Layer-1 network Aptos’ governance token, APT, witnessed a significant price drop last month. This occurred during a period when the overall activity in the cryptocurrency market was generally declining. At the time of writing, the altcoin was trading at $5.82, having dropped over 30%. APT continues to face significant risks as volatility begins to rise.

What’s Happening with Aptos?

Aptos saw the first signs of increasing volatility through the Bollinger Bands. Data from this important volatility market shows a widening gap between the indicator’s upper and lower bands. Bollinger Bands measure an asset’s market volatility and determine potential overbought or oversold conditions. The widening gap between the upper and lower bands indicates increased market volatility.

Crypto Traders Are Rushing to This App – Here’s Why You Should Too

Crypto Traders Are Rushing to This App – Here’s Why You Should Too

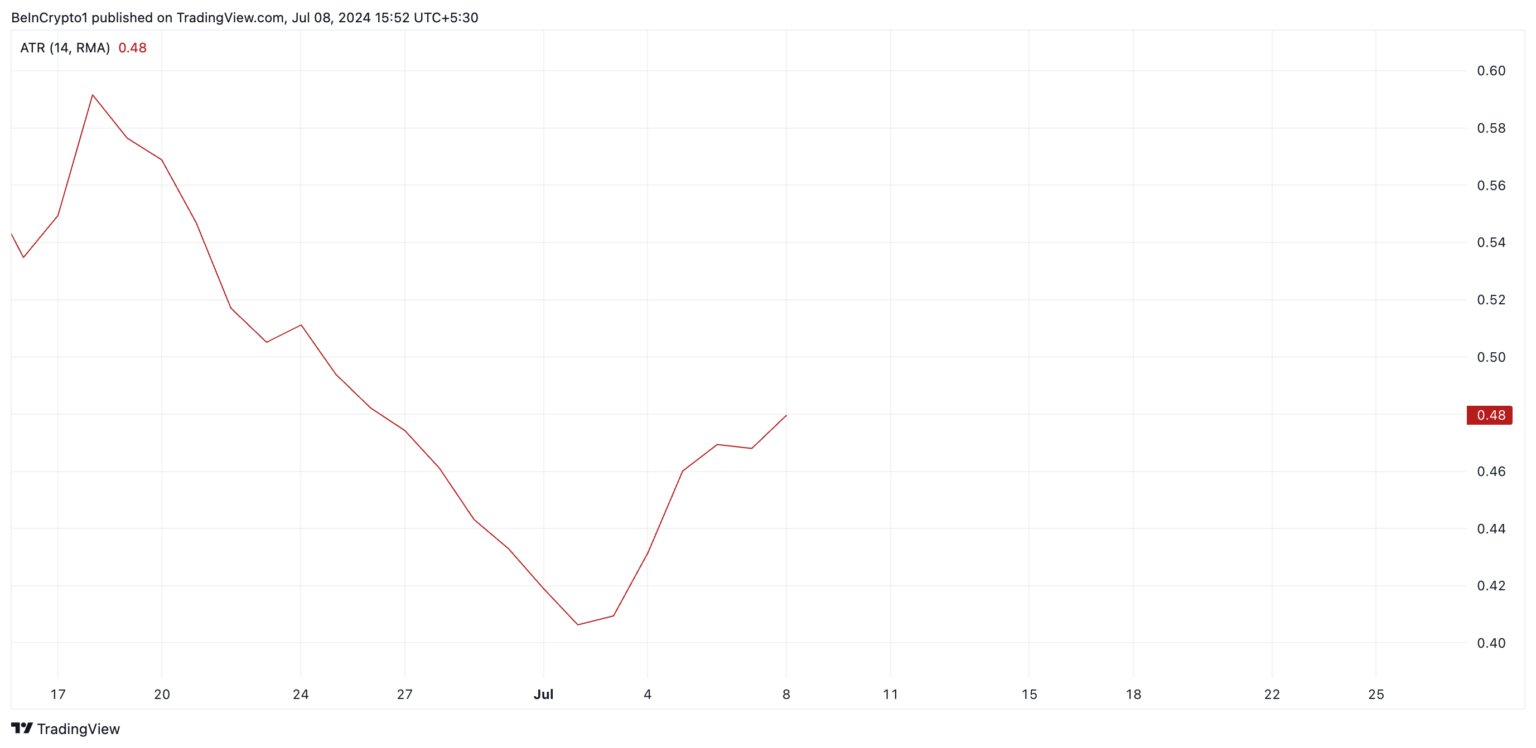

Additionally, the expanding bands during the price drop period suggest that the downward trend may continue. This signals a lack of strong selling pressure or buying interest at current price levels. APT’s rising Average True Range (ATR) data also confirms the increase in market volatility. This indicator measures market volatility by calculating the average range between high and low prices over a specific number of periods.

When its value increases, it indicates rising market volatility and signals the possibility of price changes in either direction. At the time of writing, APT’s ATR data was recorded at 0.48 and has been on an upward trend since July 1.

APT Chart Analysis

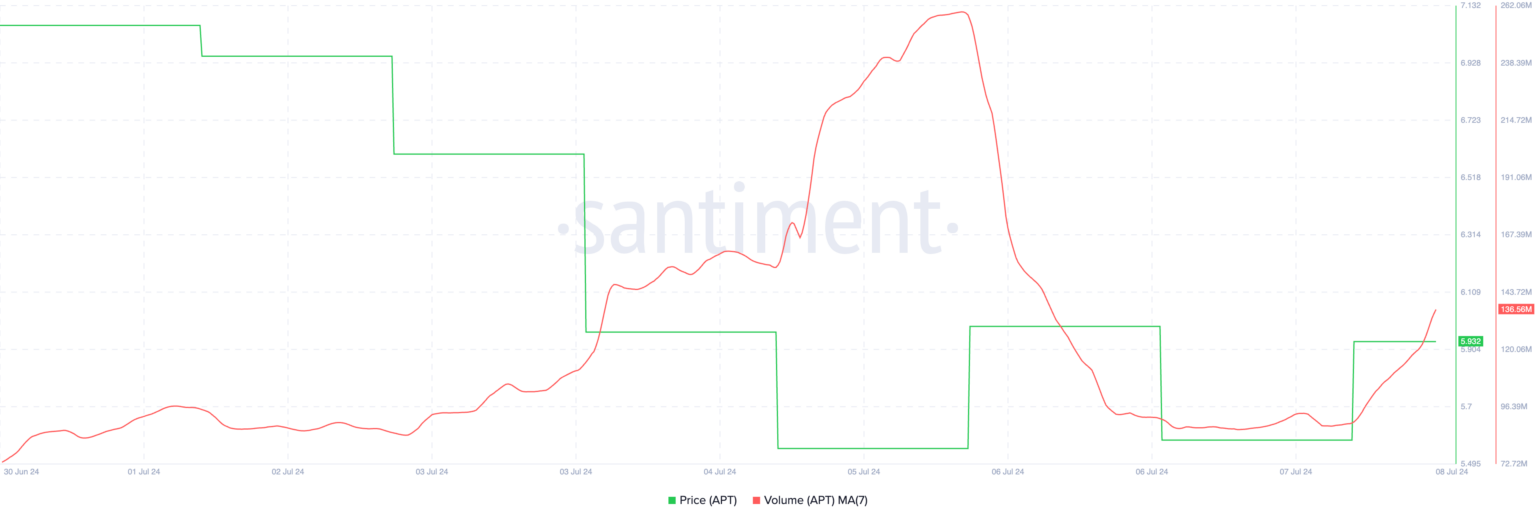

Despite APT’s price drop, there was an increase in daily trading volume. While the token price fell by 18% last week, trading volume increased by 29% during the same period. The opposite movements of APT’s price and daily trading volume create a bearish divergence, indicating that more market participants are actively selling the asset. If the selling activity remains high, the token’s value could drop to $5.62.

However, while increasing volume during a decline generally supports the continuation of the downward trend, excessive increases in volume can sometimes precede a price reversal. Therefore, if APT witnesses a correction, its price could rise above $5.90.

Türkçe

Türkçe Español

Español