Binance, the world’s largest cryptocurrency exchange by volume, sees its stablecoin, Binance USD (BUSD), continue a precipitous decline. BUSD fell below its competitor stablecoin Dai (DAI) following a $95 million wipe-off from its market value.

Despite Losing $95 Million, BUSD Stayed as 3rd Largest Stablecoin for Over 3 Months

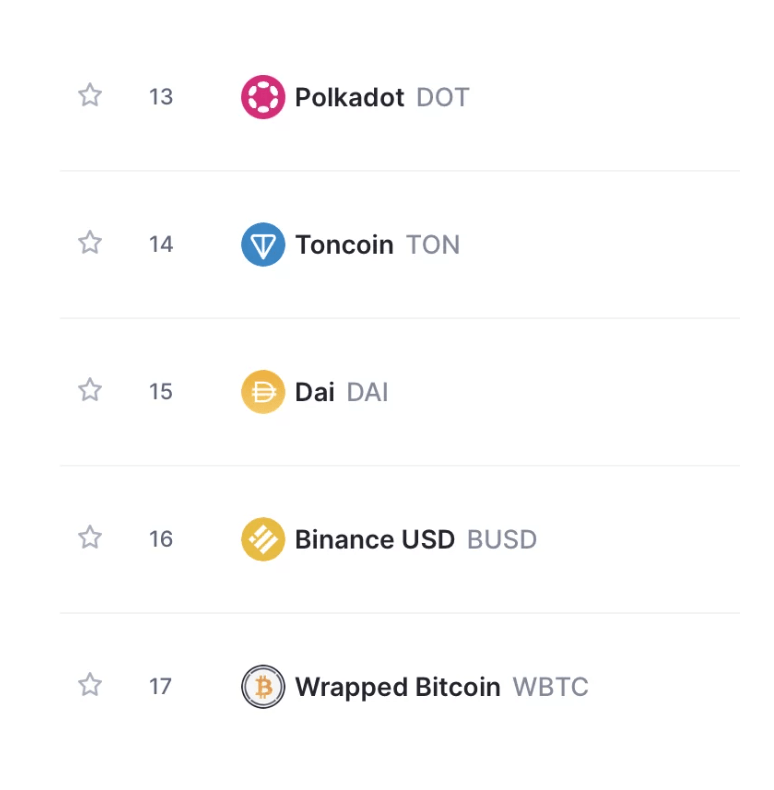

After $95 million was erased from BUSD’s market value, the stablecoin fell beneath its competitor DAI in both the largest cryptocurrencies and stablecoin lists. Currently, while DAI’s market value is $4.59 billion, BUSD’s market value is $4.34 billion.

Research analyst Rebecca Stevens at The Block Research underlined that this decline in BUSD was inevitable after its issuer Paxos ceased issuing the stablecoin in February. However, she pointed out that it managed to remain the third largest stablecoin for more than three months since then.

In the largest stablecoin list by market value, Tether’s USDT ($83.49 billion) sits at the first place, followed by Circle’s USDC ($28.2 billion) in the second spot.

A Slight Increase in BUSD’s Burn Rate

Stevens added that after the US Securities and Exchange Commission (SEC) classified BUSD as a security in its lawsuit against Binance on June 5, the stablecoin’s market value decline accelerated due to a slight increase in the burn rate of BUSD.

According to data provided by The Block, BUSD has been rapidly losing its share in Ethereum network’s stablecoin supply since March. This comes as a result of the increasing dominance of USDT and USDC in the market. Current figures reveal that USDT’s share is 48.48%, USDC’s is 34.23%, while BUSD’s is only 5.86%.