A significant development occurred today in the cryptocurrency world. Popular cryptocurrency and decentralized finance analyst Ignas noted that the amount of EigenLayer’s (EIGEN) tokens staked exceeds its circulating supply. This situation diminishes the appeal of staking rewards for users while hindering the appreciation of altcoin values.

Staked Amount of EIGEN Coin Exceeds Circulating Supply

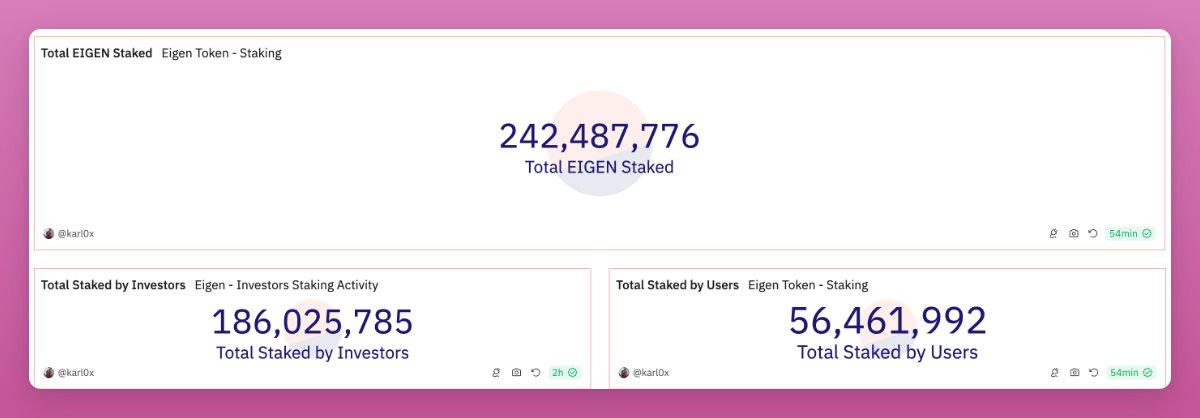

According to data, a total of 2.42 billion EIGEN coins are currently staked in the network. In contrast, only 1.86 billion EIGEN coins are in circulation. The reason for this discrepancy lies in investors’ ability to stake their “locked” coins, meaning tokens that are not actively in the market can also be included in the staking process.

Low APY Results in Decreased Purchases

On the other hand, the fact that the amount of staked coins exceeds the circulating supply also lowers the annual percentage yield (APY) rates. The lower the APY, the less interest new investors have in purchasing that asset to stake. Consequently, this scenario complicates the increase in the market value of the respective altcoin.

These situations are crucial for understanding how staking operates within the cryptocurrency landscape. While users aim to earn passive income by staking coins, in certain systems, rewards become insufficiently attractive due to locked coins, which significantly hampers potential value increases.

Türkçe

Türkçe Español

Español