Today, I came across a post about XRP on X. Investors will remember my XRP article from yesterday. In that article, I criticized analyst Egrag Crypto. I emphasized that targets should be realistic and investors should not be misled. Today, another expectation about XRP was shared in the market. In this article, I will examine this expectation.

How Realistic is the Expectation for XRP?

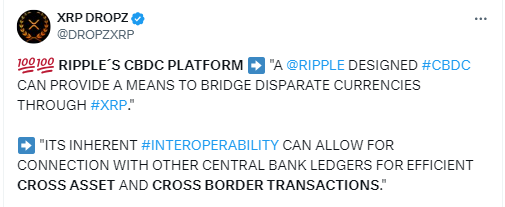

In a post about XRP, as seen below, the focus was on the characteristics of XRP’s nature. It was stated that there is potential for integration and cooperation with other central bank digital currencies.

On the other hand, it was emphasized that XRP’s interoperability feature has the ability to connect with different central bank ledgers in effective asset and cross-border transactions. This means that XRP could serve as a bridge between financial systems and provide more efficient and faster transactions in international payments.

Continuing the Praise for XRP

Professional game designer Chad Steingraber evaluated what would happen if such a development occurred. According to Steingraber, as on-chain diversity increases, the transaction volume and usage potential of XRPL could also increase. Additionally, the adoption of CBDCs, or Central Bank Digital Currencies, and stablecoins could add more diverse assets and value to this network.

With high expectations, Steingraber also evaluated the topic specifically for the USA. It was stated that the adoption of stablecoins like RLUSD by countries like the USA could contribute to increased liquidity on XRPL. In such a case, it was expressed that the usage area of XRP would expand even further.

Why Choose XRP Among So Many Cryptocurrencies?

As a writer questioning the posts about XRP, I believe there is no clarity on why Ripple made a move like RLUSD. Ripple’s XRP already behaves like a stablecoin in terms of price behavior.

While launching a stablecoin like RLUSD, there is no point in linking it to XRP. Both cryptocurrencies can use Ripple’s own network. However, it should be remembered that one is a stablecoin.

Finally, Ripple stands out with XRP praise in every move it makes. The project may have positioned itself for international payments, but today there are many projects that can do this much better than XRP. As for RLUSD, it is a very late move, and I don’t think it is very likely that the USA will adopt it. Especially considering that Ripple has been accused of unauthorized securities sales during the lawsuit process.

Türkçe

Türkçe Español

Español