SOL Coin targets $120 again as fear in the market lingers. The cryptocurrency is known for quickly pricing in major events. The rapid declines in BTC before tariffs are a fundamental reason they haven’t led to massive losses. So, what do experts expect for BTC and the broader cryptocurrency market?

Bitcoin Expert Predictions

Rumors about a meeting between Trump and Xi circulate on social media. However, neither country has taken steps to resolve the tariff increases, which have become a deadlock. China’s recent statement implied that “the US would become isolated,” raising questions about the future direction of these developments.

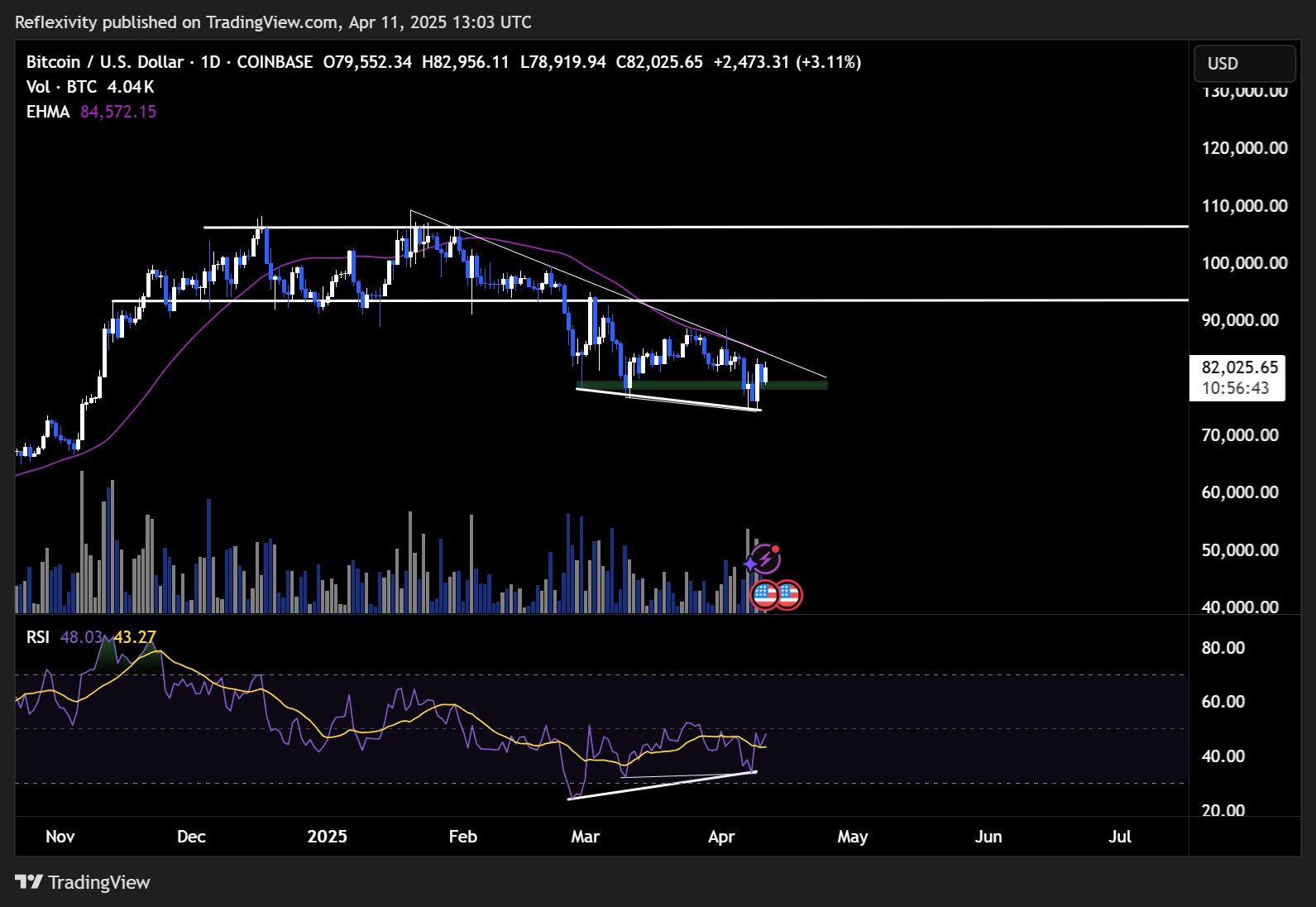

Bitcoin’s price hovers around $82,000 while altcoins continue their sideways movements. Severely battered by excessive selling, altcoins were the biggest losers in the second quarter. Will Clemente, in his latest assessment, shared a chart regarding Bitcoin (BTC)  $84,195 and remarked:

$84,195 and remarked:

“I believe there is an increasing justification for BTC to rise based solely on price movements/technicals. The market has expressed that being below $80,000 is valuable for the past six weeks. There are now two bull divergences visible in the RSI. I believe buyers will come in if we break above $84,000.”

This suggests that BTC gains could multiply above $84,000, and we might see a genuine turnaround in altcoins during this process. BTC surged to $83,333 in the last 24 hours.

“Around $78,000 is where this market structure starts to look shaky and invalidated, but for now, I’m progressing slowly; I added a bit more yesterday. Currently, about 25% of cash is being utilized. This was my personal note on March 1. (I am addressing people)” – Clemente

Cryptocurrency Analysts’ Predictions

In today’s analysis, Altcoin Sherpa mentioned that despite minor pullbacks, Bitcoin’s price will soon return to the $90,000 threshold. The analyst expressed uncertainty regarding future movements but had predicted altcoin increases for this month in his previous assessments. However, the markets, which are pricing in recession and even depression, did not deliver what he anticipated.

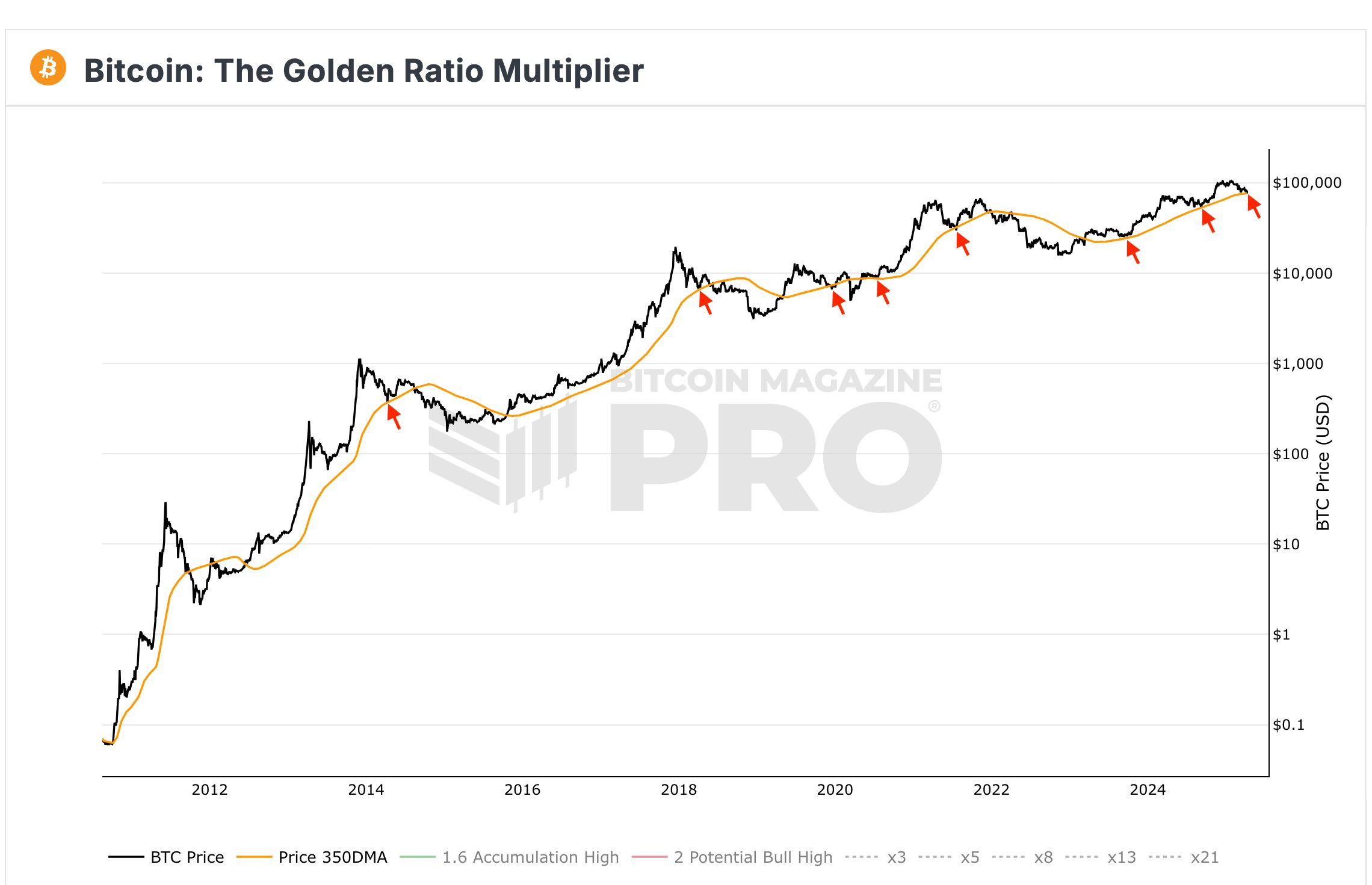

CryptoBullet shared one of the Bitcoin indicators he closely monitors, suggesting that this is what investors should focus on.

“Thus, I pay very close attention to the 50-week MA (which is the 350-day MA in this chart). This is a crucial support level, and whenever we reach it, we always bounce back (even during a bear market).”

Türkçe

Türkçe Español

Español