The cryptocurrency market continues to move on the brink of relative silence, as indicated by a slight decrease of over 0.30% in the total market value remaining fixed at $1.09 trillion. In the midst of this silence, the decentralized finance (DeFi) protocol Bancor’s (BNT) price surged over 50% to reach $0.6906.

Strong Rally in Bancor’s BNT

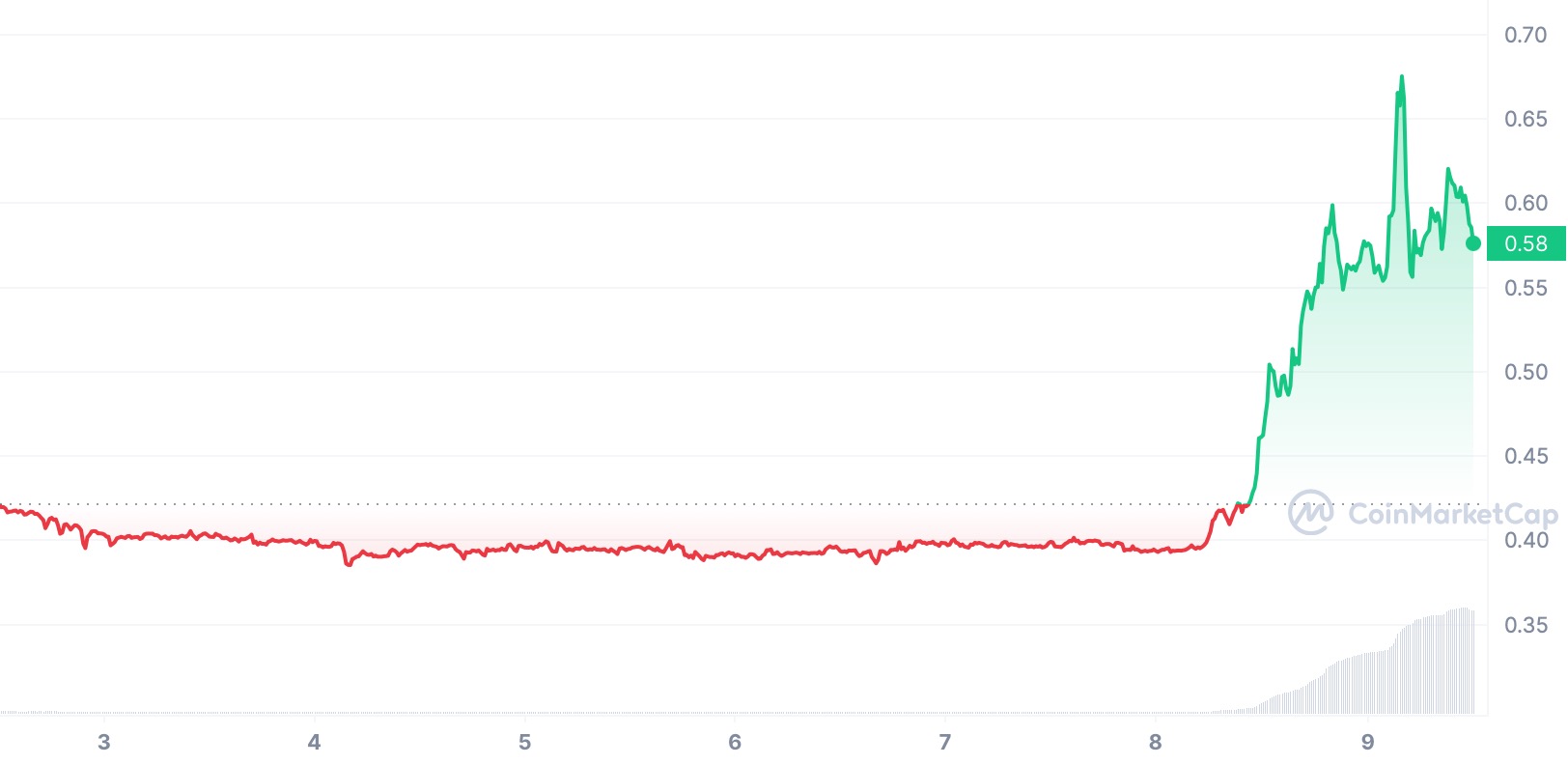

Bancor’s native asset BNT has embarked on a convincing rally within a parabolic trend in response to the increase in trading volume. Within this trend, the altcoin’s price soared over 50% from its lowest level in the past 24 hours at $0.4603 to $0.6906.

According to CoinMarketCap data, Bancor’s trading volume also surged by over 2,500% in parallel with this rally. The significant increase in trading volume indicates that the price rise is neither superficial nor artificially inflated.

As evident from Bancor’s growth trend, the current parabolic run is a result of a long-lasting upward movement. Prior to this impressive price action, the altcoin remained stagnant for a large part of the previous month, oscillating between $0.3786 at the bottom and $0.4462 at the top, forming a defined consolidation pattern.

While Bancor currently leads the altcoin market with a dominant upward rate, investors are debating whether this strong price movement is sustainable in the future.

Trigger for the Surge in BNT’s Price

The Bancor protocol took the lead in the rally of BNT by doing what many DeFi projects have rarely done in the past. The sustainability of the recent surge depends on the underlying trigger.

The protocol’s official social media account announced an attempted phishing attack in the ecosystem of the dominant protocol Carbon DeFi, which could have caused chaos, but it was detected and blocked. This proactive approach, in addition to the fundamental development proposal offered by the protocol, has increased the community’s trust in the ecosystem, unlike protocols that have recently suffered hack attacks.

While there are many innovative DeFi protocols in the market, the mitigation of associated risks continues to be a positive unfair advantage for Bancor, which may contribute to its short-term rally.