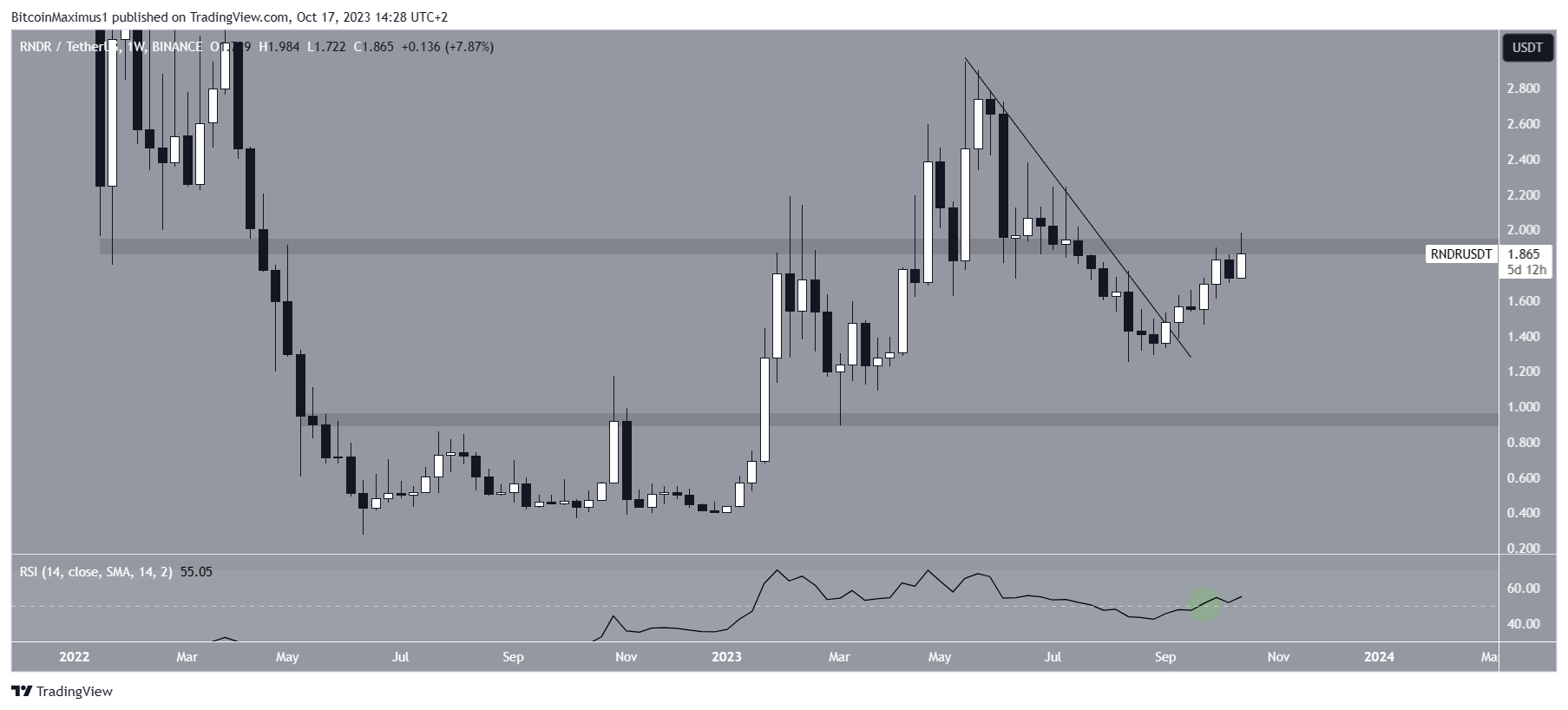

Render Token (RNDR) price broke out of a declining resistance trend line on September 9th. The token reached its highest price since July, surpassing the $1.85 horizontal resistance area. The weekly timeframe technical analysis for RNDR indicates that the price traded just below the $1.90 horizontal resistance area.

Critical Level in RNDR

Initially, the cryptocurrency price broke out of the region in April. However, it failed to sustain its upward movement in July and declined below this level. The RNDR price broke out of a declining resistance trend line in September and has been increasing since then. It briefly surpassed the $1.90 region this week, but has not yet achieved a weekly close above this level.

The weekly relative strength index (RSI) shows a bullish trend. RSI is a momentum indicator used by investors to assess whether a market is overbought or oversold and whether an asset is being accumulated or sold. Readings above 50 and an upward trend indicate that bulls still have the advantage. Readings below 50 indicate the opposite. RSI is above 50 and rising, both signaling a bullish trend.

Advancements in Artificial Intelligence

Render Token is one of the largest projects benefiting from artificial intelligence technologies. While the artificial intelligence sector is booming in traditional markets, it still lags behind in the cryptocurrency sector. This investment is particularly noteworthy in productive artificial intelligence tools such as Chat-GPT. Investments in productive AI have reached $14.1 billion so far in 2023, overshadowing $2.5 billion and $3.5 billion in 2022 and 2021, respectively.

Hatu Sheikh, Co-founder and CMO of DAO Maker, noted that the decrease in VC funding for crypto-related projects is also due to this reason. Just as the market’s enthusiasm shifted towards trends like non-fungible tokens (NFTs) and metadata databases in 2021, the current spirit revolves around artificial intelligence. It is believed that when crypto regains attention, investor interest will also increase.

Türkçe

Türkçe Español

Español