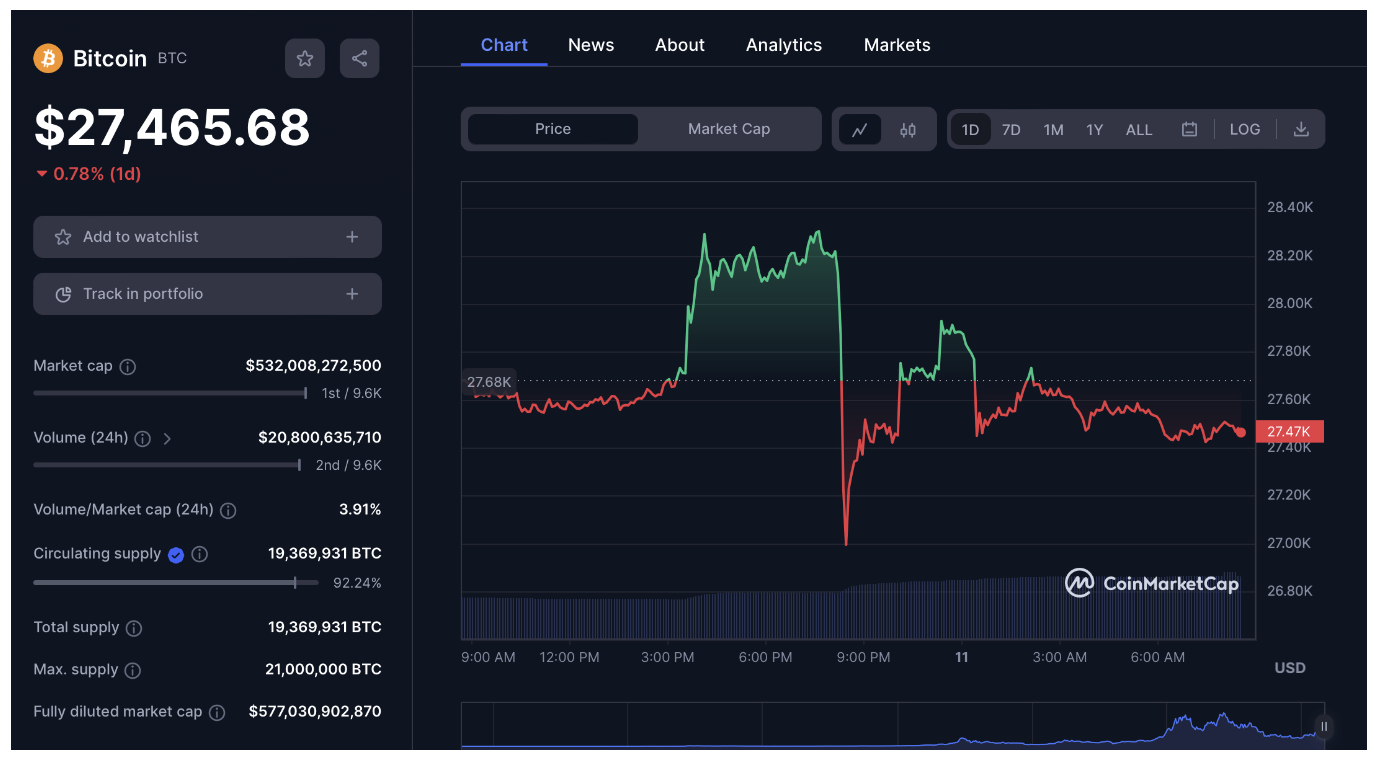

Bitcoin (BTC), the leading cryptocurrency, which has lost an average of 0.5% in the last 24 hours, started trading at $27,500, while the total market capitalization of the cryptocurrency ecosystem fell to $1.13 trillion after the declines recorded since yesterday evening. Analyzing this recent decline in the market, the analyst pointed to possible price levels that could play a critical role in the near term.

Bitcoin’s Depreciation Gains Momentum

The cryptocurrency market started the day with a bearish momentum. After the recent declines, Bitcoin (BTC) started trading at $ 27,500, while Ethereum (ETH) fell to $ 1830. Bitcoin SV (BSV), Pepe (PEPE), Terra Classic (LUNC), Bitcoin Cash (BCH) and Sui (SUI), which have recorded sharp declines since yesterday evening with the effect of this depreciation in Bitcoin, have also become the cryptocurrencies that have lost the highest rates in the last 24 hours among the 100 cryptocurrencies with the highest market capitalization according to CoinMarketCap (CMC) data.

The total market capitalization of the cryptocurrency ecosystem fell to $1.13 trillion, also according to CMC data, while with the increase in volatility in the cryptocurrency market, short and long positions worth approximately $190 million were liquidated in the last 24 hours, according to Coinglass data.

Analyst Points to Critical Price Levels

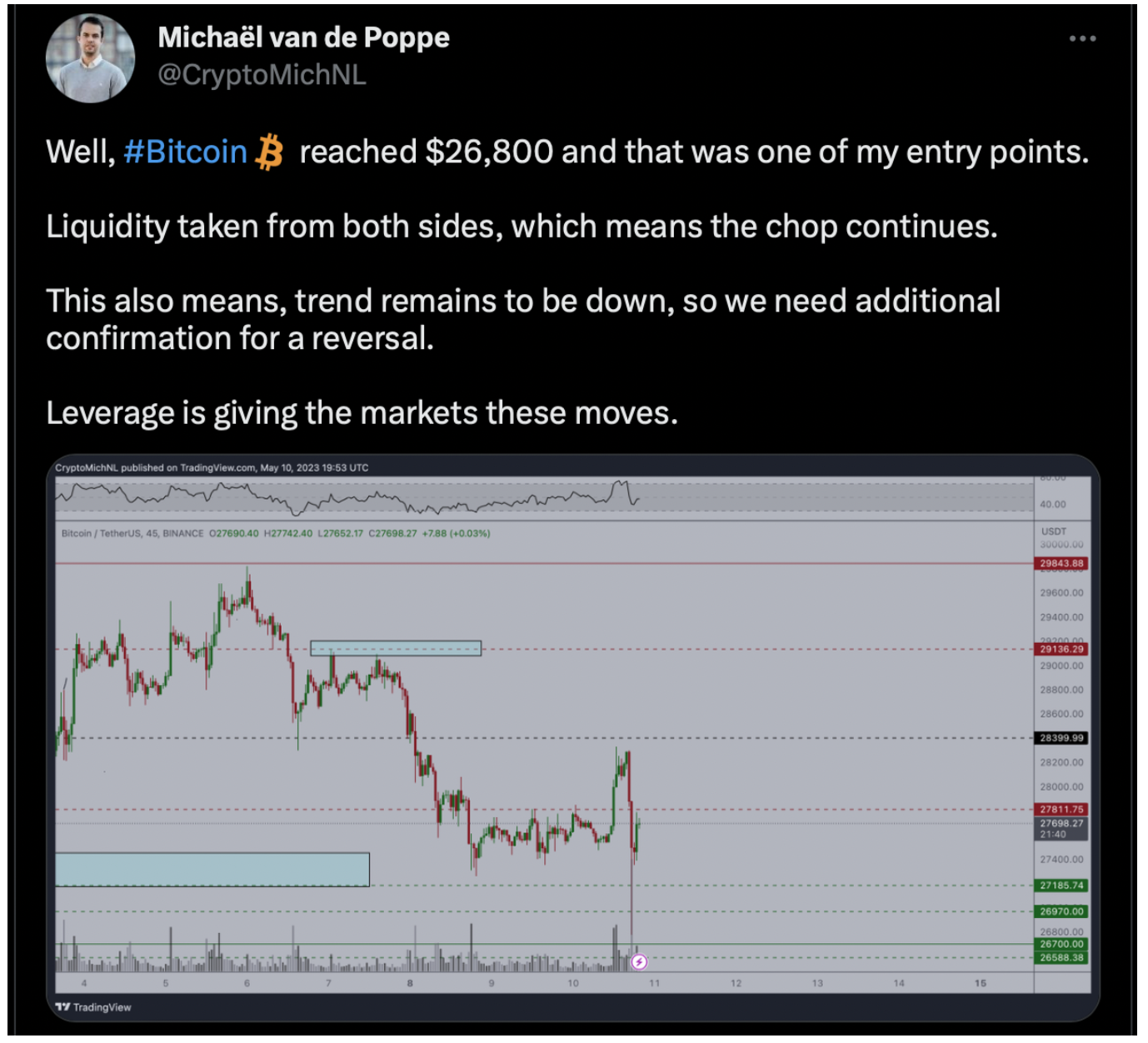

Cryptocurrency analyst Michaël van de Poppe, who evaluated the latest situation in the market, pointed to possible price levels that could play a critical role for the leading cryptocurrency BTC in the near term with a series of posts on his Twitter account. The analyst suggested that if Bitcoin fails to maintain $ 29,200 levels, the depreciation accelerates and the leading cryptocurrency could continue down to $ 26,800 support.

Stating that the recent decline in Bitcoin may indicate a reversal of the upward trend, the analyst stated that it is very important to exceed the $ 27,800 level in the near term in order to reverse the current downward trend.