The cryptocurrency market has experienced a significant downturn, with Bitcoin (BTC) and altcoins losing significant value. The largest cryptocurrency fell by about 8% to $67,345. This sharp decline is thought to be triggered by the U.S. Producer Price Index (PPI) data coming in higher than expected. Following the PPI data, the total value of the crypto market plummeted by over $200 billion.

167,000 Investors Pushed Out of the Market

During this turbulent period, approximately $450 million worth of Bitcoin long positions were liquidated, and the total liquidation amount reached $576 million, pushing 167,000 leveraged investors out of the market. Analysis by the crypto data platform Santiment shows that Bitcoin’s price dropped below the $70,000 level for the second time in just three days, indicating increased market volatility.

Moreover, the recent drop has continued to increase activity on the Bitcoin network, with signals indicating that investors are starting to sell off once again. This is interpreted as a stage of capitulation among investors.

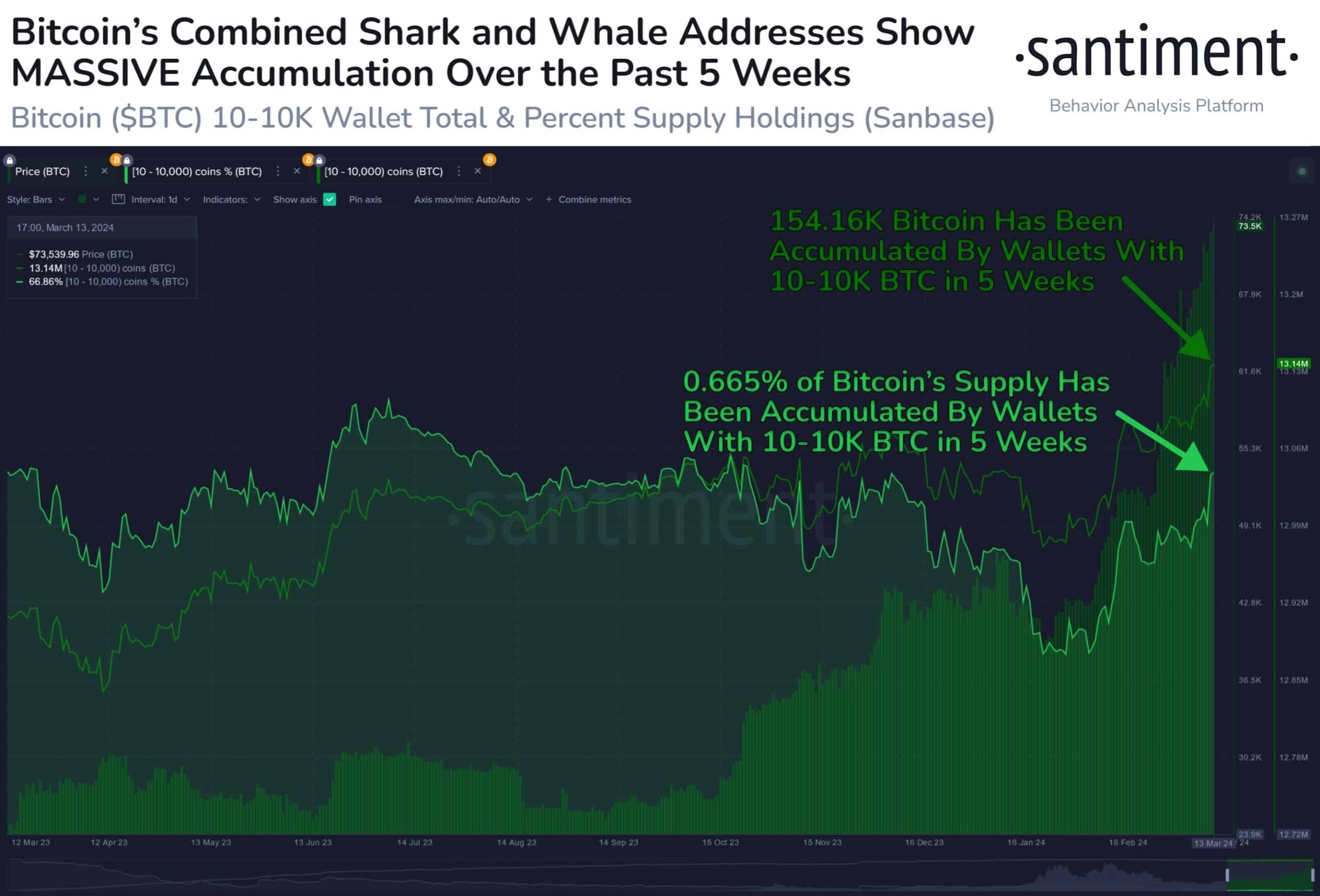

Furthermore, data from Santiment indicates that the trend of whale accumulation has started to rise again in recent weeks. According to on-chain data, since February 4th, whale-level investors have accumulated 154.16 thousand BTC, taking up approximately 0.665% of the total supply, with the value of their held BTC exceeding $10.9 billion.

Expectations of a Pullback to the $63,000 – $64,000 Range

Popular crypto analyst CrediBULL Crypto shared his views on current market dynamics, highlighting the lack of expected upward momentum and suggesting the emergence of a potential downward trend. He noted that the recent drop in Bitcoin and altcoins resulted from a decrease in Open Interest (OI), which had built up to excessively high levels, and pointed to the possibility of further downward movement before reaching a presumed “bottom level.”

CrediBULL Crypto identified a potential support level that coincides with the complete clearance of the remaining OI accumulation, questioning whether there will be a bounce or reversal in the price range of $63,000 to $64,000, referred to as the “green zone.”