Arthur Hayes, co-founder and former CEO of the BitMEX exchange, has significantly influenced the cryptocurrency market through his acquisition of the altcoin Ethena (ENA). According to on-chain data, Hayes shifted focus to ENA after selling his Aethir (ATH) assets at a loss. His recent transactions within just two days resulted in a 22.5% increase in ENA’s price, elevating its market capitalization to $2.13 billion.

Ethena Continues to Gain Momentum

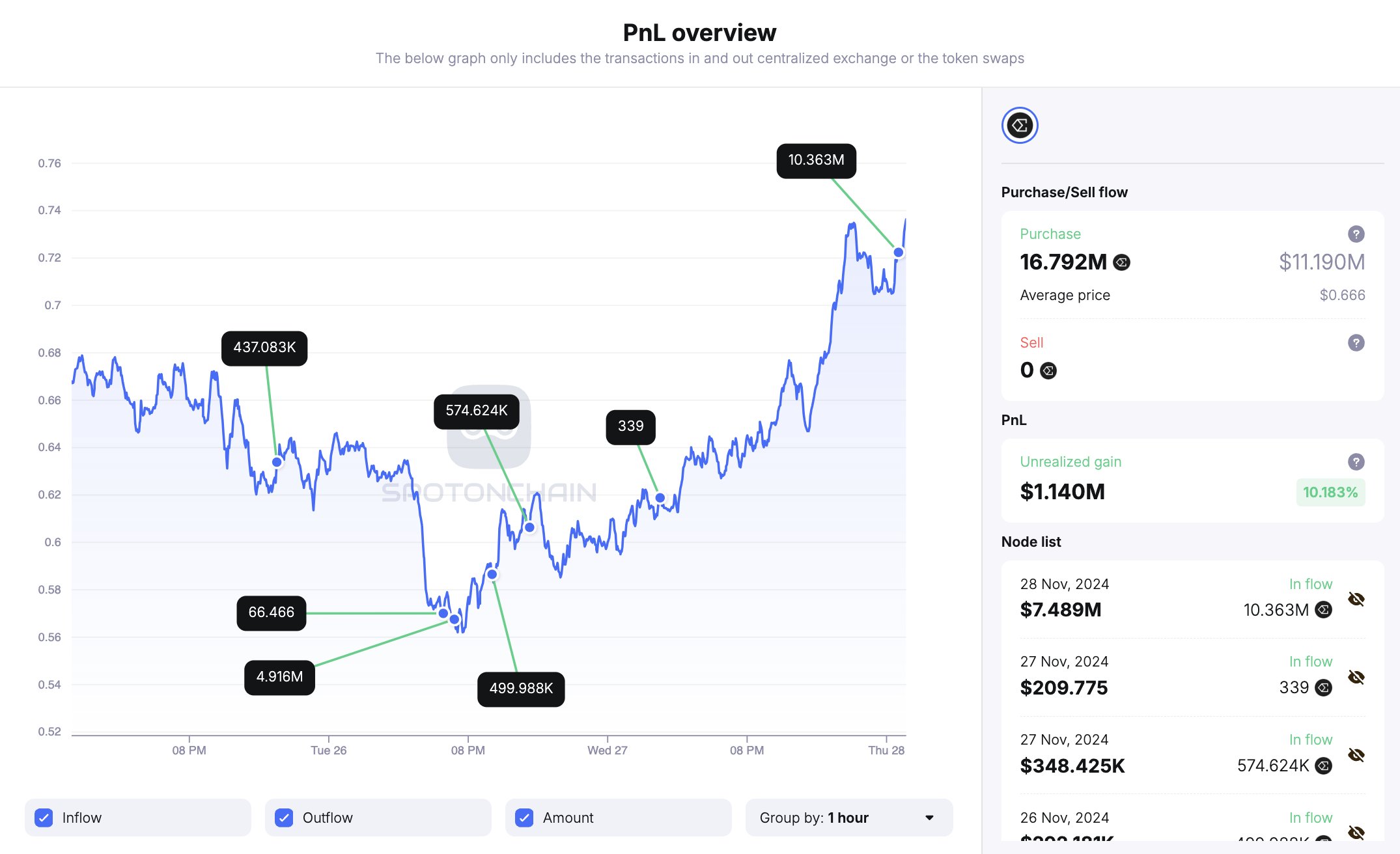

At the end of November, Hayes liquidated all his Aethir holdings, incurring a loss of approximately $815,000. However, he quickly recouped this loss with his investment in ENA, generating a profit of $1.14 million as the altcoin surged. Data from the blockchain tracking platform Spot On Chain reveals Hayes withdrew a total of 16.79 million ENA coins from Binance, purchasing them at an average price of $0.66.

Meanwhile, activity in the ENA market continues to rise. Coinglass data shows that open interest in ENA has increased by 23%, reaching $374 million, while the total liquidation amount has hit $1.29 million. Short position liquidations amounted to $956,000, and long position liquidations reached $335,000. The total value of locked assets (TVL) in the Ethena network has also increased to $4.09 billion. Crypto Traders Are Rushing to This App – Here’s Why You Should Too

New Record Price Expectations for ENA

The critical support level for ENA’s price is set at $0.75. Analysts suggest that if this level is maintained, ENA could rise by 33% to reach $1. Expectations among traders are growing that ENA may test its all-time high of $1.50.

As Ethena Labs expands its user base, it has increased the supply of USDe to $4 billion. This growth may signal new record prices for ENA.

Türkçe

Türkçe Español

Español