Bitcoin continues to hold above the $42,000 mark for now, and altcoins are relatively calm. However, this week is critical. Hosting many important developments, the ongoing easing of GBTC sales is of critical importance. Additionally, statements following the Fed’s interest rate decision will tell us whether the first rate cut will happen at the March meeting.

Cryptocurrency Commentary

Bitcoin is approaching the closing price of the first month of 2024, which is close to the price at which it started the year. Although Bitcoin reached the $49,000 mark this month, the speculative markets were reminded once again amidst high-volume sales.

Popular cryptocurrency analyst Skew, addressing the short-term charts, emphasized that investors should continue to be cautious. Skew described the $42,000 level for Bitcoin as follows;

“From this perspective, it doesn’t look too bad, but in a narrow time frame, we can see significant congestion with this mid-range level.”

Skew expects Bitcoin to maintain above the neutral zone in the relative strength index. Rekt Capital, on the other hand, is optimistic after the recovery following the last correction.

Fed Meeting

New turmoil in the Chinese markets and the ongoing problems of real estate giant Evergrande continue. The company has walked away from the table again, so we might see bankruptcy news these days. Stock prices have fallen by nearly 30%. On the macro front, political tensions in the US are also putting pressure on crypto.

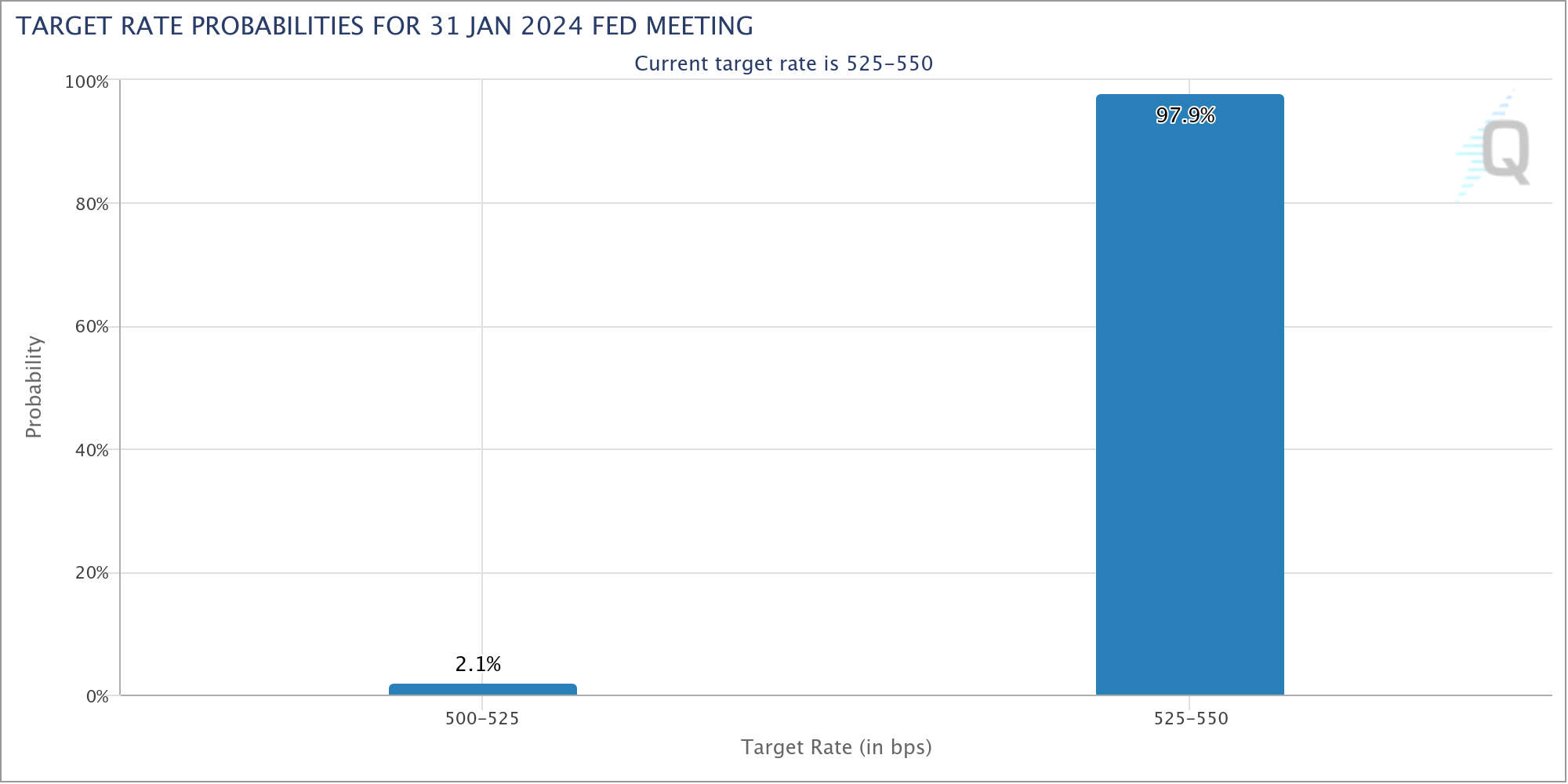

However, we are not entering this week’s Fed meeting with too bad a hand. Inflation is generally following a trajectory consistent with the Fed’s expectations, and there are no massive negatives in macro data. Interest rates are expected to remain steady at this meeting, with a 50% chance that the first decrease will start at the March meeting.

Former BitMEX CEO Arthur Hayes suggests that if banking turbulence returns to the US in the coming months, pressure on crypto will continue, but the Fed and Yellen are confident that this will not happen.

Spot Bitcoin ETF

One of the most followed items of the week is the GBTC outflows. There is still over $800 million in cumulative net inflows. Despite GBTC outflows, continued interest in other ETFs eliminates the risk of massive selling pressure.

The decreasing amount of GBTC outflows day by day last week is one of the reasons feeding optimism for the new week. If this decline continues, more positive news could be seen in cryptocurrencies until the Fed decision on Wednesday.