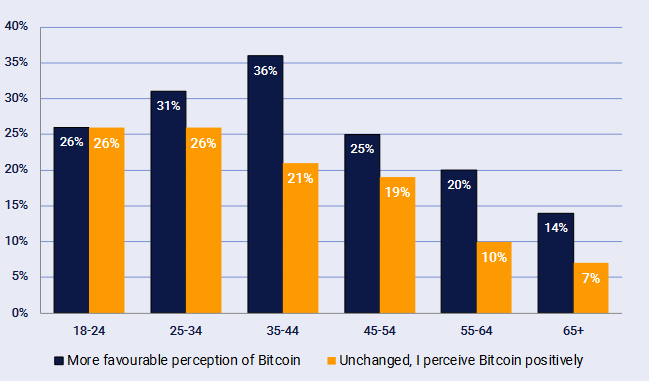

According to a recent survey, interest in Bitcoin among Australian individual investors increased following the approval of spot Bitcoin exchange-traded funds (ETFs) in the United States in January. Bitcoin sentiment in Australia rose by 25% after the approval, with adoption rates expected to continue to rise into 2024. However, the fifth annual Independent Reserve Cryptocurrency Index, published on February 21, indicated that broader adoption is being hindered by uncertain economic conditions, based on a survey of 2,100 adults.

Australia’s Growing Crypto Investment Interest

The expected increase during an optimistic period was significantly skewed by individuals aged 55 and over, who reported a 100% increase in interest in Bitcoin. Adrian Przelozny, CEO of Independent Reserve, commented on the emerging research findings:

“Sentiment has clearly changed, and we have entered a renewed phase of optimism and growth.”

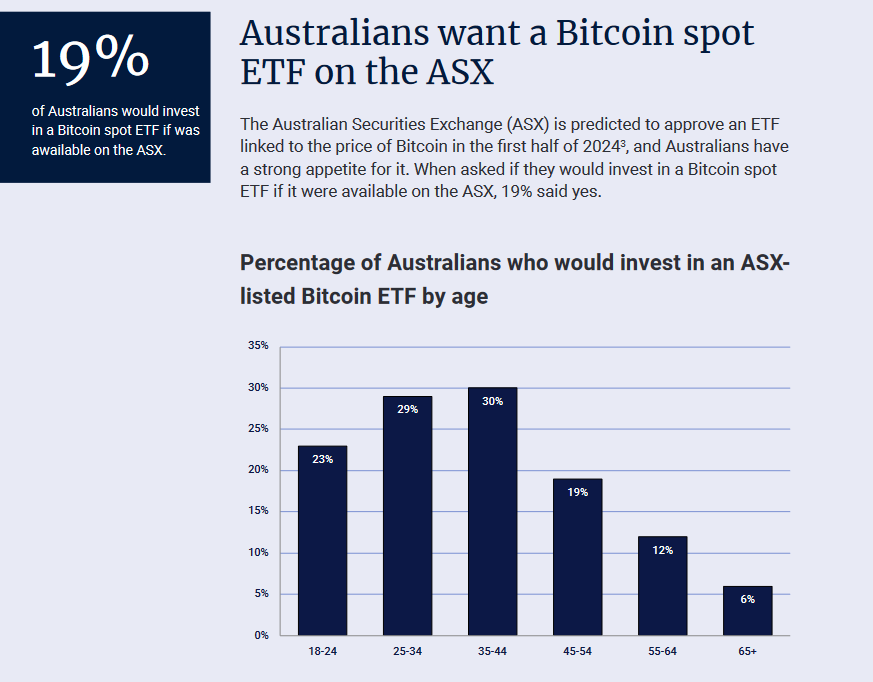

19% of survey respondents said they would invest in spot Bitcoin ETFs listed on the Australian Securities Exchange (ASX) if they were available. The most enthusiastic participants were in the 25-34 age category at 29% and the 35-44 age category at 30%.

About one-third of participants said they could invest in Bitcoin for the long term through a self-managed retirement fund. However, these participants were divided on whether they would prefer to access Bitcoin through a cryptocurrency exchange or an ETF.

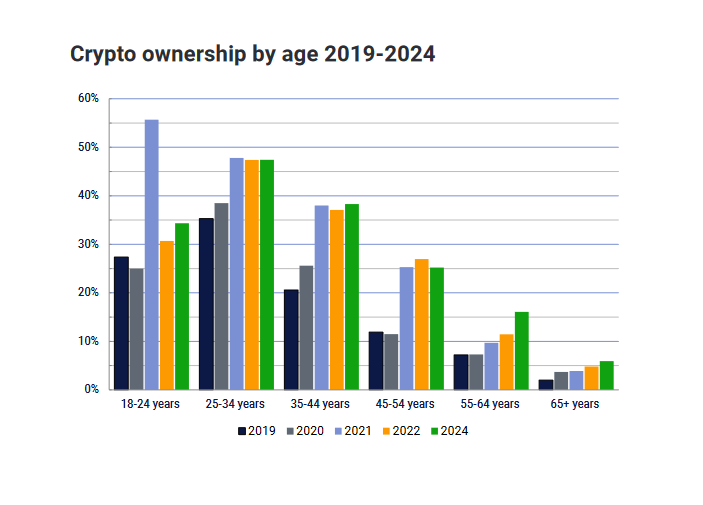

Overall cryptocurrency ownership increased by 1.9% between 2022 and 2024, reaching 27.5%, with Independent Reserve noting the largest changes were a 128% increase among those aged 55-64 and a 200% increase among those aged 65 and over.

Notable Details from the Research

An Independent Reserve spokesperson evaluating the figures suggested that stronger regulation, a Bitcoin ETF listed on the ASX, and increased adoption by businesses could help further improve the positive atmosphere.

While ownership is increasing and sentiment is strengthening, not everything appears to be on the rise. The report noted that price volatility, lack of consumer protection, and confusion continue to deter newcomers from investing in crypto.

On the other hand, 18% of participants who have not invested in crypto said they wanted to invest but decided against it due to uncertain economic conditions. Similarly, 18% of crypto investors considered parting with their crypto assets to cope with the rising cost of living and increasing interest rates.

Türkçe

Türkçe Español

Español