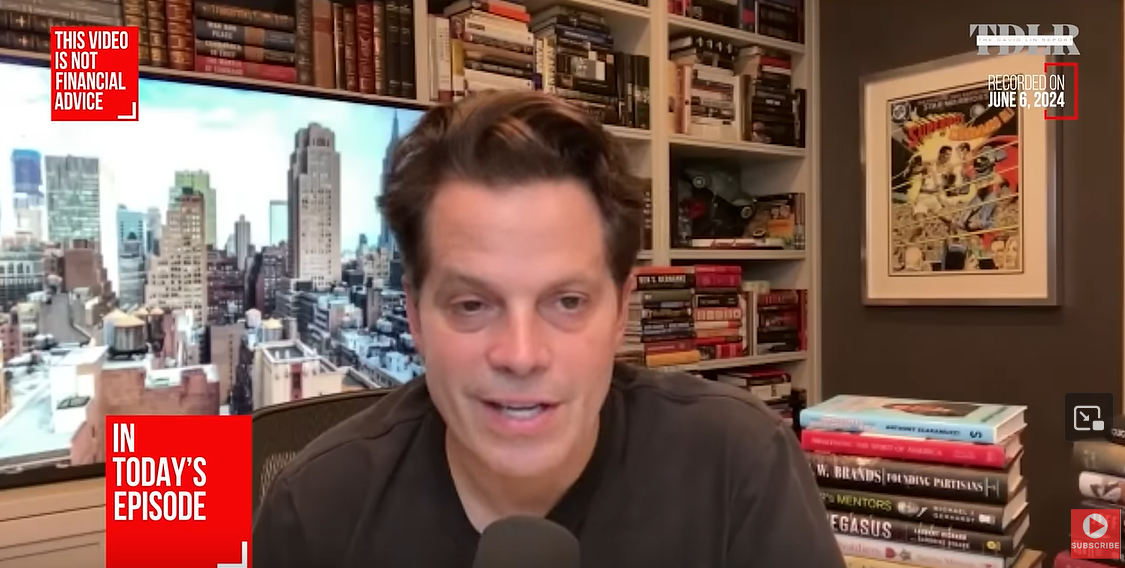

Anthony Scaramucci, who briefly served as the White House Press Secretary, made significant statements. Currently, the focus is on the US elections and the parties’ clear stances on crypto. The SEC’s approval of the ETH ETF has started to ease the long-standing pressure on investors. So, what did Scaramucci say in his latest statements?

Crypto and the November Elections

SkyBridge Capital founder Anthony Scaramucci says that despite the current US President Biden’s SEC and its negative approach, he has to soften his stance on crypto. Especially, Trump’s investor-friendly and morale-boosting statements have been quite influential in this regard.

In a new interview with journalist David Lin, Scaramucci, like many other experts, argues that the SEC’s change of decision on the ETH ETF is the main signal of this softening. Months ago, Gensler, who launched a legal battle against the entire Ethereum ecosystem, suddenly made a 180-degree turn, and after all transactions were completed within 5 business days, all Spot ETH ETF applications were approved.

All this happened after Trump’s statements, who is almost certain to be Biden’s opponent in the elections to be held in November. Trump is making increasingly bold statements about crypto and declared himself the president of crypto yesterday.

Cryptocurrencies May Rise

Scaramucci, who has served in the White House and has been a hedge fund manager for many years, says that yielding to the capricious stance of crypto opponents could pose a big problem for the elections. Recent polls support the November 2024 election rally scenario we wrote about a year ago, and this was expected.

“I think the Biden team vetoed this bill (SAB 121) last week, but despite Elizabeth Warren and Gary Gensler’s opposition, they approved Ethereum. I think now they will turn to Bitcoin and crypto assets. I don’t think Biden, who is a moderate, would want to be left in the dark on this issue. This is a very sensitive election, and I don’t think Joe Biden would want to lose this election because of the whims of Elizabeth Warren or Gary Gensler.”

Anthony Scaramucci also revealed his target figure for Bitcoin in roughly 10 years;

“This is an emerging asset. It is only adopted at a rate of 5% in the United States. If it continues to scale and be adopted at the same pace as in the last 10 years, there is no reason why it shouldn’t be a $300,000, $400,000, $500,000 asset.

If Gold (in terms of market value) is $16 trillion and Bitcoin is $1.5 trillion, can Bitcoin increase tenfold in the next 15 years? I believe it can, and I believe it has the technical features to allow it to do so, and we are already seeing it happen.”

Türkçe

Türkçe Español

Español