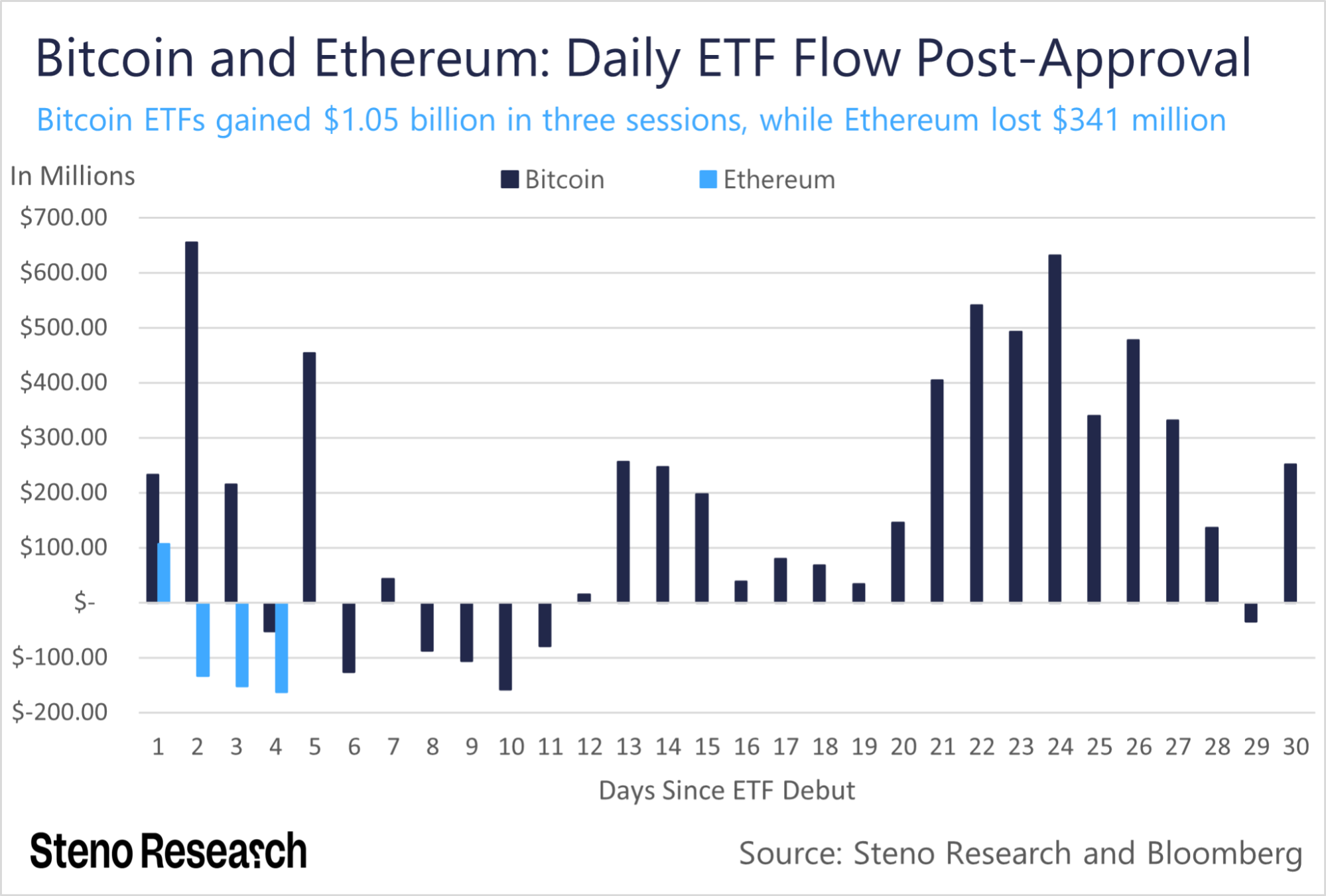

ETF funds, a new milestone in the cryptocurrency market, continue to make headlines. On August 1, despite cumulative outflows from Grayscale’s Ethereum Trust exceeding $2 billion, daily net inflows into US-based spot Ethereum exchange-traded funds turned positive again.

What’s Happening with Ethereum ETF Funds?

On August 1, Ethereum ETF funds recorded a net inflow of $28.5 million, led by a $91.4 million inflow into BlackRock’s iShare Ethereum Trust (ETHA).

Grayscale’s Ethereum Trust saw an outflow of $78 million in a day, bringing its cumulative outflows to just over $2 billion since it was converted to a spot fund. Unlike the other eight spot Ethereum ETF funds launched on July 23, ETHE was an investment vehicle for institutional investors to invest in Ethereum and was converted to a spot ETF fund on July 23.

ETHE held a total of $9 billion worth of Ethereum before its conversion. Today’s outflow data indicates that 22% of the initial fund has been sold. Several analysts predict that the slowing outflows from Grayscale’s fund could be a turning point for Ethereum’s price.

Notable Comment from a Famous Analyst

Steno Research senior analyst Mads Eberhardt previously stated that the significant outflows from Grayscale’s ETHE Trust would likely start to decrease by the end of the week and that the slowing outflows were a bullish factor for Ethereum’s price. Eberhardt wrote in a post on X on July 30:

“When this happens, it will only rise from there.”

Previously, on July 23, Kaiko’s head of index Will Cai stated that Ethereum’s price would be sensitive to inflows into spot products. Reflecting this sensitivity, Ethereum was trading at $3,168 at the time of publication, having fallen by 8.5% since the launch of the ETF funds, according to TradingView data. The recent selling pressure continues to negatively affect Ethereum’s price. This situation is also reflected in the Ethereum ecosystem, with recent data showing a decreasing interest from Web3 users.

Türkçe

Türkçe Español

Español