In the past 24 hours, Arbitrum (ARB) has recorded an 8.4% increase, trading at $1.26 at the time of writing. With prices approaching the $1.30 resistance level, bulls may attempt to convert this level from resistance to support.

If Bitcoin (BTC) reclaims $27,000 and tests $28,000, it could help extend the short-term bullish gains for Arbitrum.

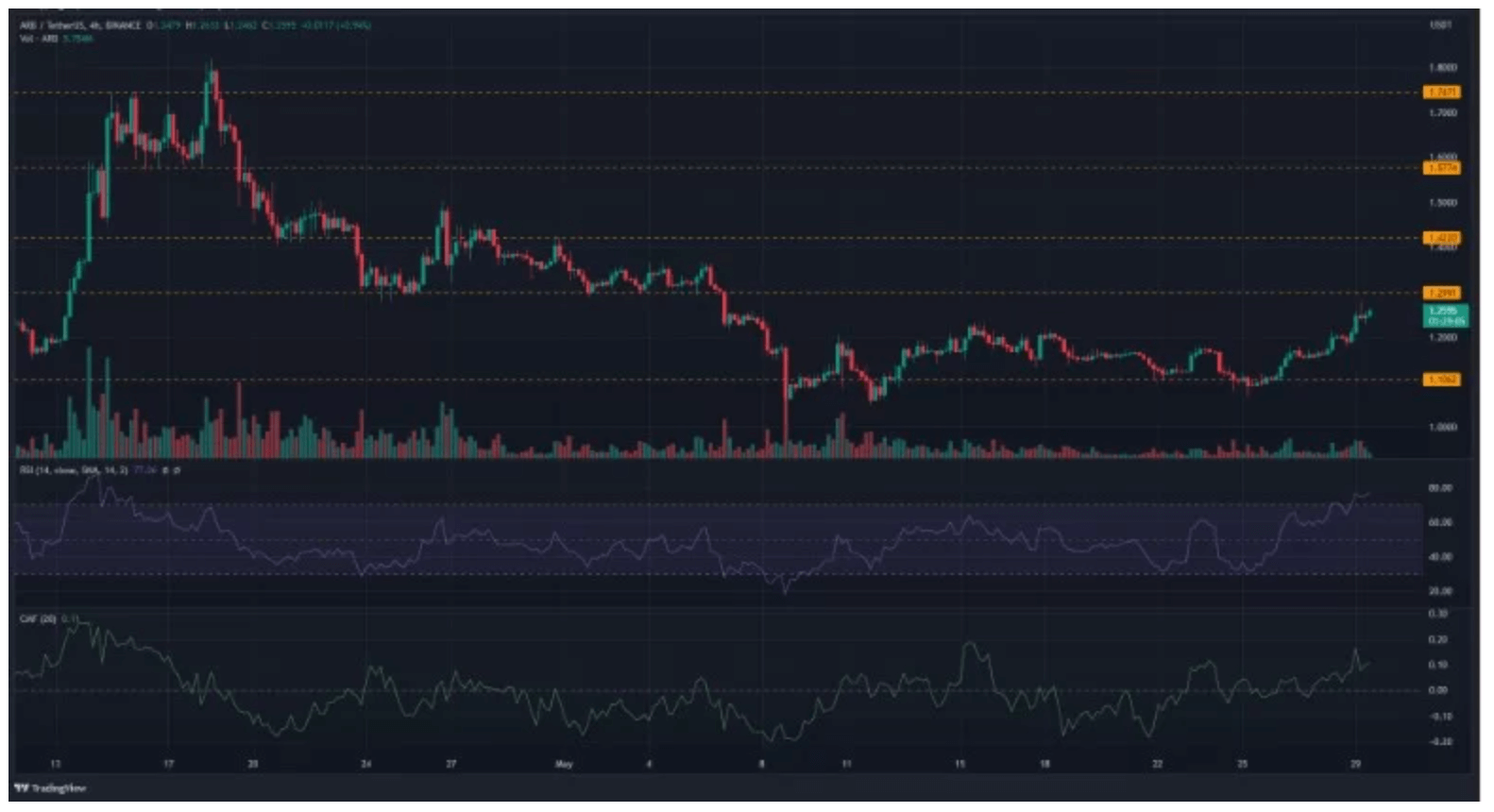

Arbitrum Price Chart Analysis

Upon reviewing the four-hour timeframe for ARB, the importance of the $1.11 support level becomes apparent. This level was tested three times between May 8 and May 26, each time resisting downward momentum. The most recent retest sparked a bullish rally, rising above the lowest level of the correction wave.

With the price bouncing back from the $1.11 support level, indicators highlight the possibility of further gains for bulls from this support level. The Relative Strength Index (RSI) entered the overbought territory and stood at 76, signaling intense buying pressure. The Chaikin Money Flow (CMF) also recorded a positive capital inflow at +0.10.

It seems that a significant price hurdle for Arbitrum bulls lies at the $1.30 resistance level. A candle closure above this resistance on the charts could encourage bulls to target critical levels at $1.42 and $1.58. Conversely, failure to break this level could indicate bears pushing back prices, eventually breaking the key support level at $1.106.

Comments on Arbitrum’s Future

According to data from Coinglass, $2.56 million worth of short positions were liquidated in the last 24 hours, compared to just $269,000 in long positions. This development strengthens the short-term bullish momentum that could push bulls to surpass the $1.30 resistance area.

Moreover, ARB’s funding rate remained positive during the same period. This reflects buyers’ willingness to continue the bullish sentiment on ARB. Hence, if BTC records further gains, especially if it exceeds $28,000 initially, the chances of bulls overcoming the $1.30 barrier could be high in the upcoming days.

Arbitrum, which had previously provided attractive returns to its investors even amidst the bear season, could potentially delight its investors again with such developments and aid in securing substantial gains.