On the last trading day of the week, a significant piece of data will be released in the cryptocurrency markets, and an increase in volatility is expected. The cumulative volume on exchanges is below 50 billion dollars, and this confirms that the excitement has faded in the short term following the approval of an ETF. Cryptocurrencies are famous for their surprise surges and drops, and one such event may be approaching.

CEEK Coin Commentary

PCE data is an indicator monitored by the Fed for inflation, and in a few hours, it will likely set the tone for the meeting next week. Although volumes are generally weak, there is lively demand on the spot side, and the accumulation of orders at BTC’s support level of 38,500 dollars is promising. These alone are not sufficient, but an increase in volatility is expected. If the pressure on the futures side weakens, we may likely see a rise; conversely, if spot demand weakens, the decline could be frustrating.

For both scenarios, there are certain levels that CEEK Coin investors should pay attention to. The price, having lost 0.05598 dollars, dashed hopes for a rise and tested the support of the parallel channel. If the decline continues, the support at 0.04127 dollars could be visited. In the opposite scenario, the middle area of the channel could turn into solid support at 0.05 dollars and again target the channel’s resistance.

Chiliz (CHZ) Chart Commentary

Compared to other altcoins, CHZ Coin price is in the midst of a more moderate price movement. It has climbed back above 0.1 dollars, and with the league finals approaching, investors’ optimism is increasing. Followers know that fan tokens generally diverge from the overall market sentiment during league finals and cup periods.

If we start to see closures above 0.11 dollars in the following hours, we may witness a continuation of the rise up to 0.13112 dollars. In a positive scenario, the 0.142 and 0.17829 region could be where profit-taking starts.

In the opposite scenario, if the 0.1 dollar level is lost, there could be a reversal to the parallel channel resistance at 0.085 dollars.

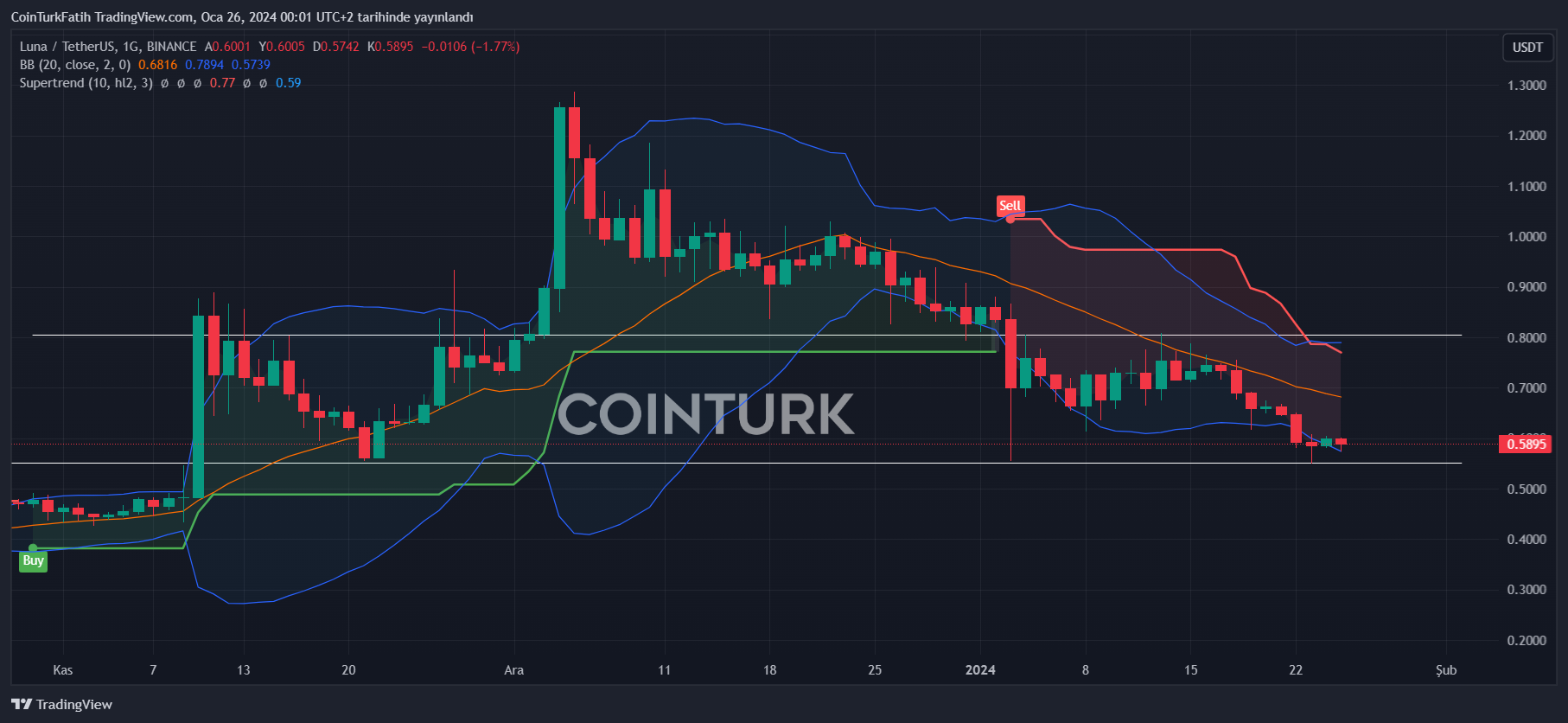

LUNA Coin Reviews

Terraform Labs officially declaring bankruptcy has seriously pulled down the price. This is not surprising, but it is also necessary to know that LUNA Coin attracts intense interest from those chasing speculative trades. This means that any news or development can trigger illogical surprise rises and liquidations.

Price levels are clear; closures below 0.546 dollars could initiate a move towards a new all-time low. If 0.67 dollars is reclaimed, this could trigger a rise to the parallel channel resistance.