Bitcoin (BTC) demand continues to rise, with noticeable increases in open positions in the derivatives market. Price fluctuations in cryptocurrencies are evident, linked to the FOMC meeting on June 12. Investors are quickly positioning themselves before the meeting.

Analyst’s Bitcoin Comments

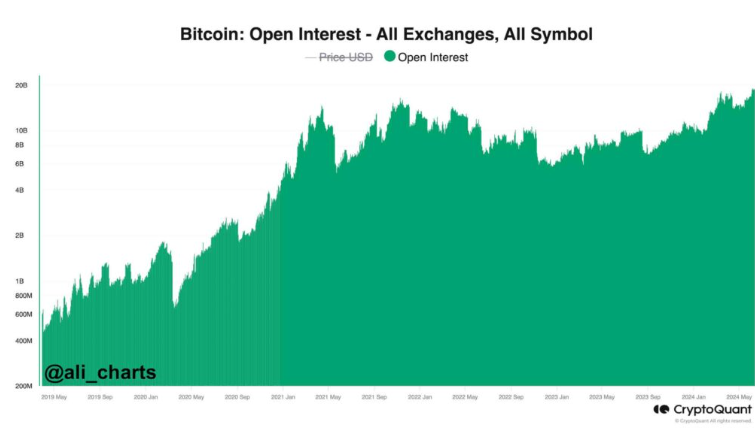

Open interest (OI) is monitored as a significant market indicator. OI represents the volume of active and open long/short positions. Traders aim for substantial gains by adding to their positions, leading to high volatility tied to Bitcoin’s liquidation levels.

As the number of open positions increases, their impact on spot trading grows, encouraging more enthusiastic trading among investors.

During these developments, well-known analyst Ali Martinez shared crucial information about Bitcoin, revealing an OI value of $18.75 billion. According to Martinez, this indicates strong market movement and an impending price fluctuation.

Ali Martinez stated:

Bitcoin open interest is at an all-time high of $18.752 billion! This indicates increased trading activity, strong BTC market sentiment, and higher volatility potential.

Bitcoin and the FOMC Meeting

Interestingly, key market figures expected volatile price performance ahead of the Federal Open Market Committee (FOMC) meeting, which will announce the Federal Reserve’s interest rate. These meetings significantly impact Bitcoin’s price. Generally, high volatility and increased open interest positions are observed during such periods.

Martinez highlighted in another post on X that BTC typically shows noticeable recoveries after FOMC meetings. At the time of writing, Bitcoin is trading at $67,100. If BTC follows the pattern in Martinez’s chart, its value could rise to $73,000 after a price recovery.

Recently, ChatGPT-4.0 was asked to predict BTC’s price considering the interest rate decision. ChatGPT-4.0 estimated BTC’s price to be between $70,000 and $73,000.

Türkçe

Türkçe Español

Español