Spot Bitcoin (BTC) ETFs’ anticipated approval has brought significant volatility. However, according to some analysts, an event that occurred nearly a week ago has led to a decrease in the volatility of the leading cryptocurrency.

Analysis of Bitcoin ETFs

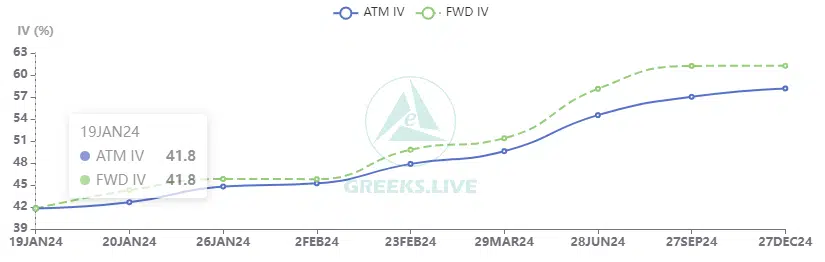

Market researchers Greeks.live analyzed the current options market and showed that the immediate effects of the ETF approval have mostly subsided. Bitcoin’s volatility reached a new low, marked by declines in both realized volatility (RV) and implied volatility (IV), with short-term IV falling below 45%.

Realized volatility (RV) reflects the actual price fluctuations of a token, while implied volatility (IV) measures market expectations of future price movements. The decline in both RV and IV may indicate a period of reduced price volatility and decreased uncertainty about Bitcoin’s short-term movements. Bitcoin may soon see the direct effects of reduced volatility. Risk-averse institutional investors may move towards the leading cryptocurrency in search of a more stable environment for their investments. The mentioned decline may also indicate increased market confidence and potentially lead to wider acceptance of Bitcoin.

Bitcoin Price Forecast

However, analysts and investors who benefit from price volatility for profit may not gain sufficient benefit. For them, a less volatile environment could limit trading opportunities and potential earnings. Additionally, prolonged low volatility could decrease the interest of speculators and potentially affect Bitcoin’s overall trading activity and liquidity. The expectation of approval for Spot Bitcoin (BTC) ETFs brought significant volatility. However, according to some analysts, an event that occurred nearly a week ago has led to a decrease in the volatility of the leading cryptocurrency.

Furthermore, at the time of writing, the leading cryptocurrency’s price had seen a 0.65% decrease in the last 24 hours, trading at $42,507.73. The BTC‘s MVRV ratio also significantly dropped during this period.

Türkçe

Türkçe Español

Español