Arbitrum network will release 92.65 million tokens today, valued at approximately $107 million. However, the release of these tokens could lead to a series of concerns among investors. Specifically, the introduction of ARB tokens could potentially pressure prices. This situation can be considered a downward catalyst when there is potential for buyers to quickly profit.

ARB Token Unlock Event

The Arbitrum network will unlock approximately $107 million worth of ARB tokens, making up 3.49% of the network’s circulating supply. The event will occur today at 16:00 Turkey time. The unlocked tokens will be allocated to the Arbitrum team, future team members, advisors, and investors.

The last unlocking event took place on March 16, releasing 1.11 billion ARB tokens, which constituted 41.89% of the circulating supply.

Arbitrum Price Outlook Before the Unlocking Event

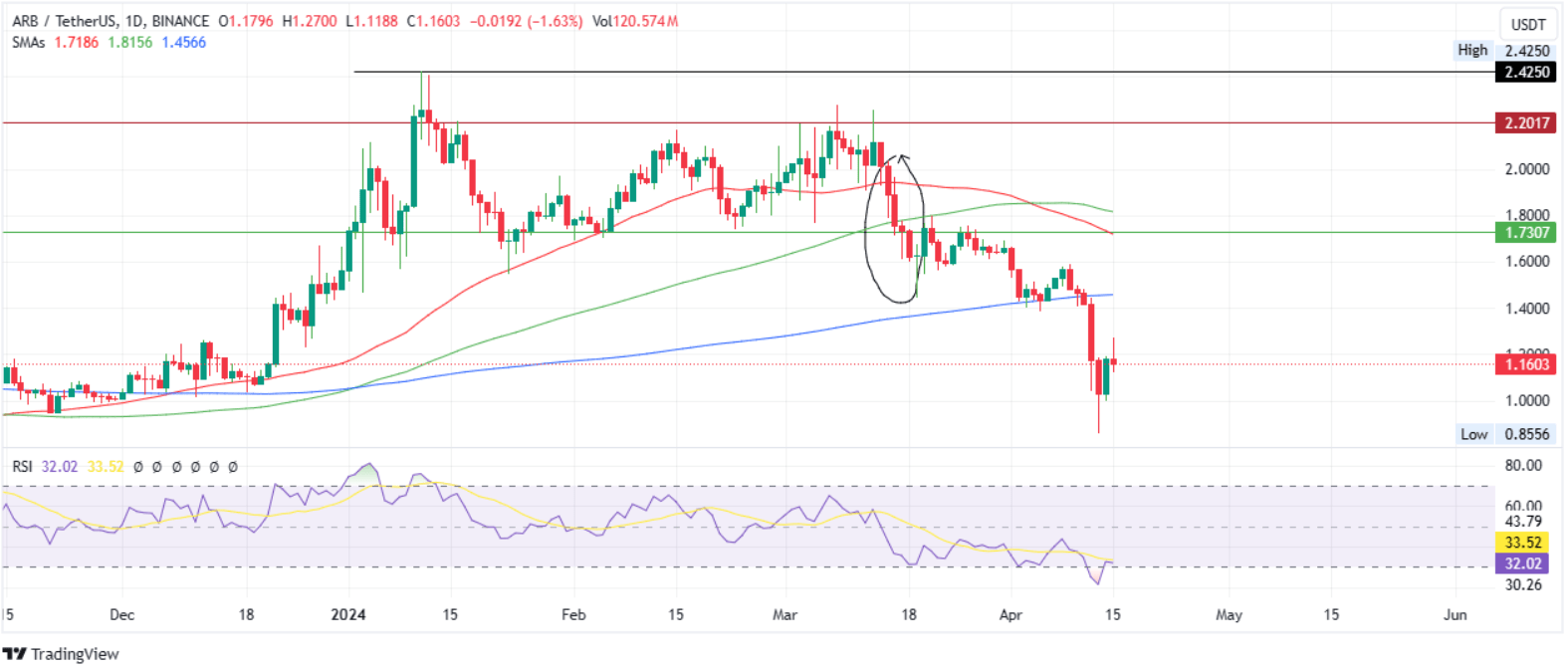

The price of Arbitrum fell to $0.85 on Saturday before attempting a recovery on Sunday. However, the L2 token currently faces strong resistance from the north, and the recovery ended early. As investors flee the market to avoid being caught in exit liquidity, the price of Arbitrum faces further decline risks.

A potential decline could indicate a 10% drop if a sell-off wave comes with the released tokens. In this case, the ARB price could test the psychological support at the $1 level. However, if the price falls further, the ARB price could drop to Saturday’s low of $0.8556, which would mean a 25% drop from current levels.

Watch the 200-Day SMA!

On the other hand, increased buying pressure could facilitate a strong northward price movement, pushing the ARB price above the 200-day SMA to $1.45. However, to invalidate the bearish thesis, the price needs to break and close above $1.73.

Breaking the level mentioned above, which coincides with the 50-day SMA at $1.71, will encourage more buyers, lifting the ARB price above the projected target.

The unlocking of Arbitrum network’s tokens could cause market fluctuations. However, maintaining the price above a certain support level could be a promising sign that the downtrend may be invalidated. Nevertheless, investors should closely monitor such developments and develop appropriate strategies to manage their risks.