Bitcoin continues to experience price fluctuations, struggling to maintain the $30,000 mark. The upcoming Fed meeting and rumors of the US Department of Justice selling BTC have significantly weakened investor risk appetite. So, what does the current situation tell us about the price?

Bitcoin (BTC)

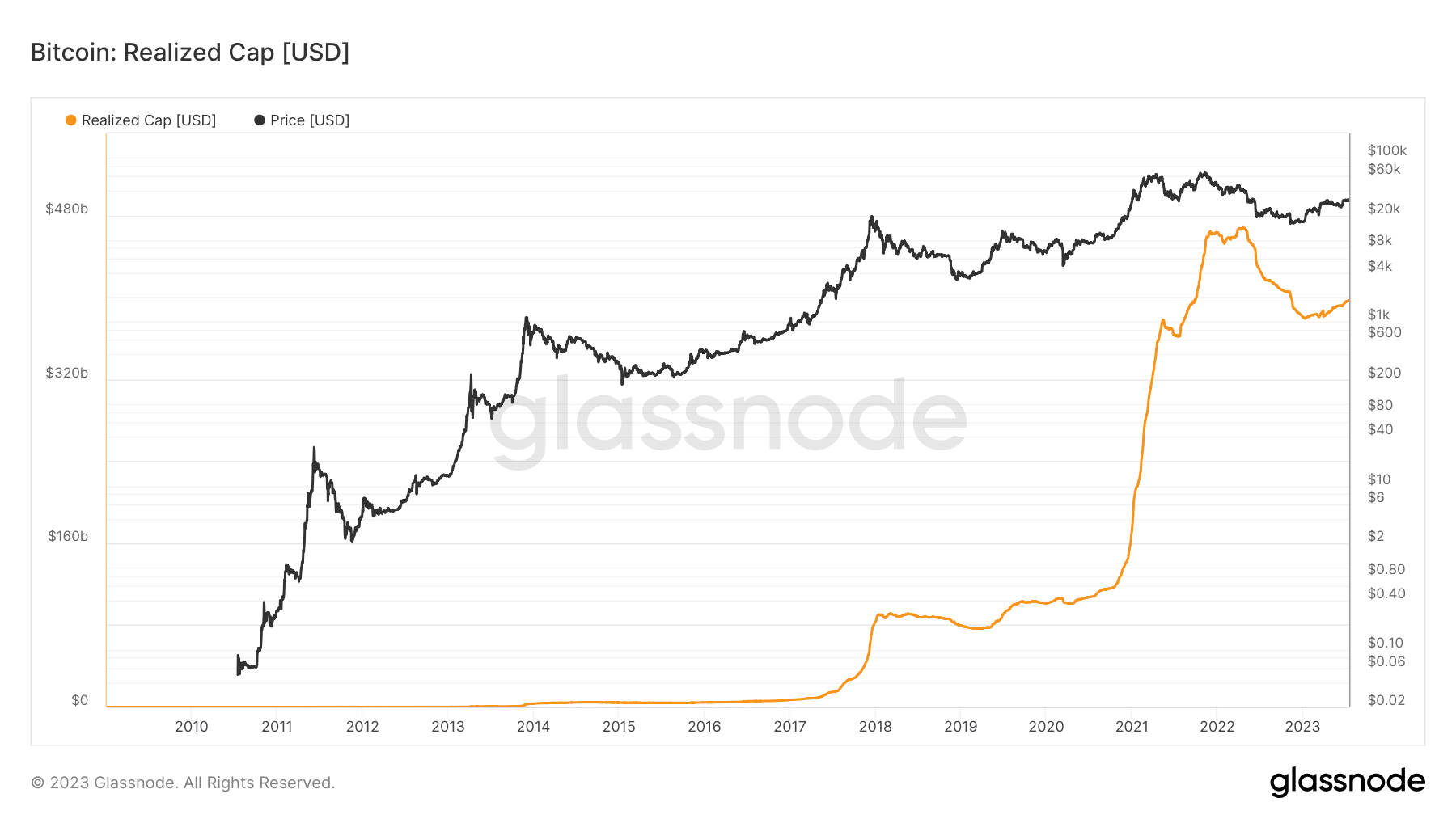

Glassnode recently shared a post indicating a significant capital inflow into Bitcoin, as more users rush to buy BTC. As of now, the Realized Cap surpasses $394 billion, pointing to a stable capital flow into Bitcoin throughout 2023.

This upward trend in Realized Cap suggests that coins are generally changing hands at higher prices, with a modest increase in new demand for Bitcoin this year.

It is worth noting that during bear markets, Bitcoin typically experiences significant capital outflows as investors try to minimize losses. However, the current scenario presents a different picture with the influx of capital into the asset. Considering the price has rebounded from its lows, this indicates that the upward trend could continue steadily.

Will Bitcoin Rise?

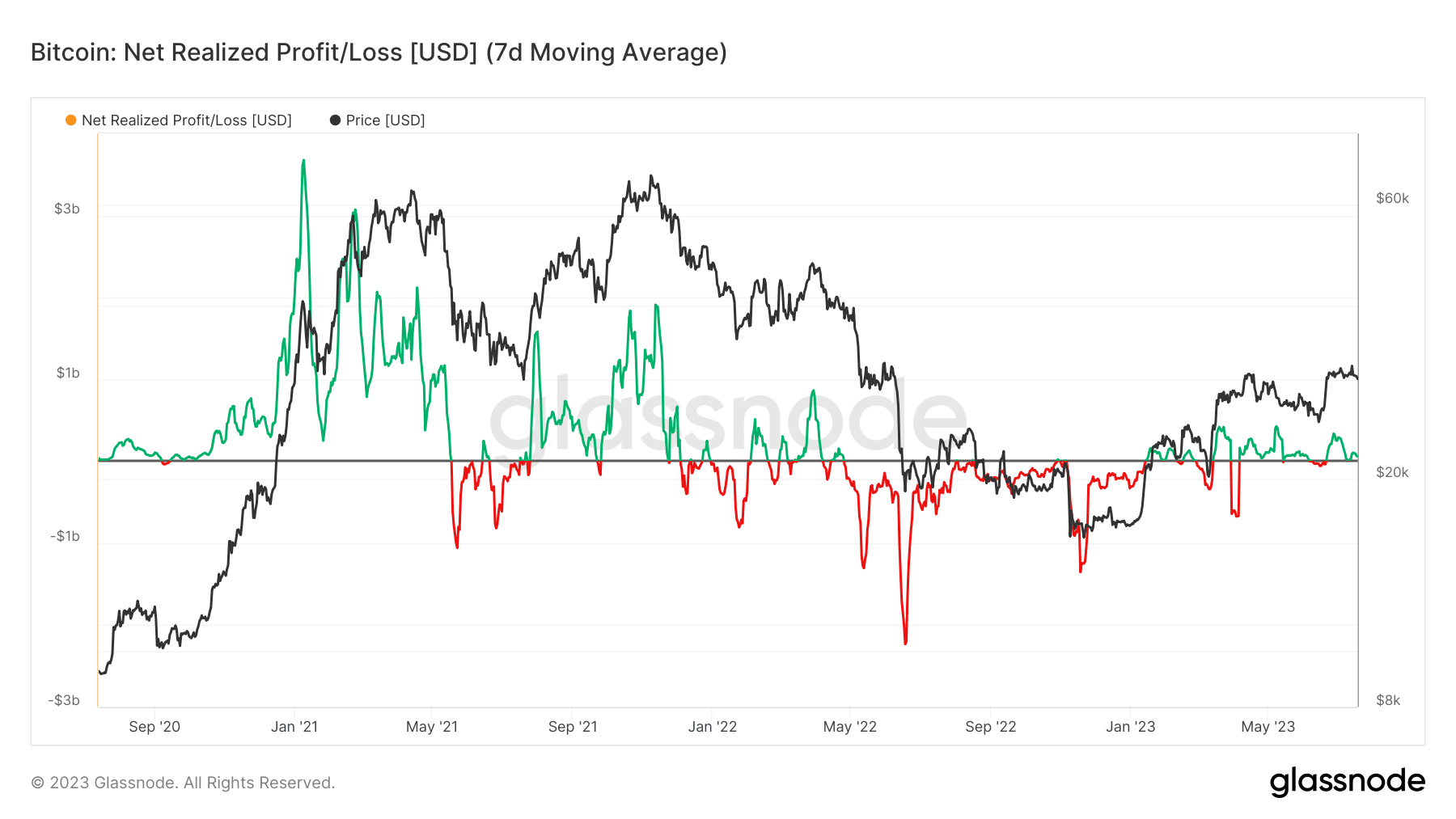

Realized Cap, one of the oldest and most common metrics observed on-chain, is a powerful tool for assessing real capital inflows into Bitcoin. With the reinforced capital flow in mind, it prompts us to consider the profitability of this asset. In 2023, Net Realized Profit/Loss (NRPL) has primarily followed a profit-oriented trajectory, witnessing a net inflow of approximately $270 million (profit minus loss) on a daily average. This continuous profit mode represents the first of its kind since April 2022. The magnitude of this inflow is comparable to periods observed in the first half of 2019 and the end of 2020.

By examining the ratio between total realized profit and loss, we can gauge the overall performance of the year. So far, 2023 has been a positive year, surpassing the breakeven level of 1.0 at the beginning of January. At the time of writing this article, NRPL had exceeded $57.2 million.

Recently, Bitcoin has displayed a negative trend, hovering around the $30,000 price range for the past few days. Surprisingly, it has managed to maintain stability within this range.

In conclusion, on-chain data and ongoing capital inflow indicate that despite negative sentiment among investors, the price of Bitcoin continues to remain strong. This suggests that the recent downturn could quickly reverse (perhaps after the Fed meeting). Since many altcoins have bounced back from resistance tests, this rise could lead to a rapid recovery across cryptocurrencies.