Despite poor US data, Bitcoin price made its best weekly close since November 2021 at $52,137. We were discussing that bear markets had long ended, and there is a growing belief that we are approaching the most fervent days of the bull. BTC bulls are not rushing to convert their profits into cash because the rapidly revolving price at $52,000 confirms optimism for 2024. So, what is the latest situation with altcoins?

Ethereum (ETH) Forecast

First, we must talk about the largest altcoin because it has returned to levels above $2,800 from its dip to $881.5 during the crash period. On February 17th, Ethereum (ETH) turned the $2,717 region into support. Two days ago, it also surpassed the $2,868 resistance, and the bulls confirmed their belief in the uptrend.

If the current trend continues, peaks above $3,000 are near. However, the RSI in the overbought zone signals a possible correction risk. Yet, it’s not impossible for the price to continue to the peak without correction while demand is at this level.

If the Ethereum (ETH) price rise continues, a peak around the $3,400 region could occur. On the downside, the targets of $2,717 and $2,615 are current.

Binance Coin (BNB)

The rising 20-day EMA ($330) and RSI data indicate that BNB Coin’s uptrend maintains its strength. If bulls can achieve closes above $367, the rally could extend to $400. If the region is recorded, a drop to $314 is expected.

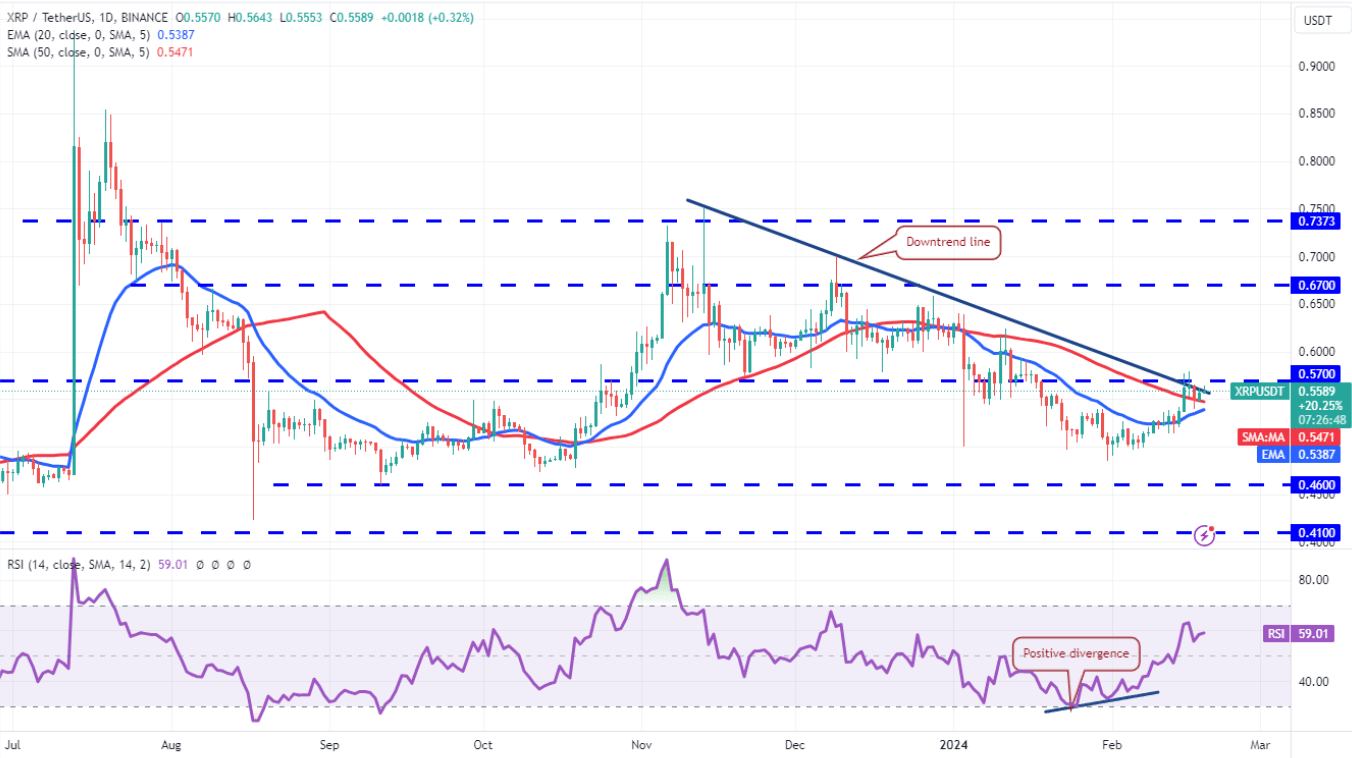

Ripple (XRP) Commentary

Bulls look weak and we haven’t seen a strong bounce from the $0.5 support. The price is at $0.56 and if demand increases, a new move to $0.67 could start. In the opposite scenario, a return to the support at $0.5 is likely.

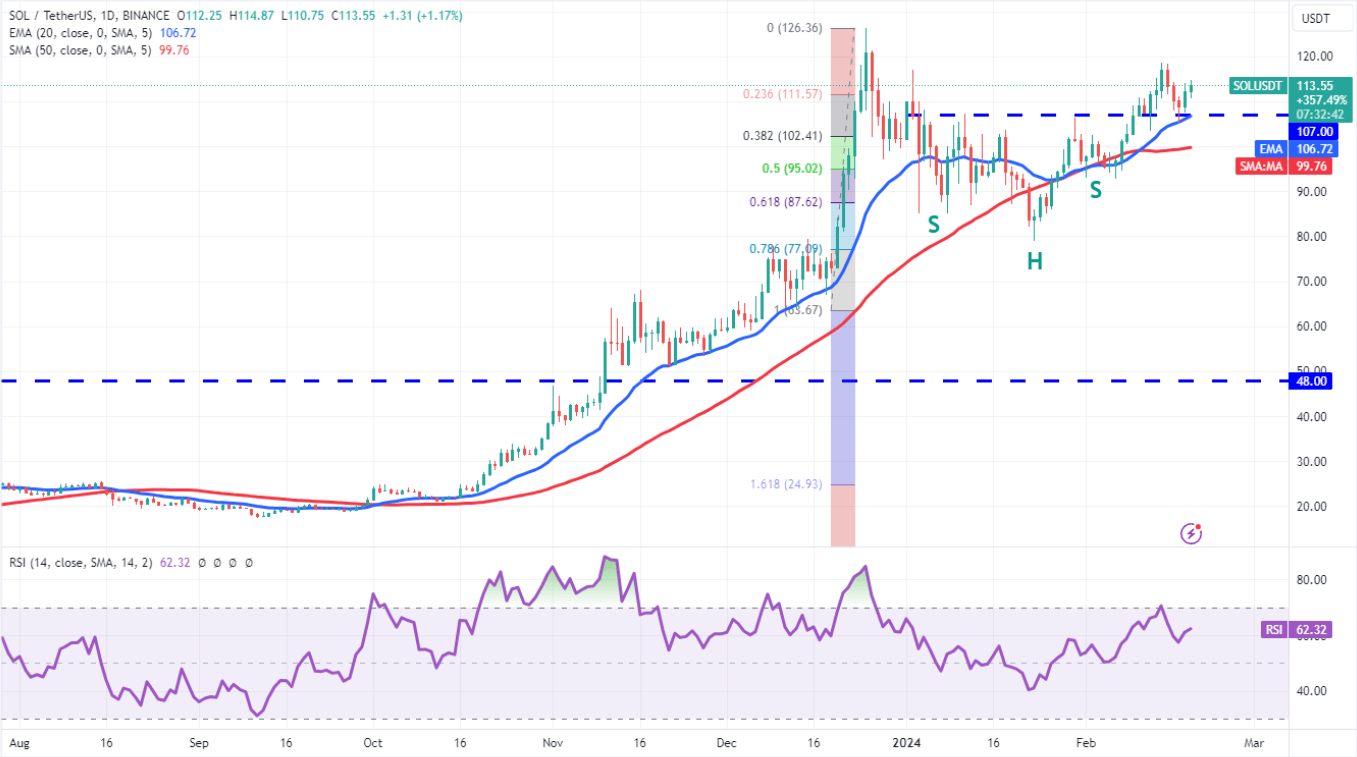

Solana (SOL) Commentary

Solana pulled back to the neckline of an inverse head and shoulders formation on February 17th. The 20-day EMA at $106 and RSI (62) away from the neutral zone suggest a possible move to the $119 resistance area. SOL Coin had already visited this area recently.

If resistance is overcome, the rally could continue to peaks between $127 and $135. However, in a bearish scenario, a return to $100 could be expected.

Türkçe

Türkçe Español

Español