Following recent developments over the last few hours, a Bloomberg ETF expert has significantly heightened investor excitement. Cryptocurrency investors had lost hope after the FTX collapse, and despite prices rising more than 2x in recent months, many remained unconvinced. However, the latest developments suggest that these fears were unfounded.

Significant Developments in Cryptocurrencies

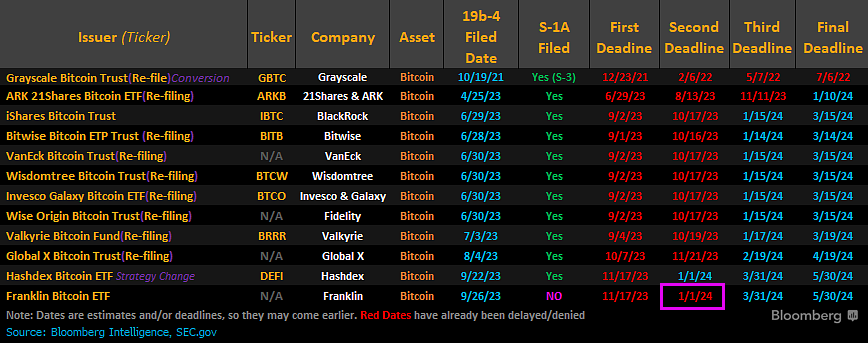

The leading cryptocurrency has remained above $38,100 in the past hour despite ETF rejections. There are reasons for this resilience. Firstly, BTC demand stayed strong following the last resistance test, and despite profit-taking, new open positions in futures worth $500 million pushed the price upwards. The second reason is the delayed decisions for the Franklin and Hashdex spot <a href="https://en.coin-turk.com/the-current-state-of-the-crypto-market-will-consolidation-continue-in-bitcoin/”>Bitcoin ETFs.

Moreover, these decisions were postponed earlier than expected, and Bloomberg ETF Expert James says that this is no surprise. James Seyffart made the following comments after the recent developments:

“Wow. The SEC acted very early for Franklin. It is noteworthy that Franklin is the only issuer that has not yet submitted an updated S-1.

At the beginning of January, there was also a postponement for Hashdex, which is in full support of my thesis that approvals will come for all applicants by January 10, 2024. The SEC is making the applications ready for a potential mass approval.”

January 2024 Crypto Bull Market

Bloomberg Experts predict that ETF approvals are 90% likely to come in the first ten days of January 2024. Many technical readings point to a significant rally in January. The halving is approaching, and the Fed is expected to begin interest rate cuts in the second quarter of 2024. When you line these up and look at them from a distance, what you see is a large monthly green candlestick.

Of course, expectations do not always materialize, but the conditions seem to be pushing the market towards a bullish phase, similar to how the conditions pushed the market into a bear season at the beginning of 2022. Remember those days? While the Fed was about to start raising interest rates, some investors were convinced that crypto would rise. They maintained this belief even as crypto companies went bankrupt.

Investors’ hopes were alive until Bitcoin lost the $30,000 level (remembering the mid-2021 test of $30,000 gave hope to investors?) until the FTX collapse. After that, investors remained cautious despite intentions from asset managers with trillions of dollars to enter the crypto space (at least a significant portion).

- Recent developments hint at unfounded fears.

- Delayed ETF decisions spark optimism.

- January 2024 may herald a crypto bull run.

Türkçe

Türkçe Español

Español