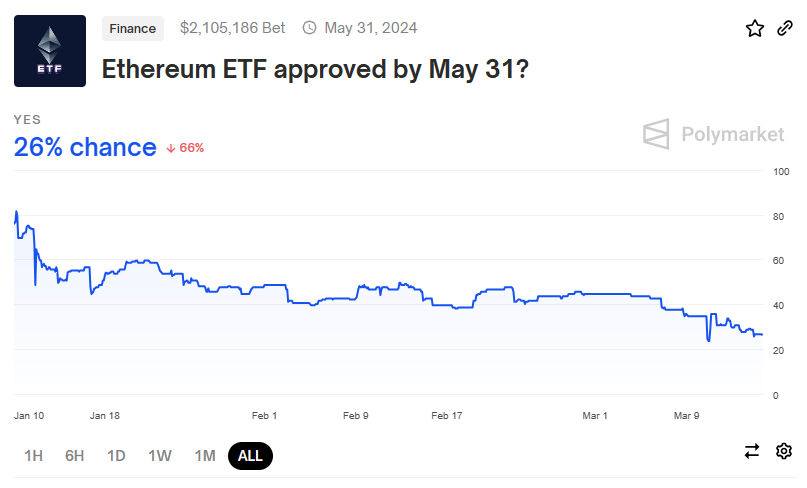

The cryptocurrency market continues to buzz with excitement over the ETF process. According to prediction markets on Polymarket, there is currently a 28% chance of a spot Ethereum ETF being approved by the end of May. This percentage marks a significant drop from the 74% chance for spot Bitcoin ETF funds that were predicted on Polymarket on January 10th.

Dimming Prospects for Ethereum ETFs

Since the U.S. Securities and Exchange Commission (SEC) approved 11 spot Bitcoin ETF funds in January, attention has shifted to whether the agency will greenlight spot Ethereum ETF funds. Asset managers, including BlackRock and Fidelity, have made submissions so far.

However, earlier this month, the SEC postponed its decision on Ethereum ETF applications from BlackRock and Fidelity, signaling that the likelihood of such a financial product is more remote than initially thought. Analysts at Ryze Labs believe this is likely and added, “We think SEC Chairman Gary Gensler, who has been the most validating of the crypto asset class by approving multiple ETF funds, does not want to be the Chairman who approves spot Bitcoin ETF funds with limited authority, leaving the agency more room to reject future non-Bitcoin ETF applications.”

What’s Happening in the ETF Process?

The chances of a spot Ethereum ETF approval faced more obstacles this week. Two Democratic U.S. senators urged SEC Chairman Gensler in a letter dated March 11 not to continue approving future crypto products following the regulator’s approval of spot Bitcoin ETF funds in January.

Earlier this week, Bloomberg Senior ETF Analyst Eric Balchunas, lowered his expectations for the approval of spot Ethereum ETF applications from 70% in January to 30% now. In his statement, Balchunas mentioned a 30% chance. In January, Balchunas had predicted a 70% chance of approval by May, while his colleague James Seyffart had estimated 60-65%.

“This Ethereum ETF cycle now seems like the complete opposite of the Bitcoin ETF approval rates. The more I see or hear, the less optimistic I become.”