As the U.S. continues to tighten its grip on cryptocurrency companies, Asia is taking steps to foster innovation. The internet’s next age with Web2 is met with reluctance from the U.S., but regions like Singapore and Hong Kong recognized the potential early on. So, what’s the current situation in the region?

U.S. and Potential Crypto Regret

Every week another American fintech firm is filing for bankruptcy or targeted by regulators. In recent months, we have seen the American government does not openly want an emerging digital asset industry or the innovation that comes with it. At least a significant part of the power in the hands of the bureaucracy at SEC and the Democrats are doing this. The regulatory confusion about asset classification and feeding of uncertainty about the sector by federal agency chiefs have not yielded a good result.

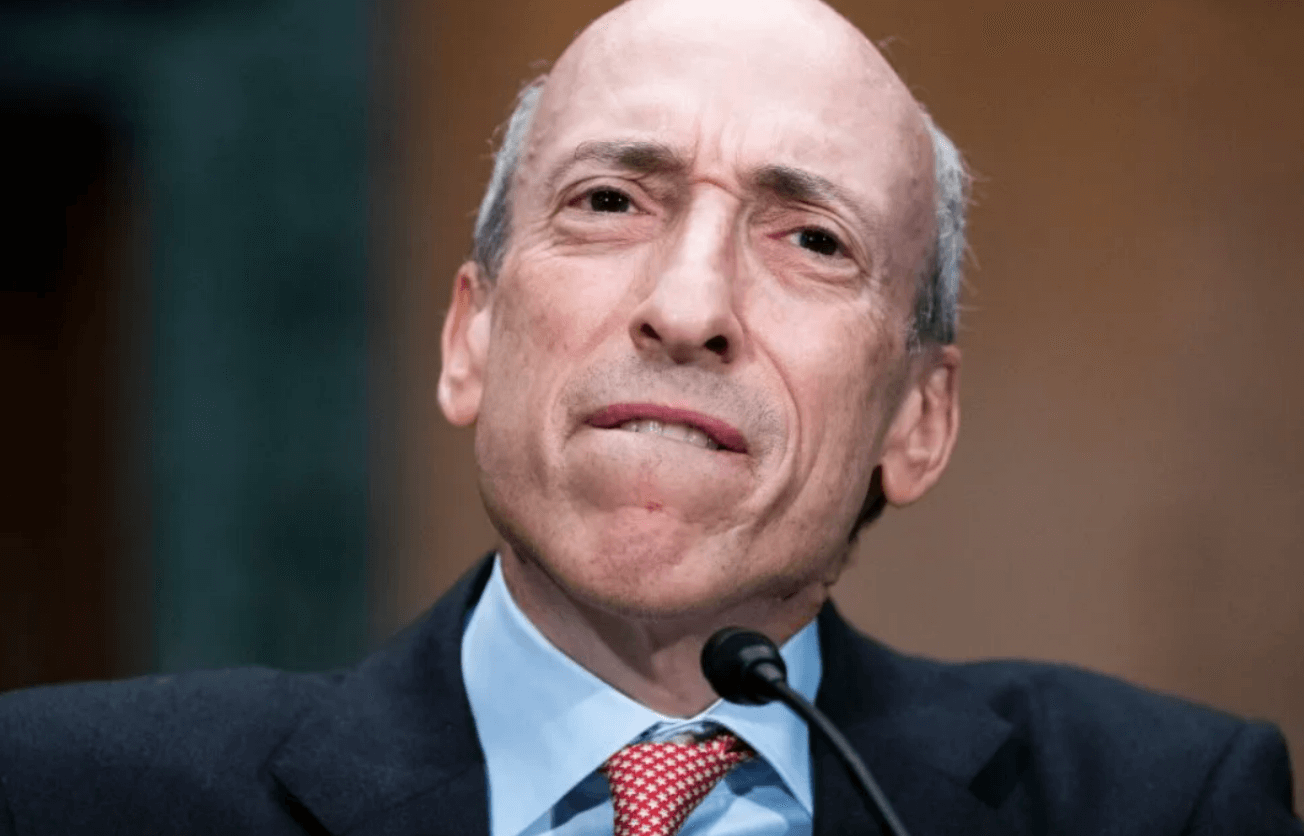

The migration of America’s leading crypto and fintech companies has already begun, and many are heading to Asia. SEC Chairman Gensler recently openly expressed his disapproval. He made clear statements such as, they can go if they are not following the rules.

Asia and Cryptocurrencies

With clearer rules, Asia is in a position to benefit the most in this crypto battle. According to a report published by Straits Times today, companies are forced to diversify their operations elsewhere. According to market players, Hong Kong will benefit the most before Singapore. Liu Yusho, founder of the Singaporean exchange Coinhako, stated that Asia already hosts an emerging blockchain and crypto industry.

He added that Southeast Asia accounts for 8.6% of the world’s population. Furthermore, it constituted 14% of global crypto transactions by the end of 2022.

As Asia adopts blockchain and digital assets, we can expect more sustainable growth and innovation in the region.

Stephen Richardson, CEO of Fireblocks, also added that Hong Kong will receive most of the movement coming from the U.S.

Japan is also emerging as a crypto center in Asia. It was one of the first countries in the world to accept and regulate digital assets. A legal framework that allows banks to use stablecoins was also launched this month.

Just this week, Ripple  $2 received a significant payment license to operate in Singapore. Earlier this month, the Singapore Monetary Authority granted a license to Circle, which issues stablecoins. Coinbase and Gemini are among the many crypto companies setting up exchanges and offices outside the United States as the migration continues. While all this is happening, the U.S. needs to analyze its potential losses well.

$2 received a significant payment license to operate in Singapore. Earlier this month, the Singapore Monetary Authority granted a license to Circle, which issues stablecoins. Coinbase and Gemini are among the many crypto companies setting up exchanges and offices outside the United States as the migration continues. While all this is happening, the U.S. needs to analyze its potential losses well.