The recent drop in the crypto market has caused double-digit losses for cryptocurrency investors. However, most crypto enthusiasts see chaos as an opportunity. In the past, we have seen that altcoins quickly recover and offer huge profit opportunities after major declines. Of course, not every drop brings profit opportunities, but the recent Santiment report is warning.

Altcoins to Consider

First of all, no technical analysis, expert, or on-chain indicator can predict the future. Naturally, it does not guarantee definite profit from any cryptocurrency. So, what does it do? Based on success rate, certain technical setups and on-chain models indicate the possibility of an upward trend. New data shared by Santiment, a crypto on-chain analysis company, also supports this. The new data from Santiment shows that altcoins can recover some of their losses caused by the sharp decline in the crypto market last week.

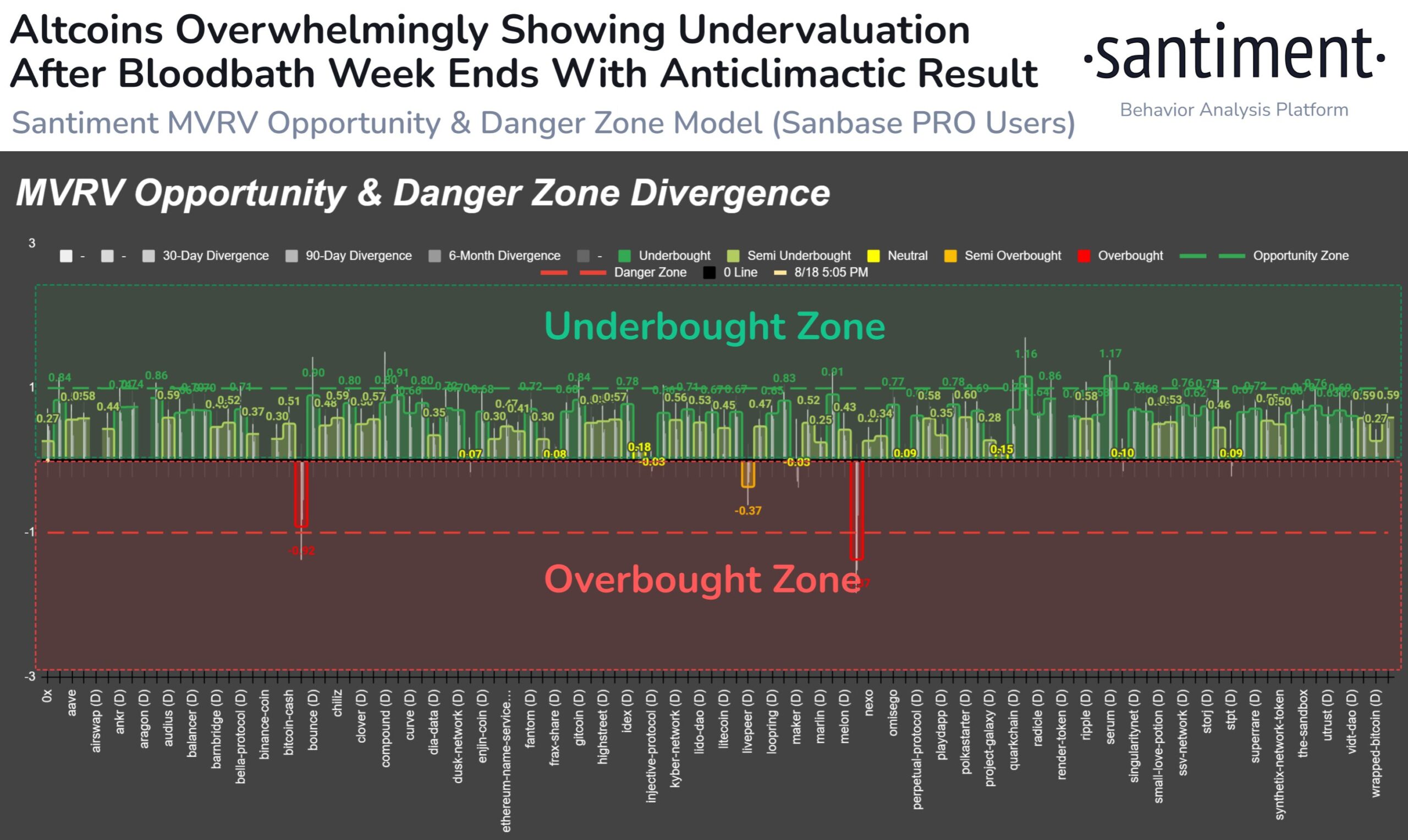

According to the crypto analysis platform, altcoins are showing “overwhelmingly low valuations” after the bloodbath of the past week, dividing investors on how quickly the markets can recover.

Which Altcoins Are in a Buying Zone

The metric that measures whether a crypto asset is overvalued or undervalued is generally the MVRV data. This metric, known as the market value to realized value (MVRV), is often used by investors looking for oversold signals.

“Market values have dropped significantly throughout last week, and traders are highly polarized. While many believe in a quick recovery, others see it as just the beginning of the decline. However, undeniably, average crypto returns are currently in a historically opportunistic range.”

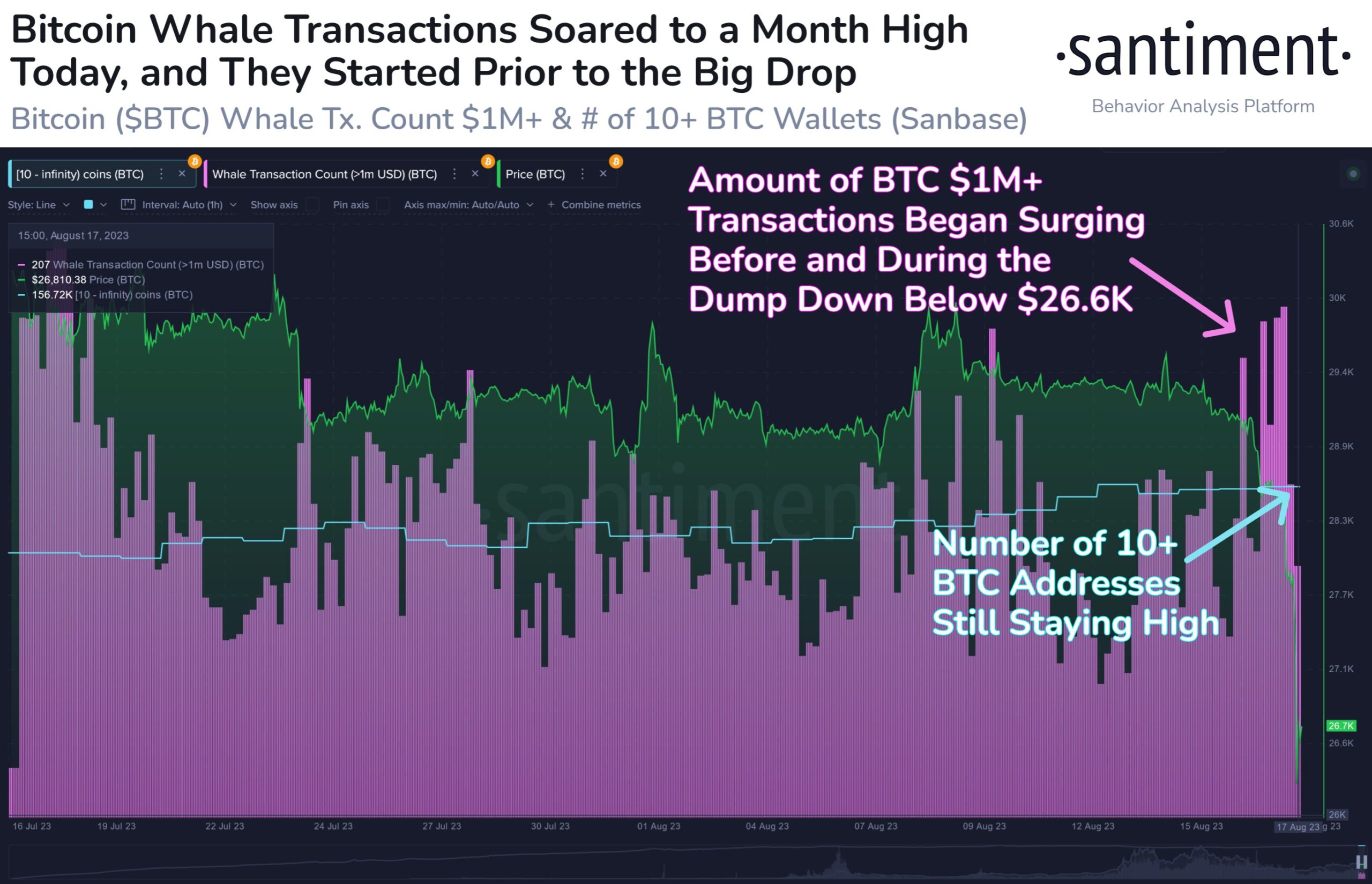

Santiment states that the recent crash is one of the “sharpest declines witnessed this year,” but Bitcoin (BTC) whales remained highly active during the drop.

“Crypto markets are not yet calm after experiencing one of the sharpest price drops of 2023. We are seeing a significant amount of $1 million+ BTC transactions, indicating that whales have been very active during this decline.”

In summary, it may be beneficial for investors to be cautious against larger sell-offs. Larger drops in BTC price may cause altcoins that appear in the buying zone to make even deeper lows.

Türkçe

Türkçe Español

Español