Altcoins, although initially shaken by the BTC price fluctuations, have reignited hopes for a rally as the $67,000 mark is reclaimed. ETH has surpassed $3,800 and a rally above $4,000 could trigger a relaxation in Bitcoin Dominance (BTCD), potentially leading to more capital flowing into altcoins. However, it’s crucial to focus on the current targets for SOL, CHZ, and CEEK Coin in both scenarios.

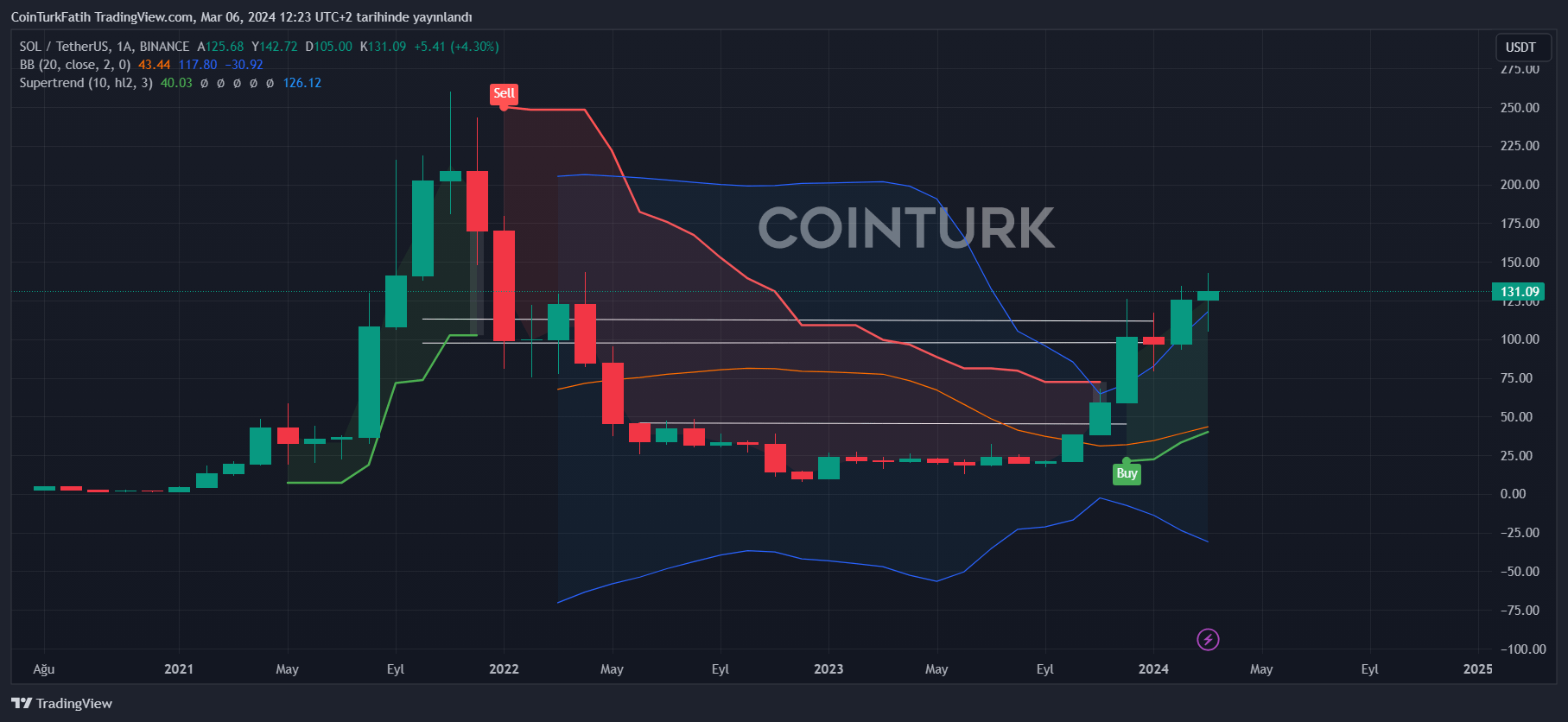

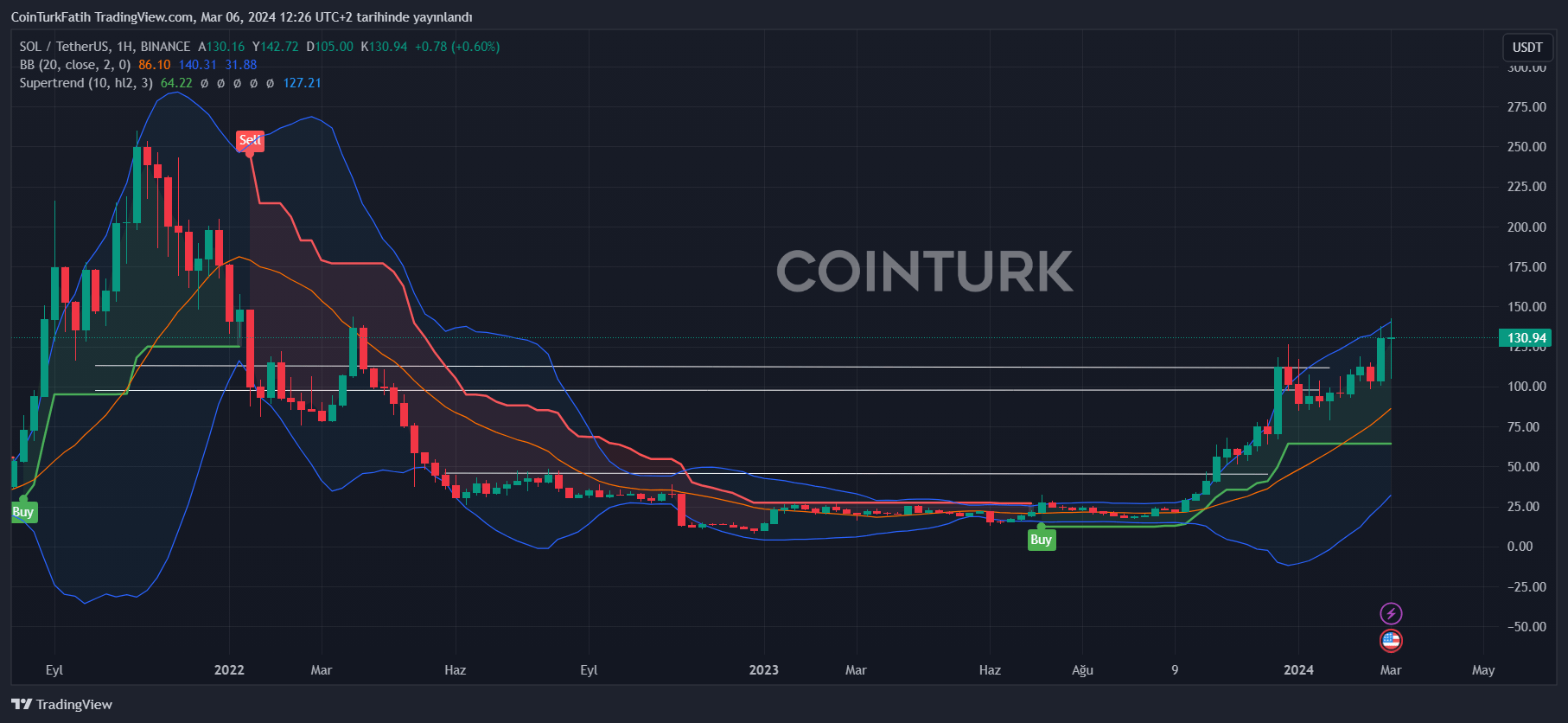

Solana (SOL)

The long-term bullish trend for Solana is much more apparent on the monthly chart. The SOL Coin price has seen an approximate 550% increase in 152 days since October. Considering the days it dipped to $8, the current price of $130 is quite satisfying. Yet, those who entered at the bottom and joined the rally do not seem eager to take profits just yet. According to the monthly chart, closing prices above $143 could lead to new peaks between $178 and $243.

On the weekly chart, closing prices above $143 are also important for the continuation of the uptrend since December. Additionally, the price above the $111 parallel channel resistance indicates a strong appetite for further increases. Moreover, the long lower wick created by the BTC drop reflects investors’ appetite for lower levels.

In a potential downtrend scenario, a drop below $128 could deepen the move towards $111 and $100.

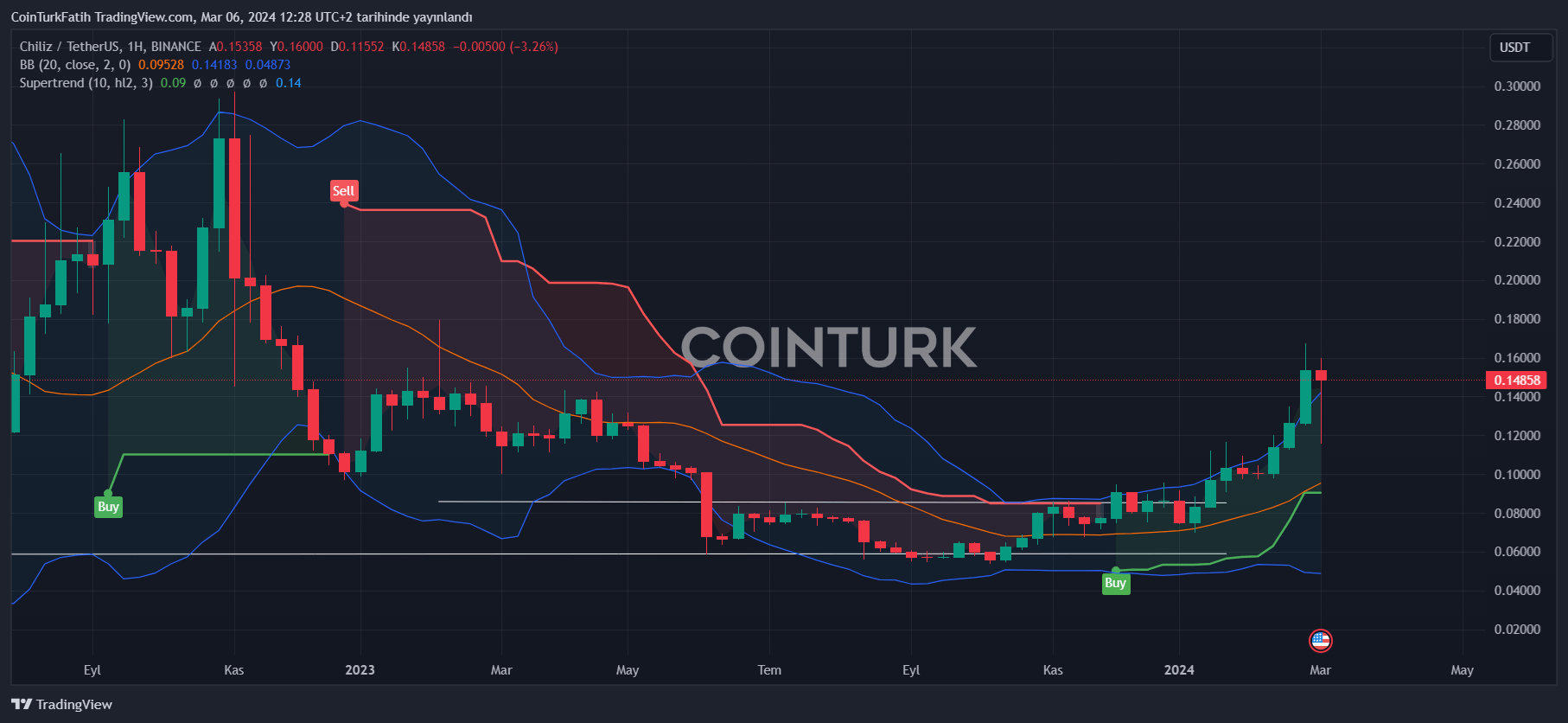

Chiliz (CHZ)

The meltdown in the BTC price also resulted in a long lower wick for Chiliz. Bitcoin’s drop to $59,000 forced investors to make quick decisions late yesterday. However, those who remained calm do not regret their decision so far. The pullback of BTC to the demand zone and its subsequent upward movement was a reasonable scenario for most experts.

CHZ Coin has reached the mentioned target of $0.17 and experienced an increase of nearly 100%. If the $0.16 region can be maintained, it could initiate a parabolic rally between $0.177 and $0.27. Particularly, announcements from the Dreyfus side should be closely monitored, as a news-triggered rally scenario could become a reality.

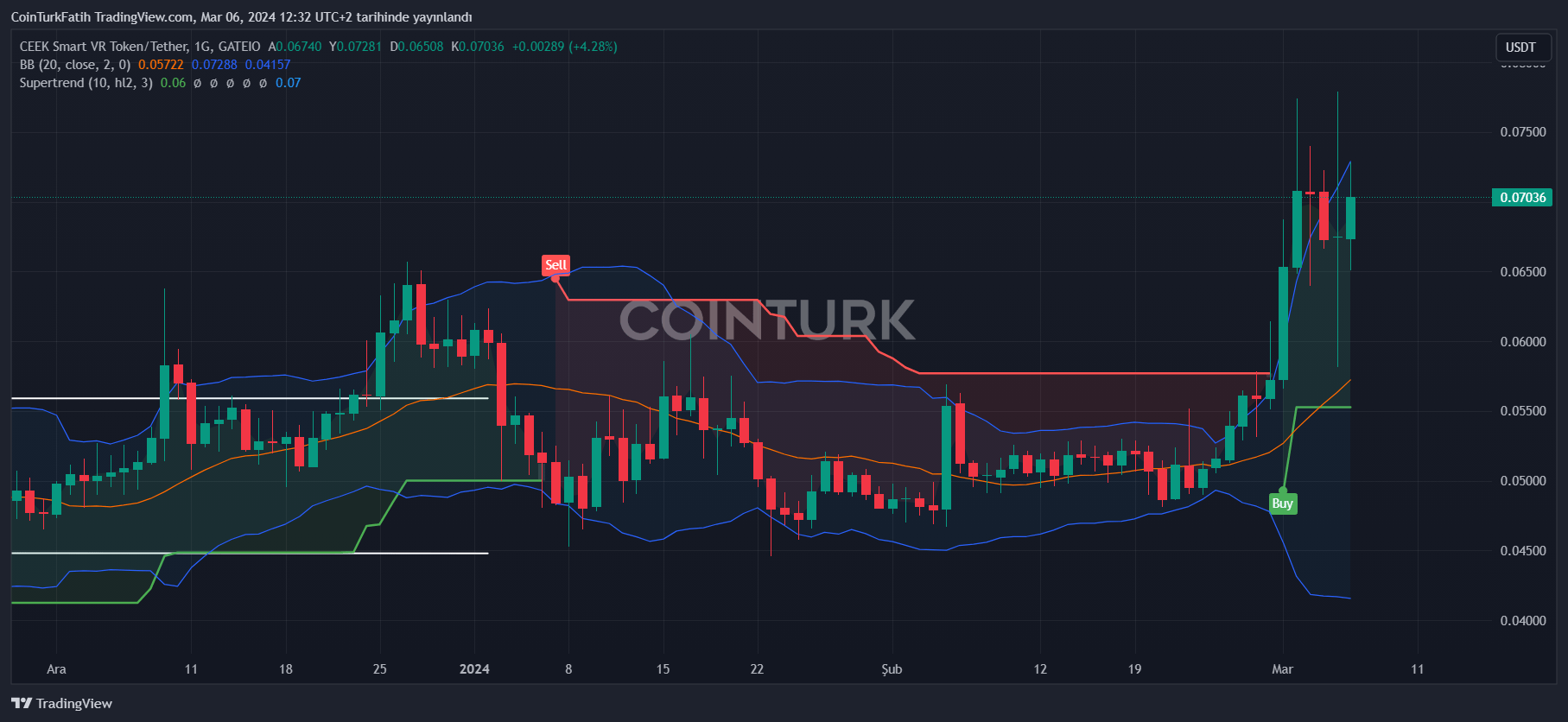

CEEK Coin

CEEK Coin, which has been psychologically taxing for its investors during the bear market, continues its intermediate rallies with closures above the $0.055 resistance.

If the price can close above $0.073, it could initiate a rally towards the $0.1 target. However, there are significant issues in areas such as project progression and investor motivation. Overcoming these requires something to reinvigorate the community.

Türkçe

Türkçe Español

Español