Cryptocurrency investors eagerly awaited the ETF approval, and December 29 was a critical date with significant developments now unfolding. We were discussing the announcement of AP agreements, which would indicate a step closer to this approval. After more than 30 meetings, we now see a new detail that suggests the approval is forthcoming.

Spot Bitcoin ETF Approval

We have just seen a new file update in the BlackRock iShares Spot Bitcoin ETF application. The expected AP agreement detail is present. This is an agreement indicating arrangements with Authorized Participants. More importantly, it now represents the final stage for SEC ETF approval. If there are no surprise negative developments, approval could come by January 10.

Bloomberg ETF Expert Eric Balchunas wrote;

“BlackRock just published its updated S-1 and names the APs: Jane Street and JPMorgan (which is somewhat ironic). It seems the first horse in the race is clear. The Authorized Participants are Jane Street Capital, LLC, JP Morgan Securities LLC”

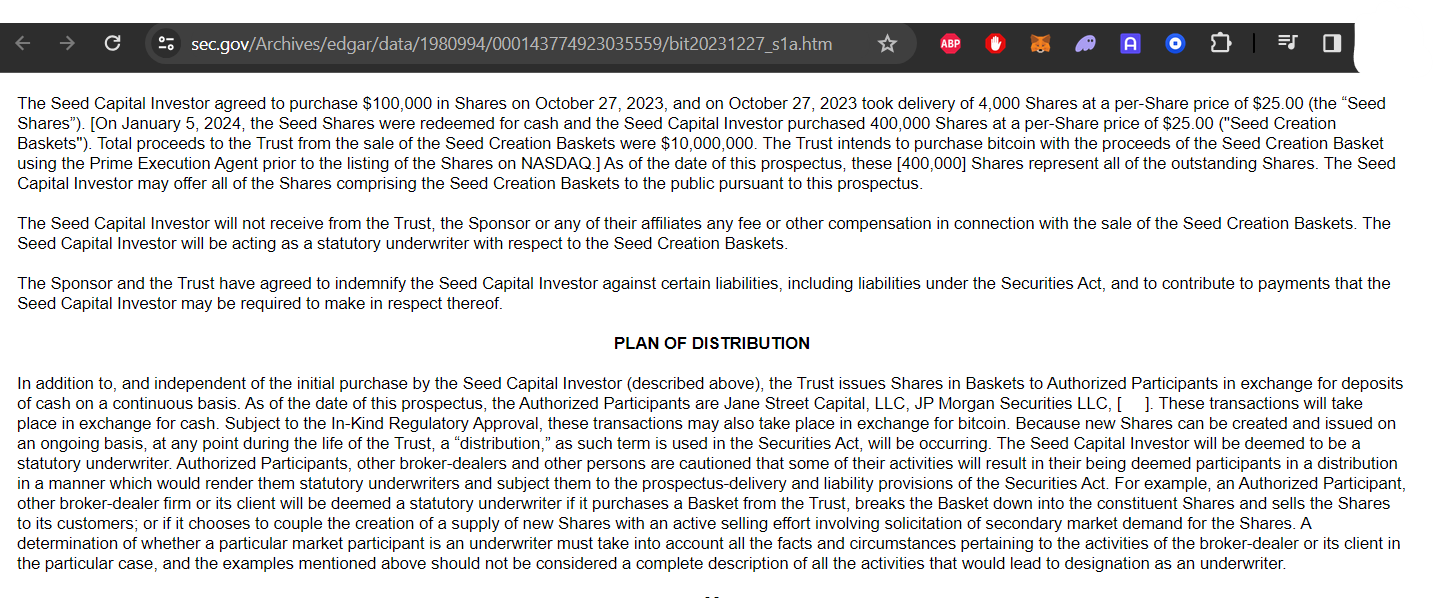

The ETF file update includes the following details in the Authorized Participants section;

“In addition to the initial purchase made by the Core Capital Investor (described above) and independently, the Trust continuously issues Shares in Basket form to Authorized Participants in exchange for cash deposits. As of the date of this prospectus, the Authorized Participants are Jane Street Capital, LLC, JP Morgan Securities LLC. These transactions will occur in exchange for cash. Subject to Regulatory Approval, these transactions may also occur in exchange for Bitcoin. Since New Shares can be continuously created and issued, a ‘distribution’ as used in the Securities Act will occur at any point during the life of the Trust. The Core Capital Investor will be considered a statutory underwriter.”

As we have expressed many times before, only cash is allowed in ETF transactions instead of both in-kind and cash. BlackRock has completed this and has also determined the Authorized Participants. Now, other ETF applicants need to determine theirs.

Türkçe

Türkçe Español

Español