Cryptocurrency market analysts believe that the ongoing rally that began in mid-October could be the start of an extended bull market. Top cryptocurrencies, including Bitcoin (BTC), have been successful in regaining levels seen before the bear market.

Current Data on Stablecoins

Such a period is generally characterized by a strong inflow of stablecoins. This is attributed to most investors using stablecoins to enter and exit transactions on cryptocurrency exchanges. However, the situation is somewhat different now. According to an analysis of DeFiLlama data, the overall value of stablecoins did not show a notable increase despite the significant rise in the market.

The total market value of all circulating stablecoins was $129.5 billion at the time of writing, compared to $139 billion in December 2022. The stablecoin market began to decline following the collapse of Terra USD (UST) last year. With the general market sentiment turning bearish, trading activity and consequently the demand for stablecoins decreased.

Analytics Firm Reports

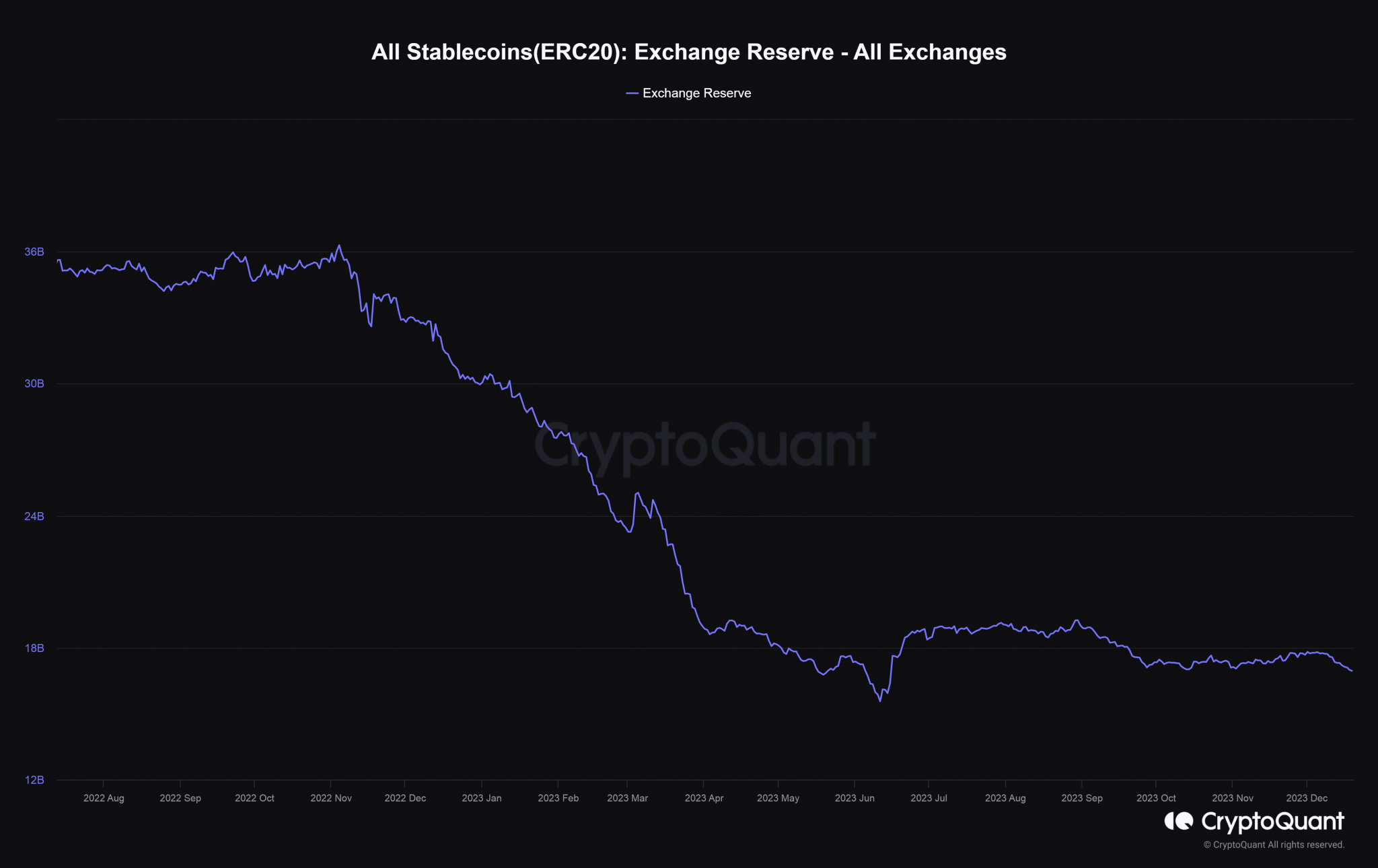

Nevertheless, the market value of stablecoins had risen to $188 billion in the weeks before the UST crash. At the time of writing, the value was 31% less than the peak. The total supply of stablecoins in cryptocurrency exchanges was still significantly lower compared to last year. According to a review of CryptoQuant data, there were $16.9 billion of ERC-20 stablecoins held in exchange wallets, whereas this figure was $30 billion in the same period last year. Generally, an increase in stablecoin reserves can indicate strong buying pressure and bullish sentiment in the market.

The lack of significant movement of stablecoins towards trading platforms proved that the ongoing rally was not supported by traditional market capital. As previously explained, stablecoins act as a bridge between the cryptocurrency market and the traditional market. Following more detailed analyses by experts, it was observed that Ethereum (ETH) was one of the biggest losers among stablecoins. According to DeFiLlama’s data, the chain lost 27% of its stablecoin market value since the beginning of the bear market in May 2022. Tron (TRX), on the other hand, witnessed a 37% increase in stablecoin supply during the same period.

Türkçe

Türkçe Español

Español