Aptos (APT) has made a breakout, breaking through its $8.8 resistance level amidst high transaction volumes. This indicates a strong belief from buyers, and a target of $10 seems highly likely. However, signs of weakness in Bitcoin’s chart present some risks for Aptos investors. Aptos’ price movement progresses similarly to how Ethereum did a few days ago, having broken the range resistance and bull block, then retested the resistance level it had turned into support.

Targeting the $10 Level

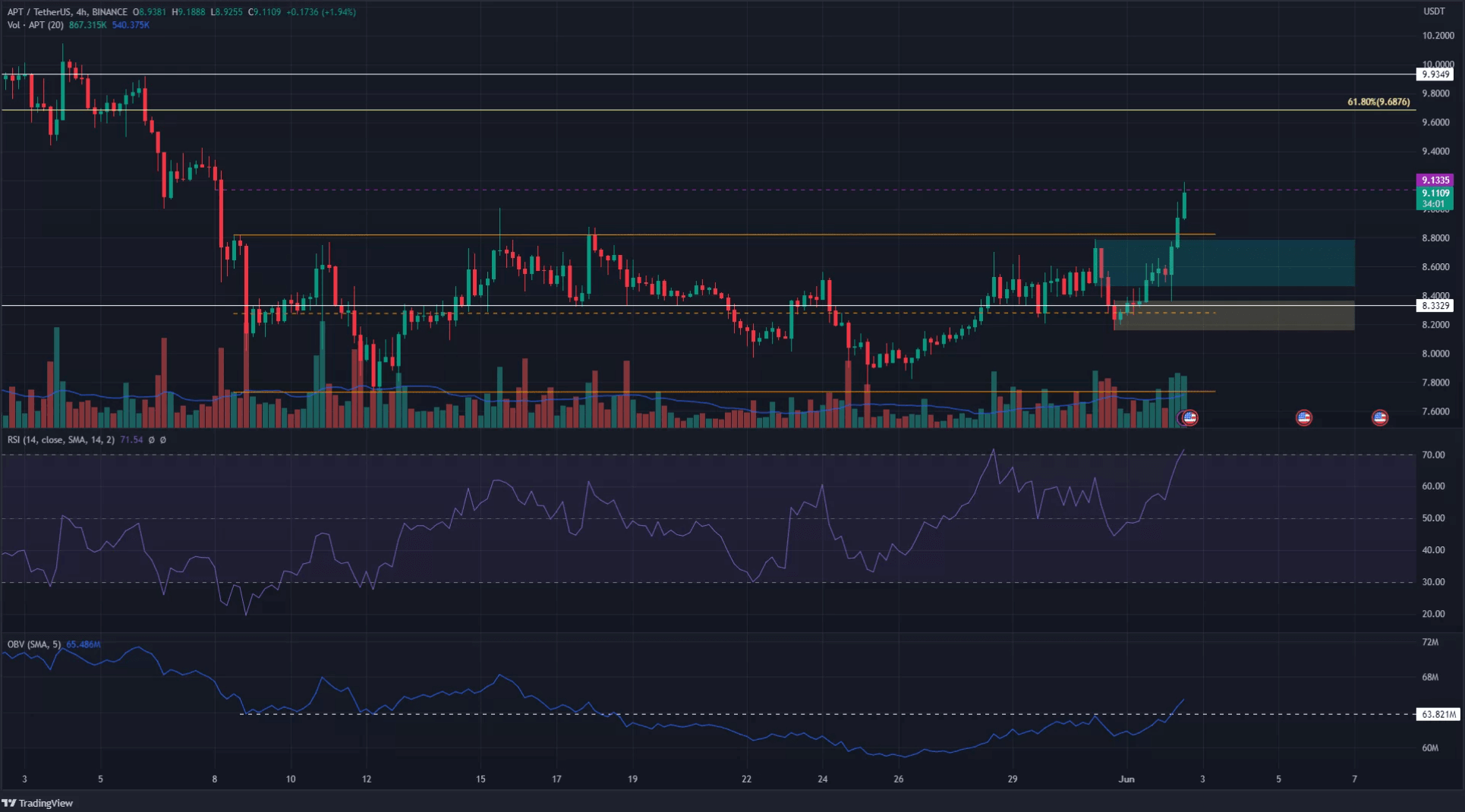

The current range (in orange) extends between $7.7 and $8.8. As of writing, Aptos (AP) trading at $8.99, has surpassed this resistance range. The Relative Strength Index (RSI) also shows bullish momentum by increasing. Consequently, in the event of a price retracement, two short-term zones have emerged for retesting. Specifically, at $8.65 (in turquoise) on the 2-hour price chart and $8.2 on the 4-hour price chart.

Along with the price, the On-Balance Volume (OBV) indicator also broke its preceding resistance. This suggests that the upward move is supported by genuine demand. However, one point to be aware of is the negative signals given by the Price Volume Discrepancy (FVG) since May 8. The purple dashed line on the price chart corresponds to the peak of this imbalance.

It appears feasible that Aptos (APT) may experience a short pullback to $8.2 or $8.6 before continuing its upward trend. The next resistance level above lies in the $10 region.

Aptos Bears in Trouble

Aptos’s short-term surge occurred alongside an increase in Open Interest. This indicates a strong bullish expectation in the market. Additionally, it seems the rise is partly backed by liquidations of short positions.

Bears being liquidated have to buy assets at market price to close their positions, contributing to the short-term bullish momentum. However, after these orders are exhausted, a retracement towards the support zones for Aptos, down to the aforementioned levels, can be expected.