 million in recent weeks. This financial support could reduce the pressure on miners to immediately sell their BTC holdings. When miners have more income, they can hold on to the Bitcoins they mine, thereby reducing selling pressure in the market.

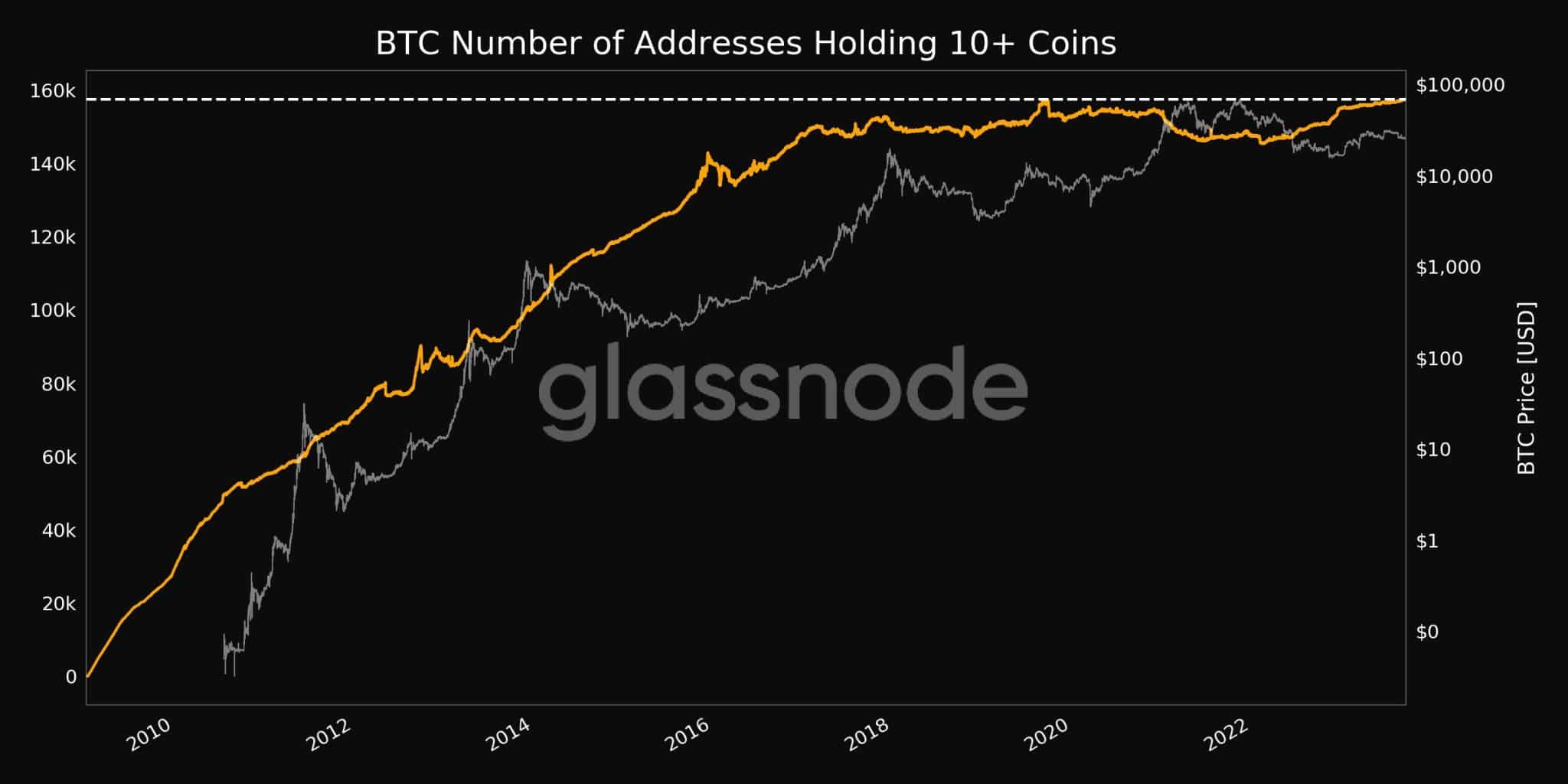

Glassnode Data

This situation can contribute to a more stable Bitcoin price. The increasing interest of whales in Bitcoin can be seen in Glassnode’s data, which reveals record-high figures from 157,514 addresses holding 10 or more tokens. While this indicates growing confidence in Bitcoin’s potential, it also raises concerns about market manipulation.

Particularly, the interest from whales can positively impact Bitcoin by attracting institutional investment and boosting overall market confidence. Institutional participation is often seen as a sign of maturity and legitimacy in the crypto space. However, the concentration of wealth in the hands of a few individuals can lead to volatility and potential price manipulation in the market.

Türkçe

Türkçe Español

Español