There are many experts who share their predictions about the future of the cryptocurrency markets. But there are also the opinions of the best ones. The founders of Glassnode, one of the leading cryptocurrency analysis and research companies, have shared their latest evaluations. So, what are the experts’ predictions about Bitcoin and cryptocurrencies?

Is Bitcoin Going Up?

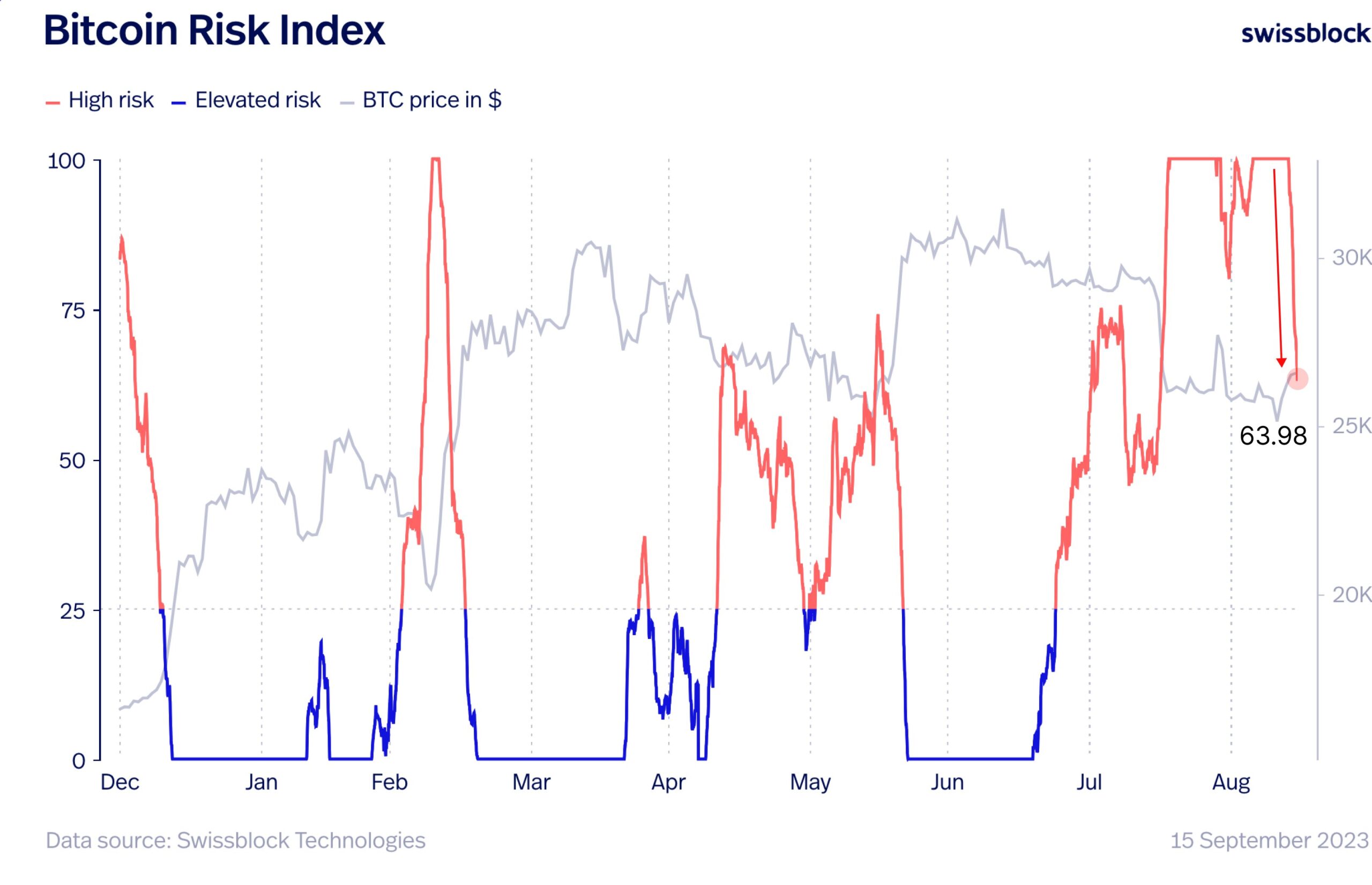

According to the founders of Glassnode, Jan Happel and Yann Allemann, Bitcoin is consolidating the $26,000 support level. Moreover, according to Happel and his partner, the Risk Signal of BTC seems to be declining. The declining metric aims to anticipate a major price drop for Bitcoin. So, this decline in the metric is of a kind to feed optimism for the price.

“It was expected that the 0.6% increase in the US Consumer Price Index (CPI) would affect the price of BTC, and it did. Rising above the $26,000 support, BTC now has the potential to break free from the range it has been trapped in for weeks by surpassing $27,000. The decline of the Risk Signal to the 60s level indicates this change in attitude. Profit sales pressure may appear around $27,400 to $28,200, but this climb will be the last step before overcoming the psychological barrier at $30,000.” Crypto Traders Are Rushing to This App – Here’s Why You Should Too

Crypto Currency Reviews

Last week, the US Bureau of Labor Statistics announced that the CPI increased from 0.2% in July to 0.6% in August, and the release of the data coincided with an increase in cryptocurrencies and stocks. The founders of Glassnode emphasize the positivity of the current outlook for BTC after these data. Analysts predict that BTC’s rebound from a major uptrend may initiate a rally where “greed, excitement, and FOMO (fear of missing out)” can arise.

So, what is the target price? The target for Bitcoin is the peak of the mentioned channel, which is the $150,000 region. In this scenario, the cumulative value of cryptocurrencies can surpass $3 trillion again and aim for a new peak. Of course, this situation has the power to open the door to massive rallies in altcoins as well.

The optimism of the experts is also supported by four-year cycles. Moreover, the fact that the Fed has clearly reached a tight policy in its last two meetings indicates that the interest rate ceiling could be announced in this meeting. As weakness continues in items other than fuel, the current monetary policy may be sufficient for the Fed to fight inflation for 6-9 months.

Türkçe

Türkçe Español

Español

Good