September did not start well for the overall cryptocurrency markets, and historical data is raising concerns for the remaining days. We saw that in the past years, September hosted price increases for BTC. However, the price has dropped by at least 7% in the intervening years, indicating that September may not be a favorable period for cryptocurrencies in general.

XRP Coin Reviews

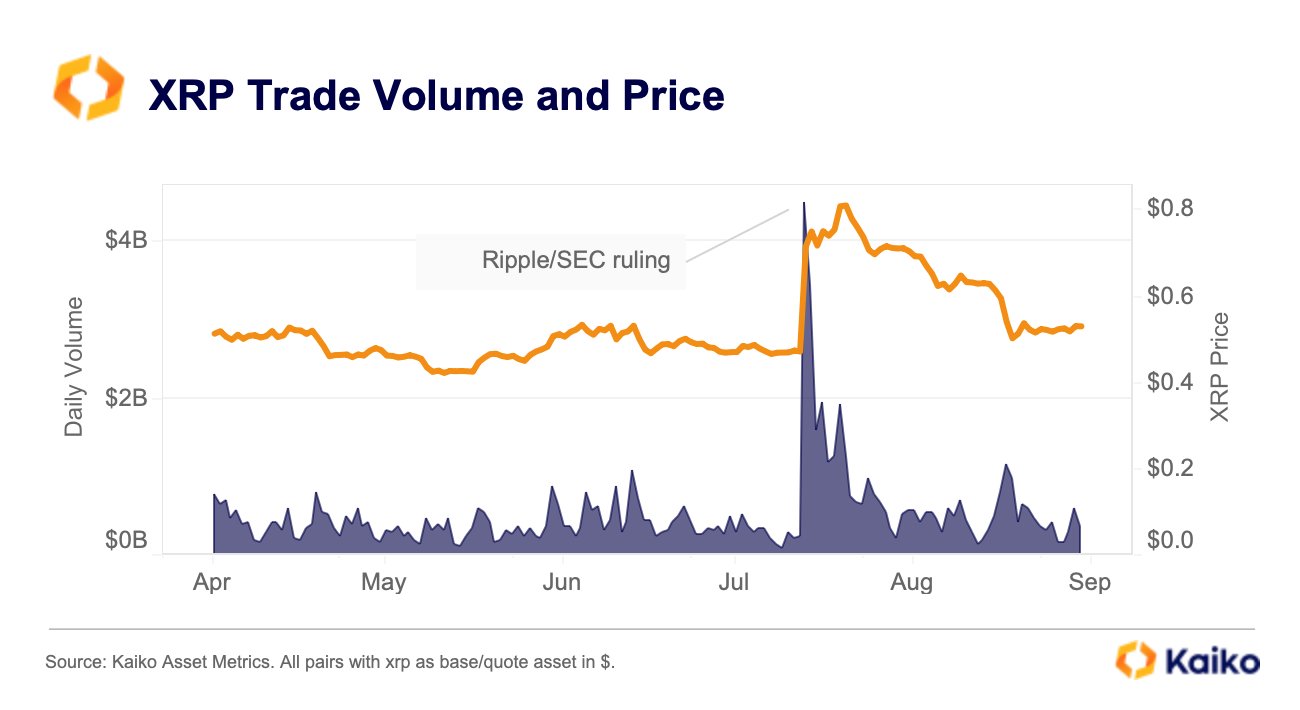

According to on-chain data research firm Kaiko, despite an increase in trading volume during this period, Ripple’s price has lost most of its gains from August. After US Judge Analisa Torres ruled that Ripple did not violate federal securities laws by selling its XRP token on public exchanges, the token’s value had risen to $0.93 in July.

The decision led to an increase of over 70% in XRP’s value within 24 hours and caused it to separate from Binance Coin, which is among the top 4 cryptocurrencies by market value. Although the performance of XRP Coin in July was exciting, its price closed at $0.70, and it experienced a decline throughout August. At the time of writing, it was finding buyers below the critical $0.5 mark, indicating further potential losses.

Ripple (XRP) Coin Price Target

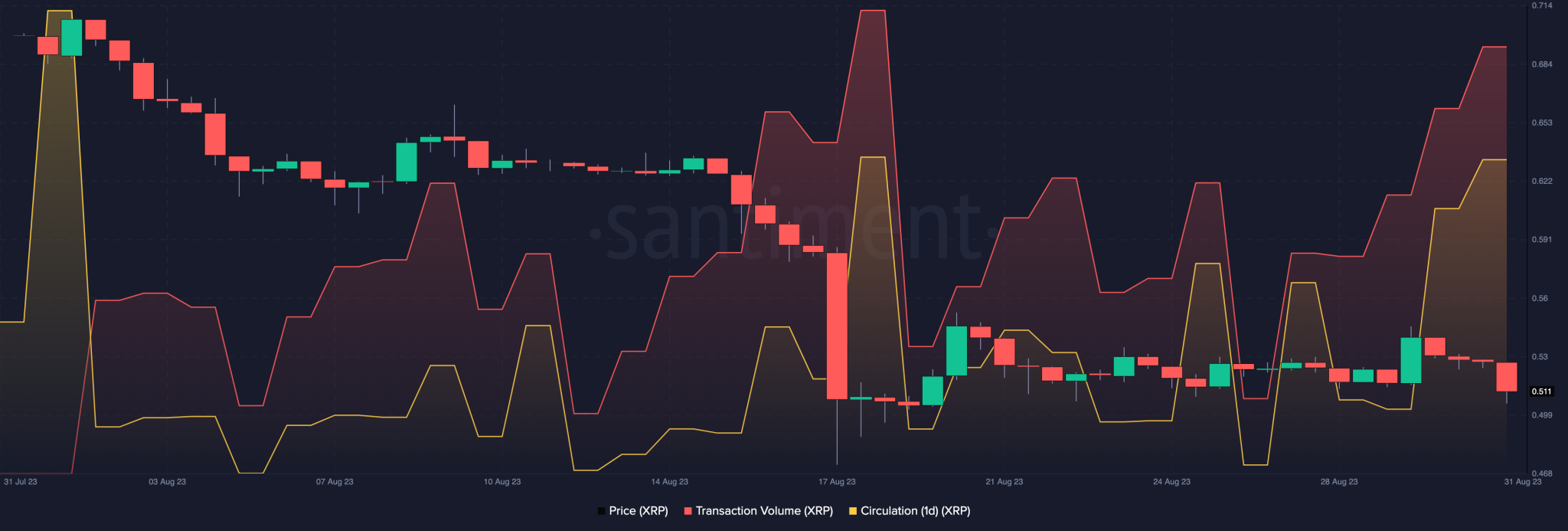

Despite the recent decline in value over the past few weeks, XRP reached its highest transaction volume in 7 months on September 1st. The transaction volume metric of XRP tracks the total number of tokens traded daily. On September 1st, this token count reached 4.8 billion XRP, the highest level since the beginning of February. Santiment data for the same period showed that 2.03 billion unique XRP tokens were traded. This rise indicates a few things. Firstly, it may indicate a renewed interest in XRP after the price decline of the previous month. If overall market sentiment improves and accumulation pressure increases, this could lead to a price recovery.

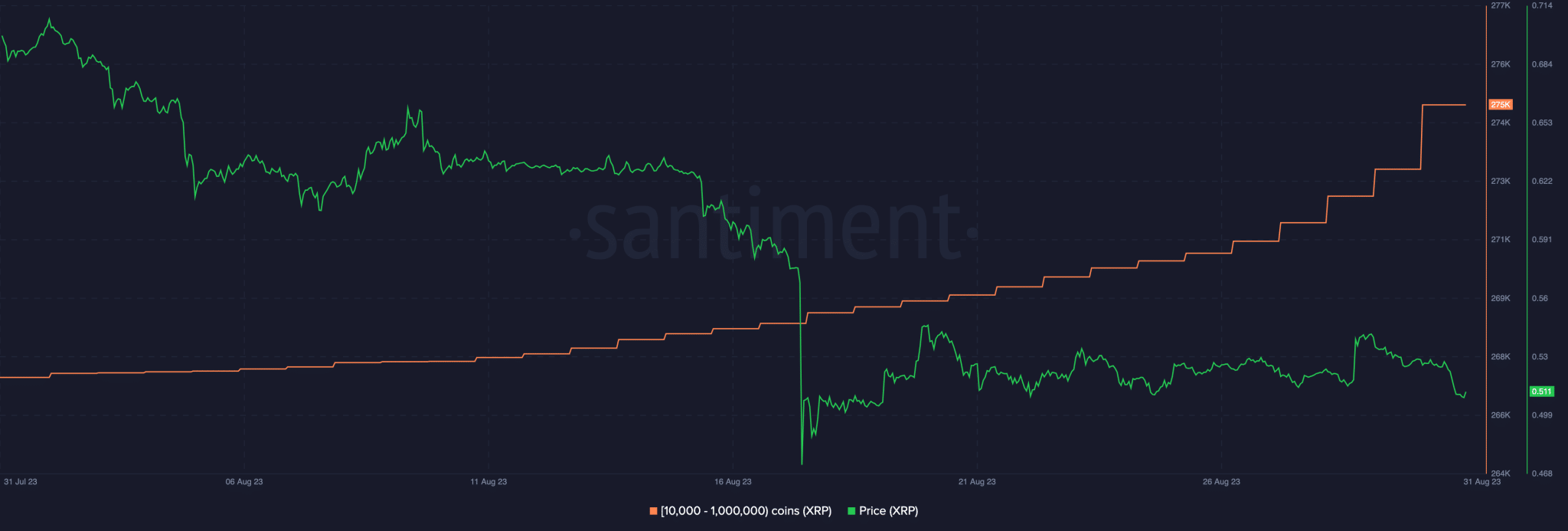

Similarly, XRP whales may have started accumulating in anticipation of a price rally when the summer lull ended. Data from Santiment revealed an increase in the daily number of whale transactions over $100,000 and $1 million last week.

For the bullish scenario to become valid, the price needs to close above $0.51 and target the $0.63 region. If the downtrend continues, we may see the price drop to $0.42.

Türkçe

Türkçe Español

Español