Renowned cryptocurrency analyst and trader, Rekt Capital, known for his long-term price predictions, has warned investors that Bitcoin (BTC) could experience a downtrend in the coming month. This prediction is particularly relevant for altcoin investors.

Two Potential Downtrend Scenarios for Bitcoin

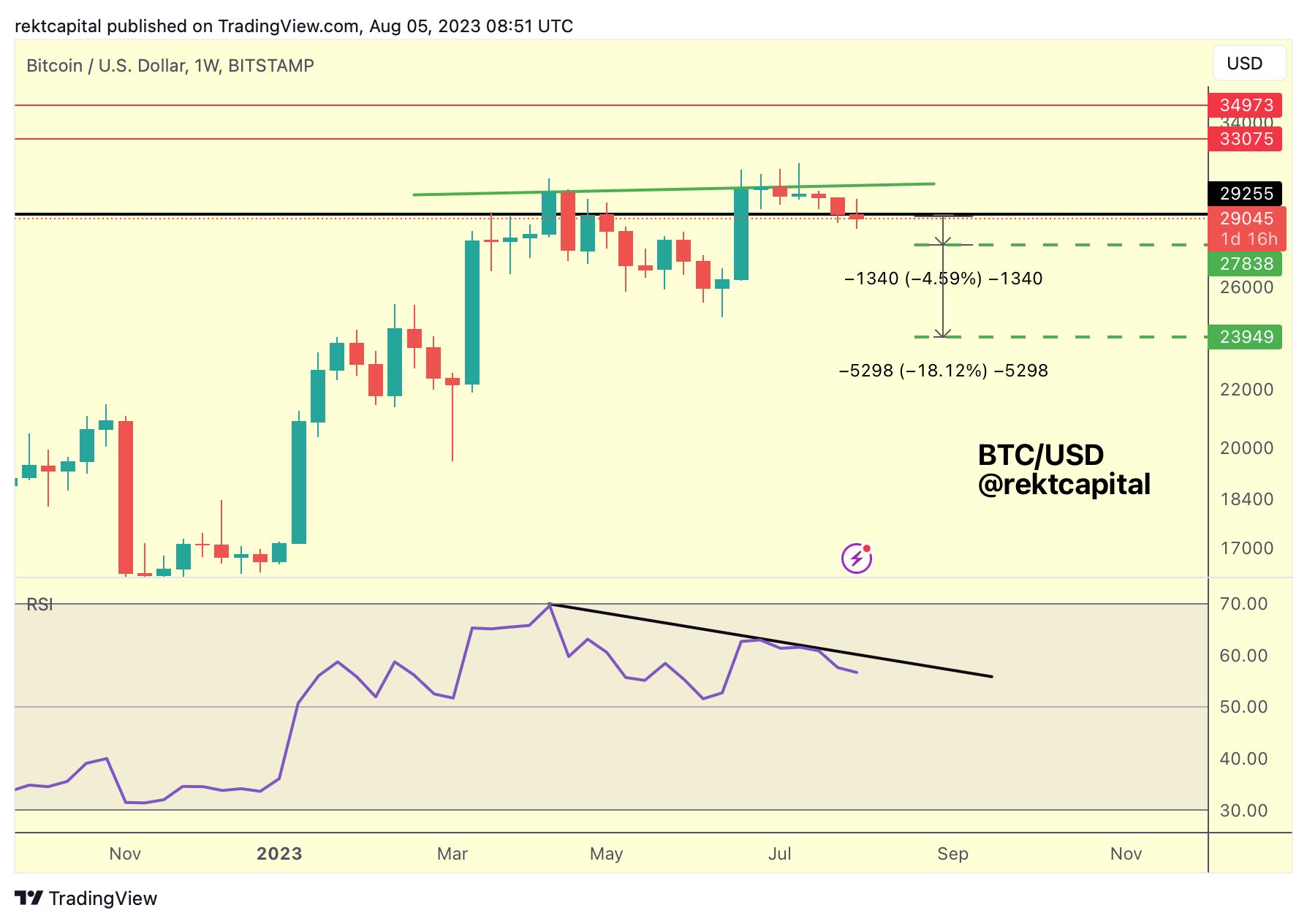

Anonymous cryptocurrency analyst and trader, Rekt Capital, has highlighted the tendency for the largest cryptocurrency to move downwards in the month preceding its block reward halvings. The analyst also pointed out that Bitcoin’s Relative Strength Index (RSI) shows a potential downward trend on the weekly time frame, indicating a decrease in momentum for Bitcoin. According to Rekt Capital, if the downtrend signal is confirmed, Bitcoin’s price could drop to $24,000:

There is a potential downward breakout forming on the weekly price chart of BTC. If it manages to act as resistance around $29,250, the possibility of a bearish divergence will increase. Looking at previous years (2015 and 2019) before the block reward halvings, there has always been a downtrend in August. After all, 2023 is the year before the next halving. If the largest cryptocurrency repeats its August 2016 decline, the price could drop by approximately 18% to around $24,000. Or if it repeats its August 2019 decline, the price could drop by approximately 4% to around $28,000.

The two potential downtrend scenarios presented by the analyst for Bitcoin also indicate that altcoins could experience further losses and move towards new lows, which is critical for altcoin investors.

Two Conditions for Bitcoin to Resume Uptrend

According to Rekt Capital, past trends do not guarantee that Bitcoin’s price will fall. The analyst stated that Bitcoin will exit the downtrend if it surpasses the key level of $29,250 or if the RSI breaks the downward resistance trendline:

The $29,250 level is once again acting as resistance. If this continues, the likelihood of the downtrend being realized on the weekly timeframe will be higher. However, if the price surpasses $29,250 as support or if the RSI breaks the downward trendline, the downtrend scenario will be invalidated.

At the time of writing, BTC is trading below the key level of $29,250, at $29,031.