Avalanche (AVAX) recently experienced an uptick and successfully overcame a major hurdle at $13. This specific barrier had proven to be a significant challenge for AVAX bulls in previous weeks, stalling their upward momentum.

AVAX Expectations!

AVAX’s surge in performance can be attributed to several factors; one of them could be the rising demand for the wrapped version of Bitcoin (BTC) on the Avalanche network. As the price of Bitcoin climbs, more users have attempted to use wrapped BTC on Avalanche, contributing to the network’s growing user base. Will AVAX’s bullish momentum continue?

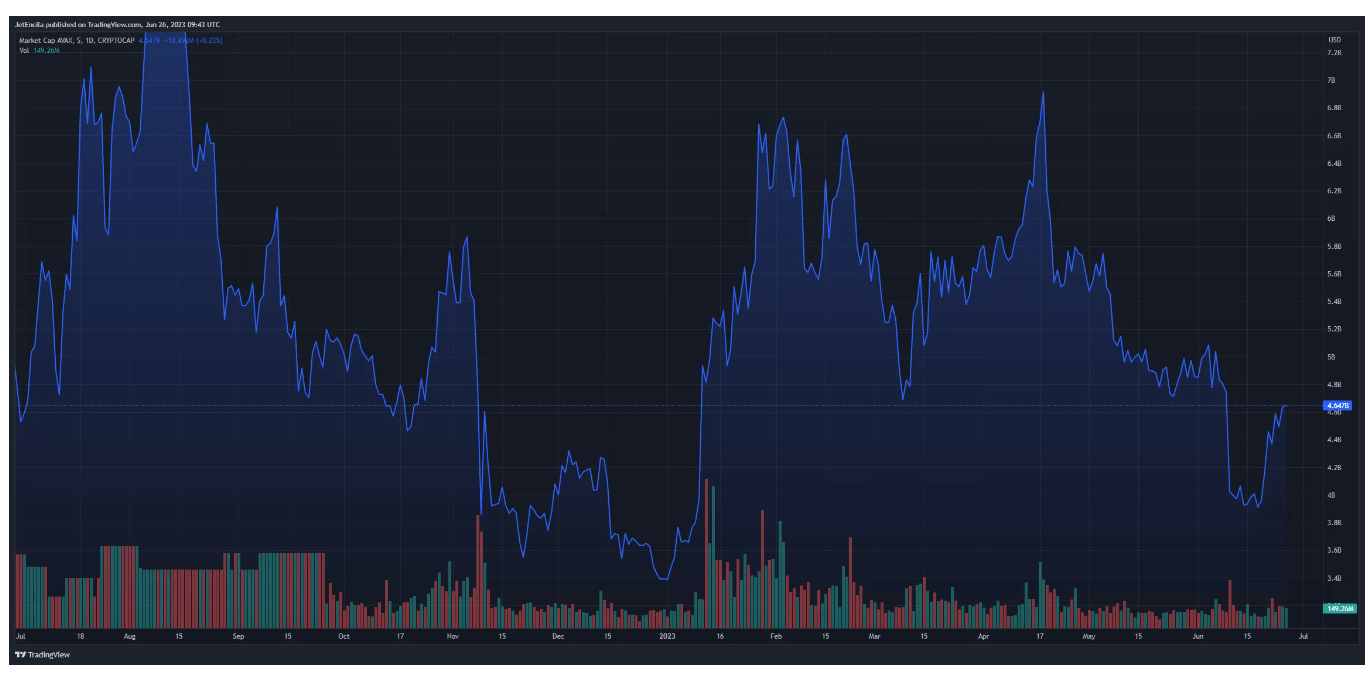

According to CoinGecko, the price of AVAX, currently at $13.37, showed a 2.7% rally in the last 24 hours and an impressive 18.0% increase over seven days. However, a closer examination reveals that AVAX’s recent bullish momentum could be losing steam.

Between June 10 and June 25, AVAX gained a significant value of 40% and set a price range fluctuating between $9.65 and $14.25. Although nearing the upper limit of this range, signs of exhaustion are increasingly apparent.

AVAX Data!

Specifically, between June 21 and June 25, AVAX’s price formed three separate peaks. However, during the same period, AVAX’s Relative Strength Index (RSI) and Oscillator (AO) formed lower levels. This divergence, known as a “bearish divergence,” could indicate that the momentum behind AVAX’s recent surge may be waning.

In technical analysis, this formation typically serves as a sell signal and usually precedes a correction in the underlying asset. Meanwhile, the potential resumption of Bitcoin’s uptrend at the start of a new week could present a challenging scenario for bears.

The interaction between Bitcoin’s movement and AVAX’s price trajectory could play a significant role in determining AVAX’s future direction. Bitcoin, as one of the most dominant cryptocurrencies in the market, can serve as a critical factor for overall sentiment and trends in the crypto space.