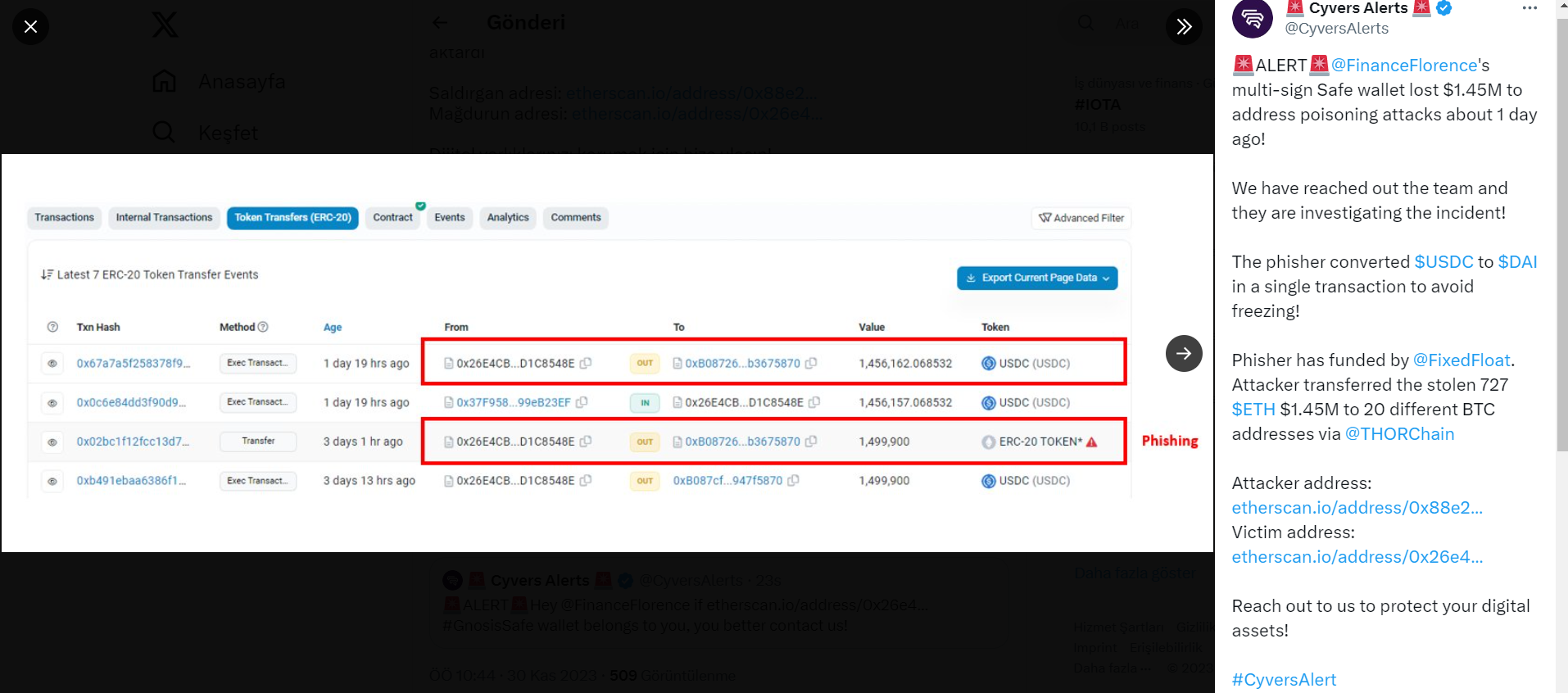

Bitcoin and the altcoin world recently witnessed an event where Florence Finance, a real-world asset (RWA) lending project, fell victim to a sophisticated phishing attack that resulted in a loss of approximately 1.45 million USDC. The attack, carried out through address poisoning, shed light on the security vulnerabilities crypto projects face, emphasizing the urgency of advanced security measures in the digital finance sector.

Crypto Project Hit by Address Poisoning Attack

Address poisoning, a common phishing technique in the crypto space, played a significant role in the Florence Finance attack. Address poisoning attacks represent malicious strategies used by attackers to manipulate network behavior. These attacks pose risks such as traffic redirection, service disruptions, or unauthorized access to sensitive data.

In these attacks, attackers typically add false data or manipulate routing tables to exploit vulnerabilities in the system’s infrastructure. The goal is to compromise the network’s integrity and functionality, potentially leading to serious consequences like data breaches or disruptions in service availability.

Defense against address poisoning attacks requires robust cybersecurity measures and constant vigilance to detect and mitigate potential threats in real-time. Cyvers’ co-founder and CTO Meir Dolev explained that this method involves creating a wallet address that closely mirrors a legitimate address used by the victim.

The attacker makes moves that rely on human error during transactions where users could select the fake address by altering a few characters of the original address. People then accidentally send money to the attacker’s wallet.

Funds Transferred to THORChain by Scammers

Following the phishing incident, hackers strategically transferred funds through multiple wallets and eventually bridged to THORChain after converting to Ethereum (ETH). Despite suspicious transactions occurring on Tuesday, Florence Finance has yet to issue a statement to the community on Twitter.

Cyvers’ co-founder and CEO Deddy Lavid emphasized the orchestrated nature of the phishing scheme, highlighting the urgent need for heightened vigilance and advanced security measures in the digital finance sector. The collaboration between Cyvers and Florence Finance aims to strengthen security protocols and reduce the risk of future phishing incidents.

Millions Stolen Could Not Be Prevented

In an era where multi-million dollar attacks have become commonplace in Web3, the Florence Finance attack underscored the necessity of robust security frameworks. Recent events like the $45 million loss of decentralized exchange KyberSwap and the $100 million heist from Justin Sun’s HECO chain and HTX crypto exchange further highlight the urgent need for a proactive approach to cybersecurity in the crypto industry.

As the sector struggles to overcome these challenges and strengthen its defense against evolving threats, each new hack incident inevitably leads to negative sentiment in the market. It is crucial for platforms to take the necessary measures at this point for the robustness of the industry.

- Address poisoning poses severe risks to crypto projects.

- Advanced security measures are essential for protecting assets.

- Recent crypto heists emphasize the need for vigilance.

Türkçe

Türkçe Español

Español