Annoying price movements continue for investors. The price of Bitcoin is still below $26,000 today, with volumes remaining weak. Four-year cycles have always been closely followed by cryptocurrency investors. Therefore, there is a strong expectation for a rise in the coming year. However, recent comments from crypto gurus suggest that investors may be mistaken in this regard. So, what’s next?

Bitcoin Halving Cycles

Four-year cycles have always been associated with Bitcoin’s block reward halving. These cycles, assumed to be related to the halving event, are based on historical data. However, an alternative theory has been suggested that this may not be the case.

The last three major market cycles for Bitcoin and crypto have consistently occurred every four years and reached their peak in the year following the halving event. According to a crypto millionaire named Pledditor, all of this may be a coincidence.

“Bitcoin’s four-year cycles are merely coincidences and have little to do with halving.”

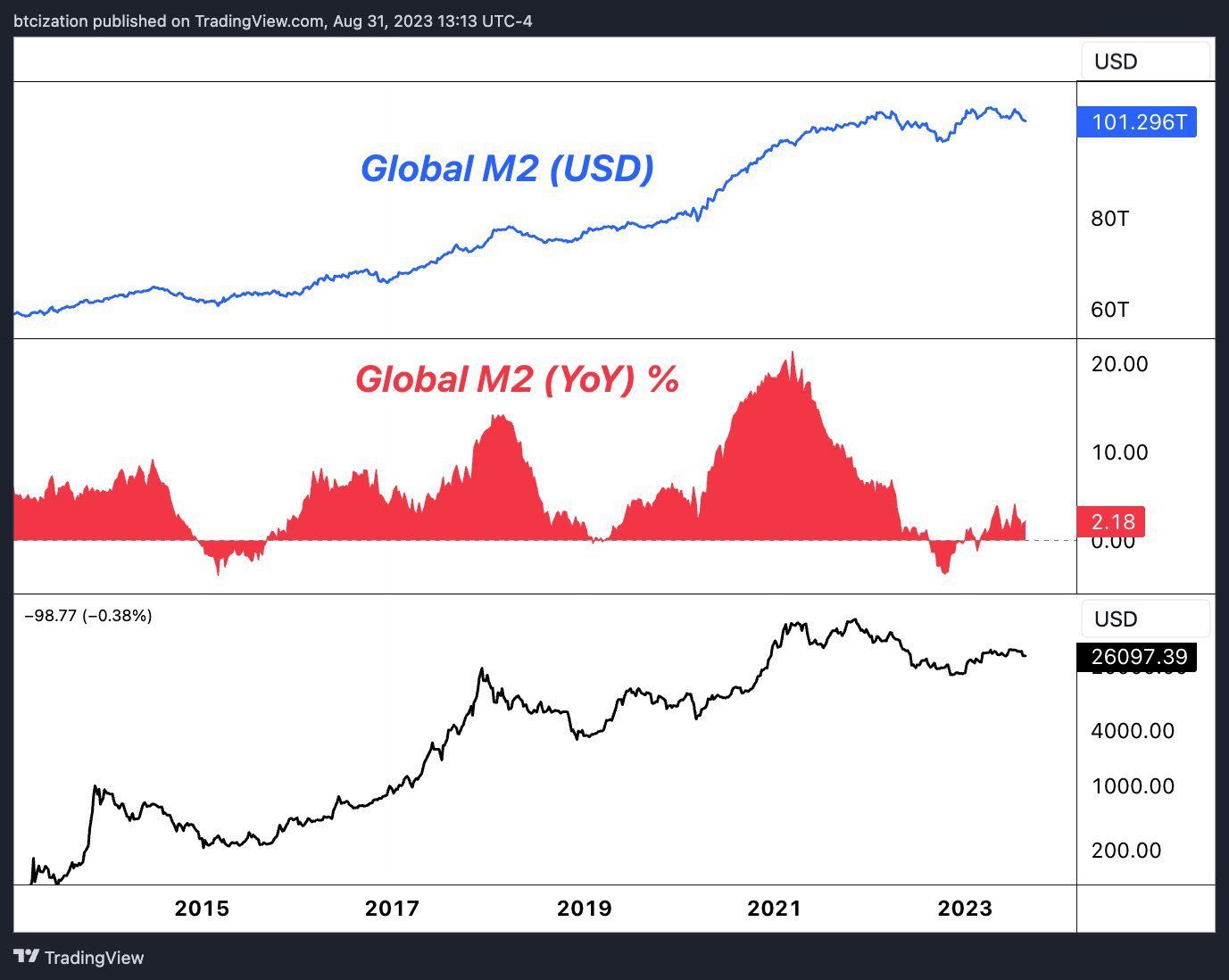

According to him, these cycles are closely related to the global M2 money supply.

“The global M2 money supply is actually experiencing its own ‘4-year cycles’ lately, and these cycles are reflected in most risk assets, including Bitcoin.”

Crypto Market Commentary

M2 money supply is a broad measure of money. It includes currency, bank deposits, and relatively liquid investments in various bank and money market funds. According to the following chart, the peaks of the last three Bitcoin cycles coincided with the largest changes in the global M2 money supply. For example, the recent cycle occurred in 2021 and 2022 when M2 grew at record rates during the pandemic. During this period, central banks were printing significant amounts of money.

Last year, GMI CEO Raoul Pal also stated that there is a connection between the M2 money supply and the four-year cycles. As global money supply declines, Bitcoin and crypto markets continue to decline. That is why signals of the Fed’s policy continuation continue to put pressure on the market.

Vijay Boyapati, the author of “The Bullish Case for Bitcoin,” recently questioned the validity of the four-year cycles in a podcast with Stephan Livera. He noted that the amount of money that needs to enter the Bitcoin market daily to maintain the current price level is much higher.

However, most analysts still seem confident that a significant recovery in the markets will begin by the end of 2024 due to a renewed expansion in M2 supply and the halving.

Türkçe

Türkçe Español

Español