The U.S. Securities and Exchange Commission’s (SEC) expected approval of spot Bitcoin ETFs could trigger a flood of investment into the cryptocurrency market. If ETFs are approved, about a dozen companies including BlackRock, Grayscale, Fidelity, and Galaxy/Invesco will need to purchase tens of billions of dollars worth of Bitcoin to meet the anticipated demand from individual investors. This raises concerns about whether the market is prepared, although leading Wall Street firms are already making the necessary preparations.

Wall Street Firms Await Spot Bitcoin ETF Approval

The current largest Bitcoin investment vehicle, Grayscale Bitcoin Trust, with assets worth $26 billion, is a significant indicator of the existing appetite for BTC. The industry seems confident in its ability to manage such a wave of investors, and key market players state that Bitcoin trading has sufficient liquidity to handle significant purchases.

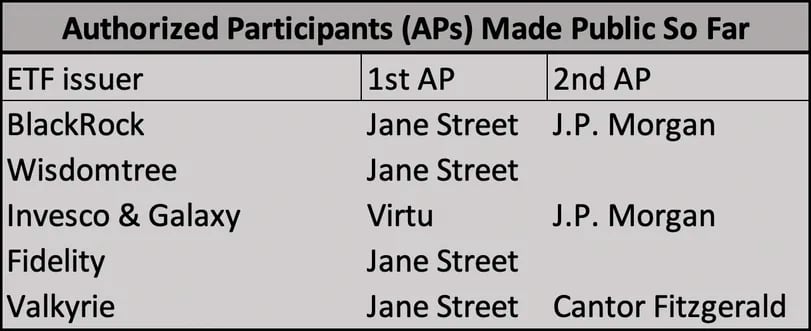

Two key players will come into play to facilitate the efficient trading of large capital amounts: Authorized Participants (APs) and market makers. APs create and use ETF shares, which is crucial for maintaining the ETF price alignment with the underlying assets. Market makers operate in the secondary market, trading on exchanges and helping to stabilize the ETF share prices.

Leading Wall Street firms such as JPMorgan Chase, Jane Street, and Cantor Fitzgerald have agreed to serve as APs for spot Bitcoin ETFs. DRW, a significant liquidity provider trading firm, is actively preparing for spot Bitcoin ETFs by incorporating issuers and securing BTC to meet potential orders.

High Confidence in Market Efficiency

Despite concerns about handling large Bitcoin orders, investors express confidence in the market’s efficiency. Indeed, the daily average Bitcoin trading volume of $22 billion, which sometimes reaches $40 billion, is considered sufficient to meet ETF demand.

ETFs are attractive options for investors due to their accessibility and close reflection of the assets they hold. If the U.S. approves its first spot Bitcoin ETFs, they will be as easy to buy and sell as traditional stocks.

While the influx of money is seen as positive for the overall health of the market, the impact on Bitcoin’s price will vary depending on ETF demand and speed. Some believe that not all ETFs will gain equal traction, with expectations leaning towards BlackRock.

Türkçe

Türkçe Español

Español