Arbitrum’s (ARB) network activity had been on the rise for some time, which seemed to pave the way for it to overtake its biggest competitor, Optimism. Despite the increase in network activity, ARB’s price has experienced a decline in the last 24 hours, which is considered concerning. Therefore, taking a closer look at Arbitrum’s metrics to understand its current situation would be beneficial.

Is Arbitrum Superior to Optimism?

A tweet shared by Nansen on February 16 highlighted some interesting facts about Arbitrum, catching the attention of the cryptocurrency community.

According to the shared information, Arbitrum seemed to have surpassed Optimism (OP), one of its biggest competitors in the market, when looking at daily activities.

The metrics for ARB showed a daily transaction count between 600,000 and 900,000, while OP’s metrics indicated a range between 300,000 and 400,000, suggesting that OP’s activity was nearly half of ARB’s. This highlighted ARB’s increasing adoption and usage compared to its competitors in the market.

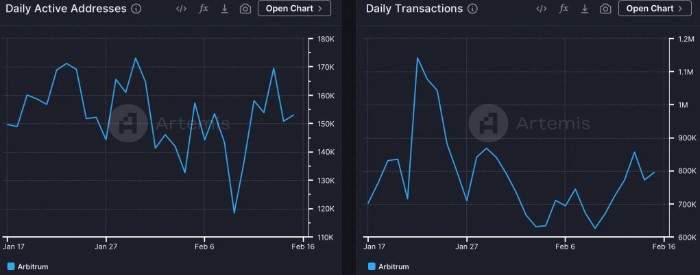

Additionally, a graph reflecting the rising activity on the L2 network was shared by Artemis. The graph from Artemis showed that the number of daily addresses transacting on ARB had dipped on February 9 but then rose again.

Despite the rise in ARB’s activity over the past week, there was a noticeable decline in L2’s daily transaction count when examined over a 30-day period.

Despite the decline over the last 30 days, the value side of things appeared more positive. Both the fees and revenues associated with L2 had recently seen an upward trend, which was considered good news for ARB’s overall health.

Current Status of ARB’s Price

Nansen’s update also mentioned that alongside network activities, ARB’s valuation was low. According to the update, Arbitrum was valued at approximately half the P/S (fully diluted market cap/annual fees) and P/F (fully diluted market cap/annual revenues) compared to Optimism.

This could suggest that the token is trading at a lower price than it potentially should be.

Setting aside these factors and examining the altcoin’s price, a decline was observed in the last 24 hours, coinciding with Bitcoin‘s price drop below $51,000. At the time of writing, the altcoin was trading at $1.94, down 3%.

The market cap had fallen over 2% to $2.4 billion, while the 24-hour trading volume had dropped over 35% to just $268 million.

Türkçe

Türkçe Español

Español